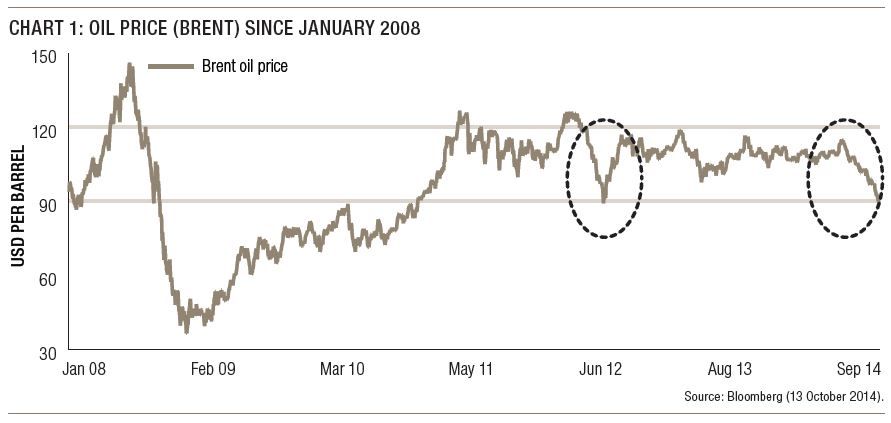

Oil prices have plummeted since the end of June 2014, and while still within their price corridor, they are getting ever close to their low point of June 2012. We believe that a combination of factors has been in play recently, but that some of them could reverse paving the way for a short-term rebalancing of the oil market. We also see similarities between the current situation and that of mid-2012. Between 24 February and 4 June 2012, the energy sector (MSCI World Energy) declined rapidly by nearly 20% (source: Bloomberg) before climbing 48% by 23 June 2014 (source: Bloomberg), as a result of the rebound in oil prices and their relative stability. Since this date, the energy sector has come down around 18% (source: Bloomberg).

We believe that a combination of economic and seasonalfactors is behind the drop in oil prices:

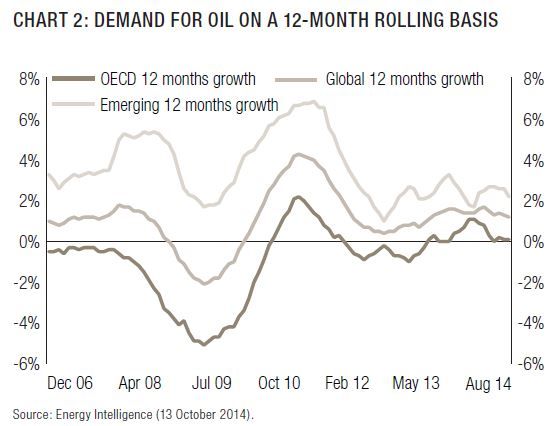

- The rate of growth and demand for oil has slowed, particularly in emerging markets (see chart 2)

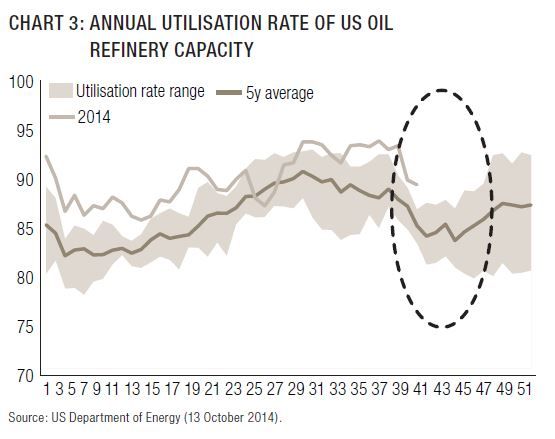

- Refinery demand drops as refineries enter their seasonal maintenance period before restarting production for the winter season. This “shoulder period” typically runs from mid-September to the end of November with a low point in mid-October (see chart 3)

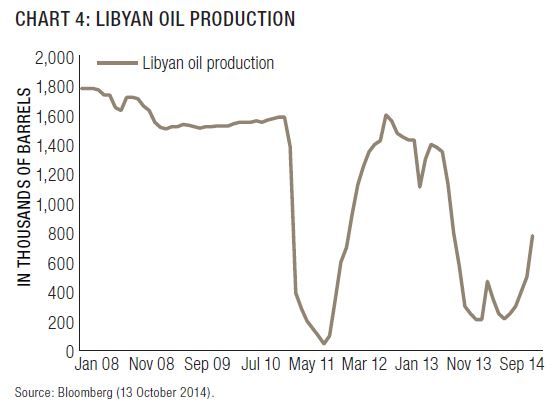

- Production in Libya has recovered quickly, but remains unpredictable, making it difficult for OPEC to make adjustments (chart 4).

From now until the end of the year, we believe that a number of factors could clear the way for a rebalancing of the oil market and a stabilisation of oil prices:

- The gradual return to production at refineries from mid-October

- The start of the winter season from November/December

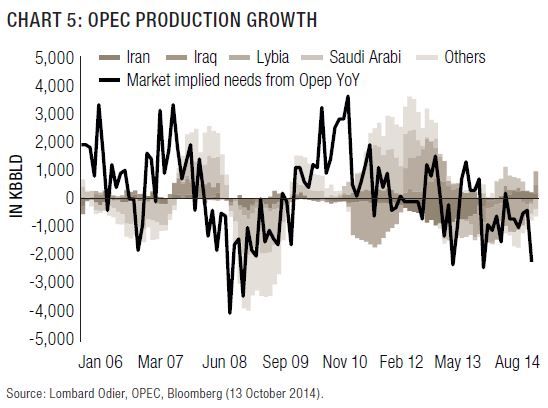

- A possible production adjustment in Saudi Arabia if production in Libya proves stable. In the past, Saudi Arabia has demonstrated its willingness to manage the volatility of its oil production (see chart 5). A potential reduction reflecting the economic environment is likely be discussed at the meeting of OPEC on 27 November in order to reach a decision based on greater collaboration.

Although the environment remains volatile, we believe that this adjustment scenario, if confirmed over the coming weeks, will boost the appeal of the energy sector.

CHART 2: DEMAND FOR OIL ON A 12-MONTH ROLLING BASIS

Weitere beliebte Meldungen: