e-fundresearch.com: What are your personal lessons learned from year-to-date market developments?

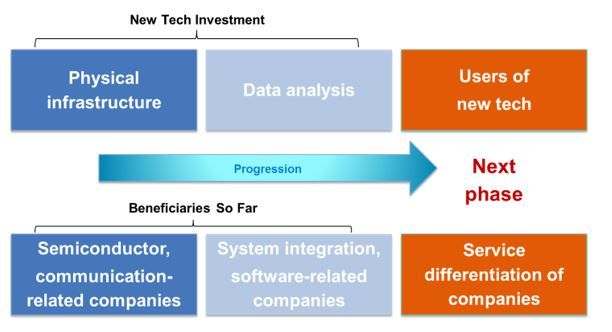

Hiroyasu Sato: The Japanese stock market has been on a strong run so far this year and some of the best performing sectors have been related to the new technology cycle, which has been greater than many expected. Companies that provide the hardware, such as semiconductors and sensors, as well as the software required for AI/IoT applications have been the main beneficiaries of this trend (as shown below).

While I do hold stocks in these areas, I have tended to favour companies that are geared to the next phase (i.e., successful implementation of this new technology to better differentiate their services and grow their earnings). I believe this next phase to be more sustainable; as we saw after the dotcom bubble burst in the late 1990s, it was service providers like Amazon and Google who were the real winners from advances in technology.

In the short term, however, this ‘indirect’ play on the new technology cycle has weighed on performance as the market has been more appreciative of first movers, such as hardware and software providers, for now. Therefore, this year has reminded me that I need to be careful about the impact of market hype over new trends while also sticking to my growth principles to maintain performance.

e-fundresearch.com: To what extent has your strategy been able to benefit from this year's market environment and which particular investment themes have delivered the strongest performance contribution on a year-to-date perspective?

Hiroyasu Sato: Gradually improving consumer sentiment and wage hikes owing to a tighter labour market have provided a stable backdrop for the domestic sectors in Japan. Within this area, one of the main underlying investment themes in my portfolio has been to do with demographic change. While many market observers view an ageing population as a big negative for the country, I believe that this also creates many interesting investment opportunities.

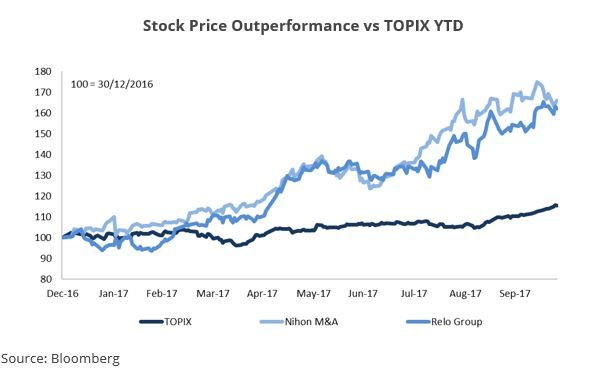

Two stocks related to this theme are Nihon M&A Center (TYO:2127) and Relo Group (TYO:8876). Nihon M&A Center is a nationwide M&A advisory service provider, which is benefitting from an increasing number of elderly business owners who are facing a successorship problem. Relo Group is a fringe benefit outsourcing provider, which is seeing greater demand for its services as more workers are shifted to ‘regular’ status due to the labour shortage and Abe’s ‘work-style’ reforms.

These two stocks have been some of my best performers year-to-date but as their valuations have increased, I have slowly started to reduce their weights in my portfolio as part of my strong price discipline approach. Now, I am focusing more on transformational ideas, such as company turnaround stories, at lower valuations.

e-fundresearch.com: With regards to the coming year: How optimistic is your view into the future and what obstacles and challenges should investors be prepared to overcome in 2018?

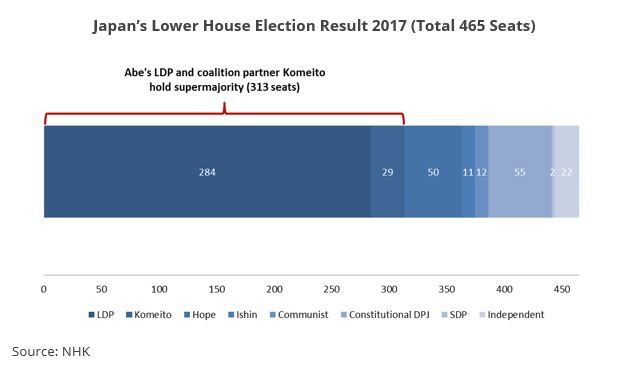

Hiroyasu Sato: In terms of Japan, I do not envisage any major obstacles domestically and am quite positive for next year. Prime Minister Abe has recently won a fresh mandate which should see him through as leader until 2021. At the same time, Japan’s economy is gaining momentum and the CPI figure is picking up, although still short of the BOJ’s 2 percent target. I also expect the upward pressure on wages to continue as available labour remains in short supply.

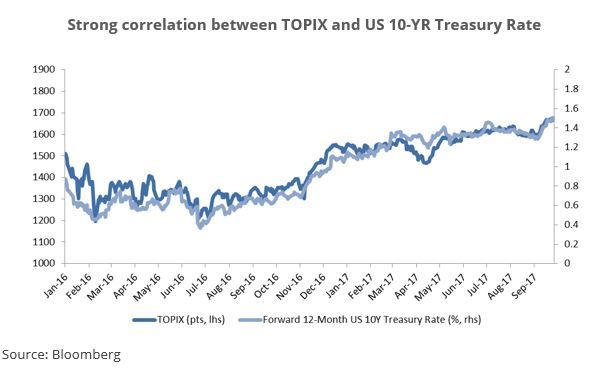

As for risks, the threat posed by North Korea is mentioned frequently by investors but we are quite accustomed to this situation in Japan now and see it more as a tail risk. Rather, the strength of the US economy as well as that of China will be key areas of focus. The Japanese market tends to benefit from a favourable external environment and as such, I will pay particular attention to indicators such as the US 10-year Treasury rate for clues on global economic conditions.

e-fundresearch.com: Why should investors consider an increase in allocation to your asset class and in particular your strategy in 2018?

Hiroyasu Sato: Despite TOPIX reaching a decade-long high in October, I believe that there is further room to run for the market. The advance has been well supported by strong corporate earnings growth and we expect this positive momentum to continue into next year, with EPS growth forecast to be around 8 percent. Valuations also remain relatively cheap as the chart below shows, with TOPIX PE still hovering around the 14 times level.

Another key factor which I would like to emphasise is the importance of sustained political stability in Japan, which is in sharp contrast to that of the West. This should be beneficial for the domestic economy. In addition, Abe’s re-election should pave the way for continued support from the BOJ in terms of an accommodative monetary policy.

Against this backdrop, I will continue to hold on to sustainable growth ideas that are benefitting from the domestic structural shifts mentioned earlier while also incorporating new ideas in cyclical growth areas. Here, I particularly like how the increasing complexity of automobiles, whether it is to do with the need for electric motors or driverless technology, is shaking up the auto industry and allowing new entrants into the market.

Global trends, such as the adoption of new technology and demographic change, are altering the market dynamic and the dispersion between and within sectors is widening in my view. Therefore, I believe that active stock selection is now as important as ever in Japan. As part of a locally based investment manager, I feel ideally placed to continue selecting the most attractive opportunities arising from these changes in my Focus portfolio for clients.