e-fundresearch.com: The world’s major central banks continue to intervene in the capital markets. At what point does monetary stimulus become an investment risk?

Andres Sanchez Balcazar: Fixed income investors inhabit a world in which central banks are the dominant force. The rhetoric and actions of the US Federal Reserve, European Central Bank and Bank of Japan will hold greater sway in the months and years to come. What happens in the underlying economy will be of less importance.

It is because central bank stimulus has pushed government bond yields to historic lows - and some into negative territory- that investors are now taking more risks than they would normally be comfortable with. As a consequence, large parts of the fixed income market now appear very expensive relative to economic fundamentals. But the distortions evident in capital markets are not limited to developed market government bonds or investment grade credit. Pretty much everywhere you look, financial assets are overvalued.

A striking irony is that in trying to suppress volatility, central banks have themselves become a source of instability. They are tearing up their old models but cannot be sure that their new approaches will be effective or free of damaging side effects.Take a look at what happened in Switzerland, for example. When the Swiss National Bank introduced its controversial CHF/EUR currency peg, the market believed it would stick to the policy no matter what. So many market participants – brokers, dealers, investors – conducted business assuming the peg would be a permanent fixture. When the SNB decided it was too costly to maintain and unexpectedly removed it, the repercussions were felt far and wide and many intermediaries in particular suffered heavy losses. Some brokerages went bankrupt.

The SNB-inspired bout of stress has parallels with what occurred in the spring/summer of 2013, when the Fed went public with its plan to begin cutting back on bond purchases. As such, the Swiss experience serves as an additional warning shot for the Fed as it prepares to tighten the monetary reins. The US central bank is aching to raise interest rates – the economy is growing and unemployment is falling – but it is not sure what the effect will be. It will use its first hike, expected in the summer, to test the market’s readiness for a shift to more normal monetary policy. This transition will not be smooth – we expect central banks to be responsible for more bouts of volatility in future.

e-fundresearch.com: Will renewed monetary stimulus efforts such as the European Central Bank’s quantitative easing programme ensure the world avoids a deflationary spiral?

Andres Sanchez Balcazar: I am not convinced. The global economy is suffering from oversupply – there is a lot of spare capacity, particularly in emerging markets as China’s economy slows. Commodity prices – which drive inflation – have fallen sharply as a result and no matter how much lower interest rates go, I don’t see this changing soon. I don’t, for instance, see any sustained recovery in the oil price, and I don’t expect food prices to rise much either.

Encouragingly, there are signs that credit growth, which is also a source of inflation, is gathering strength, particularly in Europe. But this won’t be enough to counter the weakness in commodity prices.

e-fundresearch.com: How do you expect Greece’s battle to secure its future in the euro zone to play out?

Andres Sanchez Balcazar: Although Greece’s exit from the euro zone is no tour base case scenario, the single currency region is better equipped to deal with this outcome than it was a few years ago. It has constructed a robust backstop facility while the ECB’s QE programme should offer additional support.

Partly for these reasons, we recently closed underweight positions in French and Italian government bonds. Nevertheless, a Greek departure, while unlikely, would cause severe market turbulence and it would be unwise for investors not to insure themselves against this tail risk, however expensive it might be.

But regardless of whether Greece stays or goes, the euro zone’s political fragmentation will be a persistent problem. Spain, which has a general election this year, has seen a surge in support for the anti-austerity party Podemos. This could eventually complicate euro zone reform efforts.

e-fundresearch.com: You say that there are no cheap assets infixed income. So how should investors position themselves?

Andres Sanchez Balcazar: Knowing that many asset classes are expensive is of little practical use. Investors will always have to invest somewhere, so the solution lies in extending one’s reach far enough to be able to take advantage of relative value.

One area of fixed income that looks comparatively attractive is longer-dated government debt. Bond yields here have climbed as investors have bought into the idea that US rates will peak at around 2 to 2.5 per cent once the Fed begins tightening monetary policy. That scenario looks too hawkish to me – I don’t think the US can sustain a rate of growth that is sufficient to justify raising rates by that much. This is in keeping with our long-term view that interest rates will remain lower for longer. Lower interest rates should also provide a boost for bonds issued by financial companies, which are attractively-valued relative to other areas of the corporate bond market.

Elsewhere, the fall in the oil price is also opening up investment opportunities. Bonds issued by energy companies have fallen sharply but many of these firms will continue to generate lots of cash even with oil trading at current levels, so I am looking to build positions here.

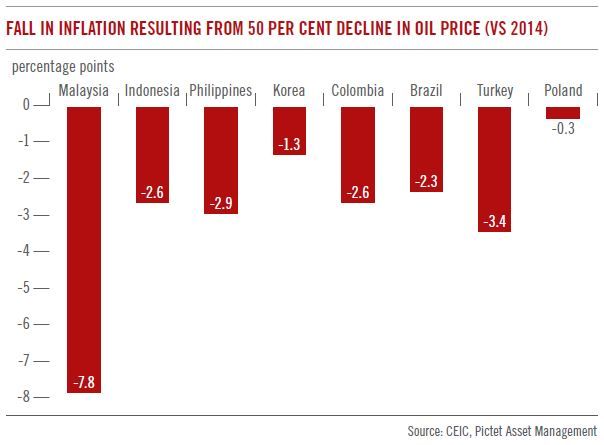

In emerging markets, falling oil prices and the rising USD are mixed blessings. Lower oil prices should cause inflation rates to tumble across the emerging world (see chart). This will allow central banks across the region to cut interest rates – we have already seen rate cuts in India, China and Turkey. Local currency bonds look increasingly attractive as a result, particularly incountries such as Brazil and Turkey, where we expect a shift to monetary easing as the year progresses.

However, the strength of the USD is a concern in the corporate bond market. Emerging corporate borrowers have taken advantage of abnormally low borrowing costs to load up on USD-denominated debt. Yet the recent rise in the USD now presents a threat as it increases the cost of servicing that debt. This is especially problematic for companies whose liabilities are in USD but whose assets and revenues are largely in local currency. China has also been negatively affected by the rise in the USD. The currency's appreciation and an increase in China's labour costs have made Chinese exports less competitive, which could act as a drag on an already slowing economy. This raises the probability of a currency devaluation by Chinese authorities to shore up growth. Even though we believe a forced depreciation of the RMB is unlikely, a short position in the currency can provide a hedge against a sharper-than-expected slowdown in China.

e-fundresearch.com: Is tighter regulation of the financial system something fixed income investors should welcome or beconcerned about?

Andres Sanchez Balcazar: Fixed income is an asset class that does not like volatility so efforts to stabilise the financial system over the long run should be welcomed. The problem we’re finding is that in curtailing banks’ ability to act as intermediaries in the bond market, regulators are eroding vital infrastructure and reducing liquidity. We notice this on a daily basis – with fewer banks involved in market making activities, our ability to trade can at times behindered. If bonds are harder to buy and sell, investors may require higher compensation in future, pushing borrowing costs higher.

e-fundresearch.com: Thank you!

Weitere beliebte Meldungen: