e-fundresearch.com: How is sluggish global growth affecting emerging economies?

Mary-Therese Barton: Economic momentum at a global level has been slow, although there was a slight improvement in the fourth quarter as a decline in oil prices bolstered consumer confidence, especially in the US. Sluggish global growth and concerns about low inflation are weighing on core government bond yields. The benchmark 10-year US Treasury yield, a closely-watched rate that affects emerging markets, may move towards 1.5 per cent before it rises again to 3 per cent – near the level that triggered a sharp sell-off in emerging markets in mid-2013. This is because investors are pushing back the timing of a first US interest rate hike towards the second half of 2015. This should support emerging debt in return.

However, emerging currencies are likely to remain under pressure for some time. The USD extended its rally in January after rising 5 per cent in the fourth quarter of 2014 against a basket of major currencies.

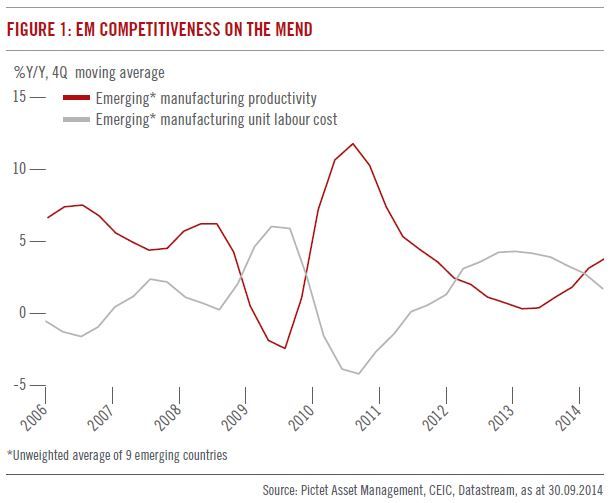

Economic growth in emerging economies also remains sluggish, largely because of slow exports. But there have been additional factors at play, other than a cyclical slowdown. Emerging economies have been losing competitiveness in the past three years, as labour costs rose and productivity deteriorated (Fig 1). As a result, the gap between emerging and developed economic growth has fallen to a 12-year low of an estimated 3.3 per cent last year, having peaked in 2009 at 7.8 per cent.

In order to strongly outperform their developed market counterparts, the developing world needs to see not onlya pick-up in global growth but structural reform and improvement in competitiveness at home. There are some encouraging signs here, with manufacturing productivity troughing in 2013 and labour costs declining.

e-fundresearch.com: What is the impact of falling commodity prices on the performance of emerging debt?

Mary-Therese Barton: We have seen some eye-watering moves in commodity prices, with oil falling nearly 50 per cent last year and copper hitting a six-year low.

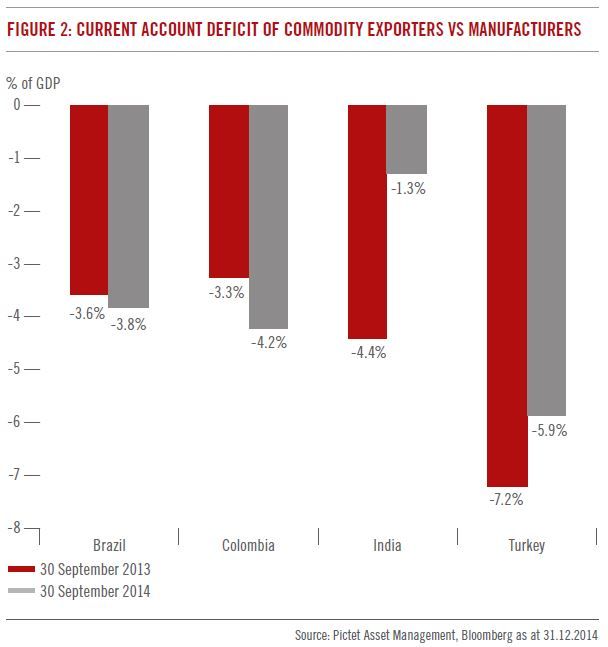

Against this background, we have seen the fortunes of commodity exporters and importers diverge. Take Turkey, a heavy importer of energy and raw materials -- both local and hard currency debt in Turkey outperformed the benchmark indices last year as falling commodity prices helped the country reduce its current account deficit (See Fig.2) and boost exports in 2014 by a record 4 per cent.

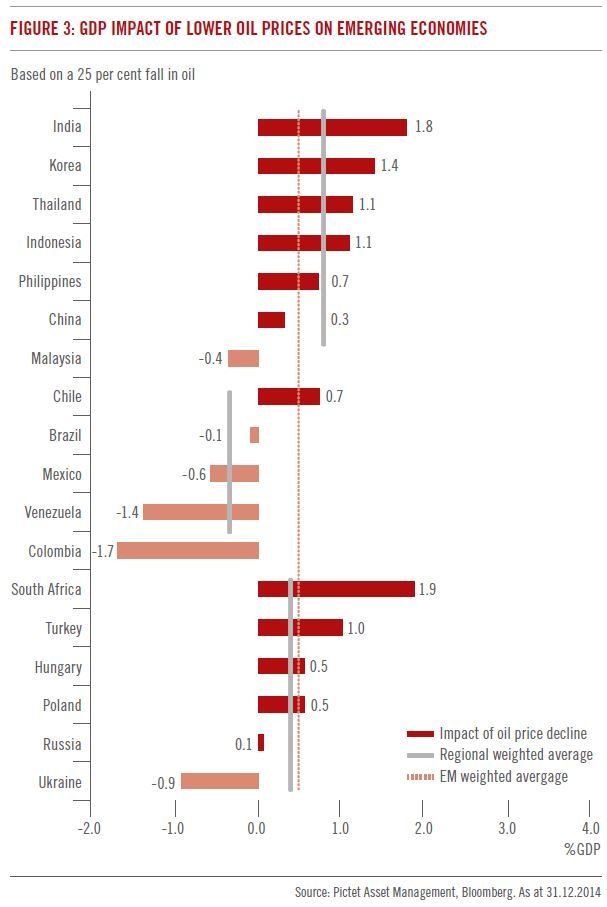

According to the calculations of Pictet Asset Management’s economists, a 25 per cent decline in oil prices boosts Turkey’s GDP by 1 percentage point, which is above the weighted average for emerging economies (See Fig.3).

India is another energy importer, whose hard currency debt beat the benchmark last year. Our analysis shows a 25 percent decline in oil prices boosts India’s GDP by 1.8 percentage points.

In contrast, Brazil and Colombia both saw their current account deficits widen; for these commodity exporters, lower oil prices are obviously negative.

Weaker commodity prices can ease pressure on inflation in many emerging economies. But we don’t think there is currently a big threat of deflation, except in some eastern European markets such as Hungary and Poland.

e-fundresearch.com: What are emerging economies doing to kickstart economic growth?

Mary-Therese Barton: So far, the majority of emerging governments have avoided resorting to fiscal expansion as a way of boosting growth. Their fiscal deficits have remained stable at around 2-3 per cent of GDP in the past three years, a period when public finances in the US and euro zone deteriorated. Emerging economies have managed to maintain their fiscal discipline, put in place after financial crises of the past 25 years. This means monetary policy is a preferred tool for emerging economies to support growth.

For this reason, we think the market is pricing in an overly aggressive hike in interest rate hikes. For example, investors expect Brazil to raise interest rates by 75 basis points over the next 12 months. Given the weakening economic outlook, this is too aggressive, in our view. We think Brazil’s central bank may even cut interest rates in the second half of this year.

India has just delivered a surprise interest rate cut, following closely on the heels of China which also took the market by surprise by cutting interest rates in November. These centralbank moves give investors an opportunity to buy emerging local debt.

e-fundresearch.com: Given your outlook on emerging economies and the USD, how is your portfolio positioned at the moment?

Mary-Therese Barton: In our local currency debt portfolios, we have an overall underweight position in emerging market currencies. Although we believe the majority of the adjustment has taken place, we could see further weakness in the coming months.

According to Pictet Asset Management's fair value models, emerging currencies are now undervalued by some 22 per cent.

This currency adjustment should help emerging economies regain some of their competitiveness. We’re already seeing some improvements and we expect the trend to accelerate later this year, when we may see interesting opportunities to buy emerging currencies.

We are positive on certain Asian currencies, including the Indian rupee which benefits from the government’s structural reforms and an improved fiscal balance thanks to lower commodity prices. The Philippine peso also looks attractive as economic growth is expected to be around 6 per cent and the currency benefits from political stability, credible monetary policy and a recently achieved investment grade status.

In local rates, we believe there are attractive opportunities as slow growth coupled with reduced pressure on inflation should encourage central banks to cut interest rates, which lead to lower yields. Indeed, Turkey, India and Romania already cut rates in January.

In our USD portfolios, we remain attracted to higher-yielding markets which trade more on their underlying fundamentals, such as Lebanon, Vietnam, Mongolia and Ivory Coast. On the other hand, we keep our underweight positions in China, Malaysia and Chile, which are trading at very tight spreads to US Treasuries.

We continue to believe emerging market debt is an attractive asset class over the long term relative to developed market alternatives. Pictet Asset Management’s Strategy Unit expects local currency debt to deliver annualised return of at least 7 percent over the next five years in USD terms, while hard currency bonds are likely to return more than 4 per cent, both above developed government and corporate bonds.

e-fundresearch.com: What’s your view on higher risk markets such as Russia and Venezuela?

Mary-Therese Barton: We have zero exposure to Russian corporate bonds and remain significantly underweight quasi-sovereign bonds which we see as being more affected by sanctions and poor economic growth. We have turned neutral on the RUB, having been underweight for much of 2014. This is because we see the currency is at risk of overshooting after it lost more than 45 percent in 2014 with significant volatility in December. The Russian economy is likely to face continued difficulties from falling oil prices and geopolitical tensions with the potential for economic contraction this year. The country has lost its investment grade status and the government has struggled to sell debt at recent auctions. However, we don’t expect to see the country to experience difficulty in repaying debt. With almost USD 400 billion in foreign reserves, the country has ample means to finance its debt.

In Venezuela, we currently only have exposure in hard currency debt portfolios and this is in line with the country's 1.6 per cent representation in the JP Morgan EMBI Global Diversified index. We believe it is too expensive to be underweight given the yield of over 30 per cent. In 2014, a tactical overweight at times resulted in a small contribution to performance and we cut the overweight in October after oil prices declined. The direction of energy prices will be key as oil makes up around 98 per cent of Venezuela’s exports and is crucial in enabling the country to service its debt.

Late last year, President Nicolas Maduro gave strong assurances that the nation would pay back every dollar it owed and we believe their willingness to do so remains strong. This is why we think there is a low risk of default over the next few months. In order to fend off worries over default, Venezuela is trying to use Citgo, a US refining unit of state oil firm PDVSA, to sell new USD debt governed by New York law. It is also worth noting that Venezuela has the world’s largest oil reserves, which are easily accessible onshore.

However, its current account surplus is shrinking along with revenues as oil prices have fallen below the break even price, a level which pushes the budget into deficit. Therefore, we think the risk of default rises significantly in 2016.

e-fundresearch.com: Thank You!