At the beginning of 2014, strategists and analysts were keen to tell anyone who would listen to sell government bonds. Valuations, they argued, were simply too high at a time when the US Federal Reserve was preparing to raise interest rates. Bonds could only go down. How wrong they were. By the end of that year, yields on developed market sovereign debt were even lower, with the JP Morgan global government bond index delivering an annual return of 8.5 per cent (in local currency terms). The trigger for the rally was as easy to spot as it was impossible to foresee: a precipitous slide in oil prices.

Fast forward five months, however, and the bond bears have found their voice once more. Global government debt has seen its steepest four-week slide on record, plunging 2.5 per cent since mid-April. But in contrast to the rally of 2014, there is no single factor responsible for the market’s violent change in direction. There are many different triggers for this one big shift.

What is behind the sell-off?

1. Extreme valuations

Thanks to central banks’ increasingly aggressive financial repression - the deliberate driving down of interest rates to levels below inflation – negative nominal bond yields have become a feature of the investment landscape. In the weeks following the implementation of quantitative easing from the European Central Bank, about 16 per cent of the bonds in JP Morgan’s government bond index, some USD 3.6 trillion, and one in four euro zone sovereign bonds were offering negative nominal yields. Viewing recent developments through a different lens, the valuation of the euro zone bond market appears even more extreme. At one point, the 10-year German Bund was trading at a real yield of -1.32 per cent. That is almost 40 basis points lower than trough hit by the 10-year US real yield in October 2012. At a time when the euro zone economy appears to be gathering strength, such exceptionally low yields look difficult to justify.

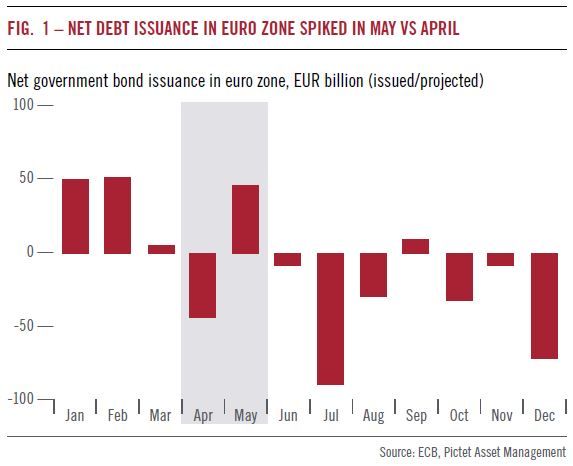

2. A (temporary) shift in ECB bond buying, sovereign debt issuance

Although the combination of QE and a decline in government borrowing in the euro zone can – all things being equal - be expected to bear down on sovereign debt yields, the month of May witnessed an unfavourable (possibly temporary) shift in bond supply and demand dynamics. Not only was net issuance of government bond debt positive to the tune of some EUR45 billion, but the ECB also switched from buying higher-duration securities to lower duration ones. These developments conspired to amplify the sell-off in longer-dated euro zone government debt.

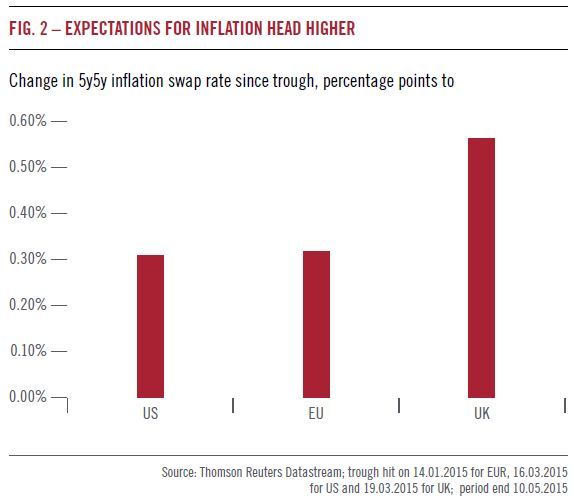

With oil prices rebounding, worries that the world would succumb to a deflationary spiral have all but evaporated. The 5y5y EUR inflation swap rate – the market’s expectation of where inflation will be in approximately 10 years’ time –has risen to about 1.8 per cent, not far from the ECB’s target of near or at 2 per cent.

There are also tentative signs of a build-up in inflationary pressures in the real economy.

Core inflation worldwide troughed some months ago and has been picking gradually ever since. US wages are also beginning to rise – the latest data shows an increase of some 2.6 per cent per year. What is more, the gauges we monitor suggest inflationary pressures should continue to build steadily over the course of the year. The resource utilisation rate across the world’s major economies – our own proxy for a country’s operating capacity – indicate that economic activity is building to levels that will begin to fuel inflation. Tellingly, the last time the US utilisation rate was at its current level was in 2004, when the US Federal Reserve last embarked on a policy of monetary tightening.

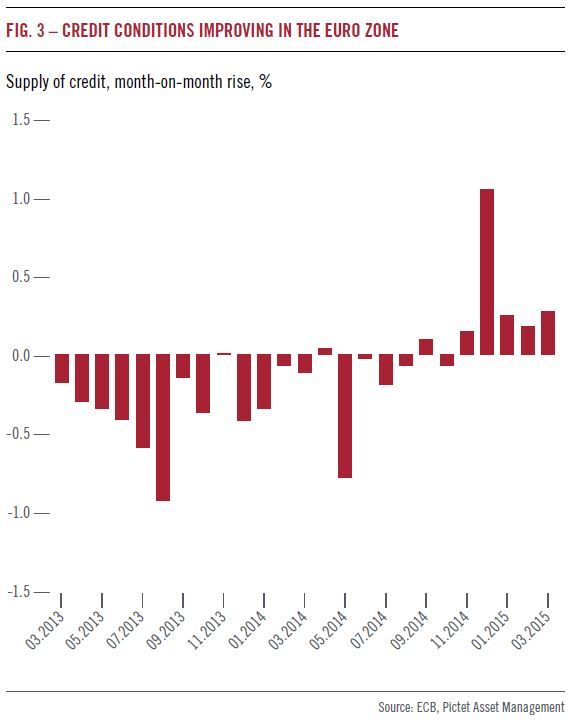

Economic conditions are improving across the euro zone. The most positive signal comes in the shape of increased bank lending to both households and companies – a trend that had begun to emerge months before the ECB decided to embark on quantitative easing. The supply of credit had been contracting a monthly rate of 0.8 per cent in May 2014 but has been rising ever since. It is now firmly in positive territory.

As regulatory oversight of the banking sector has intensified, banks have scaled their fixed income market-making activities.

This appears to be having a negative effect on liquidity: trading conditions are not as favourable as they were in the years prior to the credit crisis in 2008, when the market was much smaller than it is now. The situation has arguably been made worse by the growth in fixed income assets held by funds offering investors daily liquidity. Investors in such vehicles tend to buy and sell at the same time. The combination of many sellers and a shrinking pool of market makers can amplify price moves.

Outlook and portfolio positioning – global government bond portfolios

In our global bond portfolios, we have held an underweight position in German government bonds for some time and have instead favoured debt issued by sovereigns in peripheral Europe. We retain this stance as we believe one of the goals of the ECB’s QE is to make it easier for countries such as Spain and Italy to place their long-term finances on a more stable footing. Over the medium term, the 10-year German Bund yield could edge higher – somewhere between 0.8 and 1 per cent – before settling back lower in the summer months, when supply and demand dynamics in the euro zone debt market are set to become more favourable. Over the near term, it is also increasingly difficult to make the case for yields to rise further in the US, particularly if the country’s recovery continues to lose steam.