e-fundresearch.com: “The great return of market volatility”: What are your personal lessons learned from year-to-date market developments?

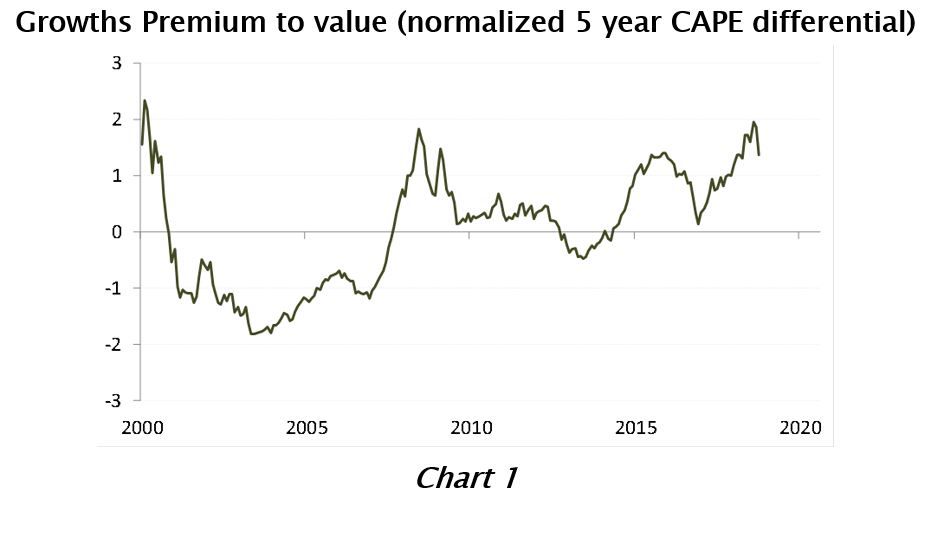

The headwinds facing value investors in general, and us in particular, have been strong as ever in 2018 so far, and “value” as a concept has underperformed “growth” by a margin not seen since the tech bubble of 1998-2000, despite a small setback during October. This has once again been a reminder that no investment style will work at all times and that part of the stock market from time to time will run ahead of the fundamentals of the underlying business. As such, it is necessary to maintain focus on the fundamentals of the business and remain long-term.

We stand firmly by our investment conviction that buying above average businesses at below average prices, over time; will generate superior results over a cycle.

e-fundresearch.com: With regards to the coming year: How optimistic is your view into the future and what obstacles and challenges should investors be prepared to overcome? What key-developments that you are focusing on the most and how do you separate noise from relevant information?

First of all it is important to emphasise that we do not spend time trying to predict the overall market development, and the fund does not engage in any form of macro bets, such as whether oil is going up or down, if the US will outperform Japan and so on. Actually, since inception we have always kept the portfolio alpha neutral towards such exogenous factors. We want pure stock selection to determine the level of alpha generation. This approach filters out a lot of the noise in the market.

Europäische Aktien im Aufwind: Mit Low-Volatility- und Small Cap-Fonds effizient Marktchancen nutzen

Europäische Aktien stehen nach einem langen Dornröschenschlaf nun wieder verstärkt im Fokus der Investoren – das zeigen aktuelle ETF-Zuflüsse in diese Anlageklasse und das Verhalten großer Marktteilne...We are always focusing on the current portfolio and searching for new ideas. A key part of our process is to filter out further noise and avoid human biases by applying our proprietary scoring system. We compare each company in our universe versus its sector and the global equity benchmark (MSCI World) on up to 155 different financial ratios in order to help us find attractive trade-offs.

e-fundresearch.com: Why should investors consider an increase in allocation to your asset class and in particular your strategy in the current environment?

That is a good question. Many of indicators that we look to are signalling that we are indeed entering a trouble zone with respect to valuation of growth vs. value: Growth is more or less trading at the same premium to value as in 2000, and the best performing stocks also have the same P/E levels as in 2000. The duration of the current bull market has surpassed the market which built up the excesses in 1998-2000, and investors are readily abandoning such factors as valuation. The market seems to be driven by storytelling and top line growth expectations.

So for instance the premium of growth vs. value is now slightly higher than before the “Trump Bump” in 2016 during which value stocks had a great run and outperformed massively in the following two quarters.

Our portfolio looks attractive both on an absolute as well as relative basis – compared to e.g. MSCI World. Fundamentals look significantly better, and valuations look more attractive. Over the long term, the market should appreciate this portfolio, but valuation is a weak force (like gravity): It takes time, and sometimes it feels like it doesn’t matter, but it always does!

KURT KARA

Head of Equities, Global Value Equities

Kurt Kara is Head of Equities, Global Value Equities and has 19 years of financial market experience. Kurt joined Maj Invest in 2005, and his responsibility has been the management of the Maj Invest Global Value Equities fund since its inception. Prior to joining Maj Invest, Kurt was Equity Strategist at Danske Bank. Previously he worked at Danske Capital as Portfolio Manager for the Danske Invest Latin American Equities fund.

ULRIK JENSEN

Senior Portfolio Manager

Ulrik Jensen joined Maj Invest in 2006 and has 17 years of financial market experience. Ulrik is Senior Portfolio Manager with co-responsibility for managing the Maj Invest Global Value Equities fund. Prior to joining Maj Invest, Ulrik was an Analyst and Portfolio Manager with Sparbank with responsibility for managing the bank's treasury holdings and started his career as Assistant Equity Research Analyst at Allianz-PIMCO Asset Management.