The opnening of its first UK presence is part of the growth strategy pursued by RAM and its aim of ensuring true proximity to its clients – primarily institutional and professional investors. RAM Active Investments has more than USD 4.1 billion in assets under management in 2014 (up 16% over the year).

At the same time by the end of December 2014 the two sub-funds RAM (lux) Systematic Funds - Long/Short European Equities and RAM (lux) Systematic Funds - Long/Short Emerging Markets Equities, now at 130M EUR and 120M USD AuM resp., celebrated their 3-year anniversary.

Thomas de Saint-Seine, CEO & Head of Equities, comments: “We are committed to be close to our clients and grow alongside them. Therefore we have decided to open an office in London which we consider as one of the most prestigious place for asset management in Europe. At the same time we are very proud of the consistent performance of our Ucits long-short funds over the last three years.”

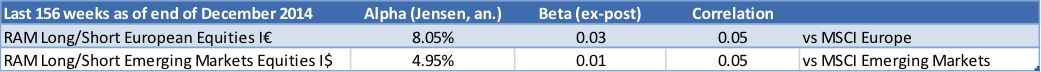

RAM has generated strong and steady returns for its investors through both offerings, which aim to generate returns uncorrelated to broad Equity markets. The European and EM Long/Short funds (launched 15th December 2011) returned respectively 26.46% and 15.33 % since launch with an annualized volatility of 6.33% and 3.16%.

To identify the best long and short investment opportunities in the market, RAM has developed a proprietary and non-directional stock selection approach which seeks to extract alpha on both the long and the short sides with beta-neutral strategies to offer investors a decorrelated, alpha-generating product.

A highly diversified bottom-up stock selection is carried out systematically on the basis of company’s fundamentals, analysts' revised assessments and technical factors. Internal research to identify the most/least appealing Value/Quality/Growth-Momentum companies within the investment universe has been carried out for over 10 years.

Weitere beliebte Meldungen: