e-fundresearch.com: Bond markets have suffered bouts of volatility in recent months and high-yield has been included in that. Is this a good time to invest in the asset class?

Roman Gaiser: Obviously markets are very volatile in general, not just in high-yield. The recent reversal in the German Bund market put a spanner in the works while Greece is clearly another source of volatility. How these factors will play out over the next month is somewhat difficult to predict and volatility will generally be higher. But from a fundamental and technical point of view, things look OK.

One attractive feature of European high yield is that the duration of the asset class is very short compared to both US high-yield debt and to other European fixed income asset classes. At just three and a half years, the average duration is less than half that of Bunds.

The significance of this duration gap should not be lost on investors. Duration is perhaps the biggest risk facing investors at this point in the economic cycle. This is what we have seen in May and June with German yields moving sharply higher but high-yield bonds remaining relatively stable. This has been even more apparent in the case of short-term high-yield where the average duration is one and a half years.

From a fundamental perspective, it is true that company earnings are hardly shooting the lights out. But high- yield investors do not necessarily need rapidly growing profits to secure healthy returns. Profits are stable, benefiting from the moderate economic improvement across Europe, in contrast to the situation two years ago when we were definitely in recession. That favours high- yield more than equities which always need to have bigger and better numbers. If a company is just stable, its share price is going to go down. In high-yield, if a company is stable and solid, an investor is still going to get that attractive coupon.

High-yield performs better than equity markets over time in the sense that it delivers a better return per unit of volatility. High-yield also has done better than government bonds over the long term as well. Why?

Because high-yield bonds have a big income element that compensates for any defaults. Every year investors can get that 4 to 6 per cent coupon, and that makes up for some of the potential capital loss.

e-fundresearch.com: So looking beyond the immediate market volatility stemming from tighter US monetary policy and Greece’s debt crisis, why is the longer term outlook still positive for high yield in Europe?

Roman Gaiser: As for the current environment, in Europe, we have moderate growth and low inflation even if recently we’ve seen inflation move from -0.3 to +0.3. That’s a good environment for high-yield debt. High-yield investors should be wary when there is too much growth because that leads to inflation, rates go up and companies tend to be more aggressive and so on. They need an economy that is not too hot and not too cold.

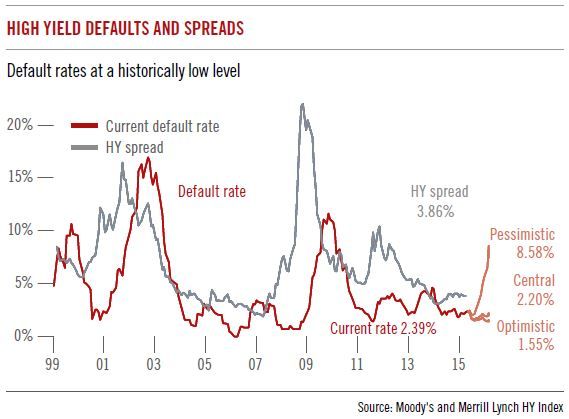

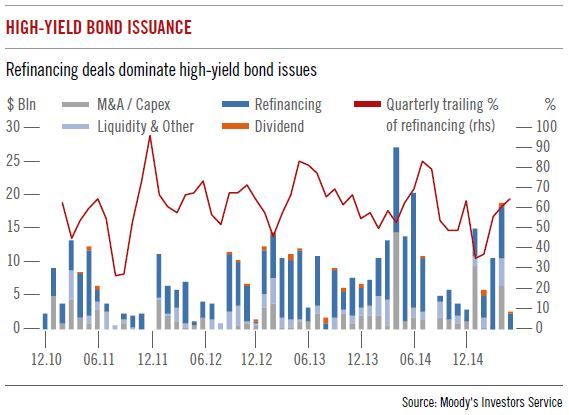

And then on the corporate front we have seen lots of companies which have refinanced shorter term liabilities with longer term bonds. People like to give stark warnings of a “maturity wall”, a huge wave of bond redemptions that are about to hit all at once and lead to defaults. I think that view is largely wrong. I don't see it as a wall at all. It’s more like the bow wave in front of a boat. You are always three metres behind it and never quite reach it. Companies have used the low interest rate environment to extend the maturity of their debts. So you haven’t got very many maturities coming up this year, next year or the next three years. What is more, if you look at the Moody’s Liquidity Stress Index, which measures liquidity for the lowest graded issuers, you see there are very few companies under stress. That’s usually an indication that default rates are going to be low because companies default when they run out of cash.

e-fundresearch.com: Given this support from Europe’s modest economic recovery, are there any sectors you like more than others?

Roman Gaiser: We like sectors that are exposed to the European recovery. So anything that’s consumer related - like retailers. If you look at car sales, they have been improving. As unemployment comes down, people do spend a bit more. We also like services, whether that’s consumer-related services like car rentals, or gaming. Business-related services are also doing well. Telecoms is another sector of interest. Admittedly telecoms are under a fair amount of pressure because of high levels of competition, but there’s also a huge amount of consolidation going on. In the US for example there are something like five big telecom companies. In Europe there are 120 or so. I’m not saying we’re going to be at five European telecoms in three or five years’ time but there is a lot of merger activity going on. That’s positive for us because we tend to be invested in smaller companies which are usually the ones being taken over by bigger companies and that is good for their bonds. This is what happened to the credit rating and bonds of Ono when it got taken over by Vodafone.

e-fundresearch.com: What would you say to investors who are attracted to high-yield bonds' fundamentals but remain uncomfortable with their higher credit risk?

Roman Gaiser: People often don’t realise that some of the best known companies are in fact high-yield borrowers. They mistakenly assume they're all small firms with weak balance sheets. But high-yield companies are anchored into the real economy. High-yield companies are everywhere and part of their everyday lives. It’s the family car, it’s the food the children eat, the airline they fly with. Most airlines are sub investment-grade issuers – British Airways, Air France or Lufthansa. Many car makers are high-yield too, such as Renault, Peugeot, Fiat and Aston Martin. Some of them were downgraded through the financial crisis but many of them are high yield by choice. They want to have leverage because it’s a better return for their shareholders if business goes well.

In terms of issuers, I think high yield represents 20 to 50 per cent of all corporate issuers in Europe. In the more mature US market it's actually much more than that and every second company is rated high yield. Europe clearly has some catching up to do, but recent trends show it is beginning to close the gap.

e-fundresearch.com: Thank you!