Inflation across emerging markets is at multi-decade lows. But one region is bucking the overall trend: Central & Eastern Europe. What does it mean for investors?

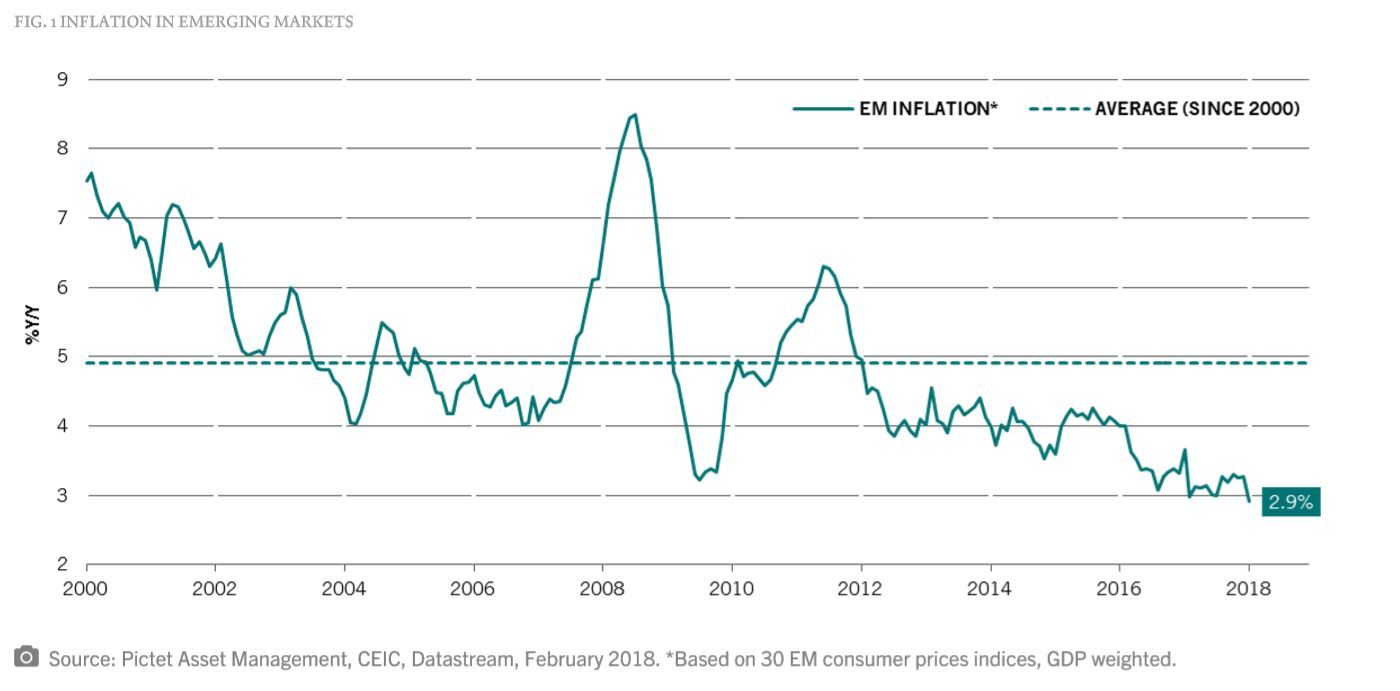

First, some global observations about inflation. Average inflation across emerging markets has fallen to 2.9%, a level not seen since the 1970s, and this is good news for holders of hard currency debt.

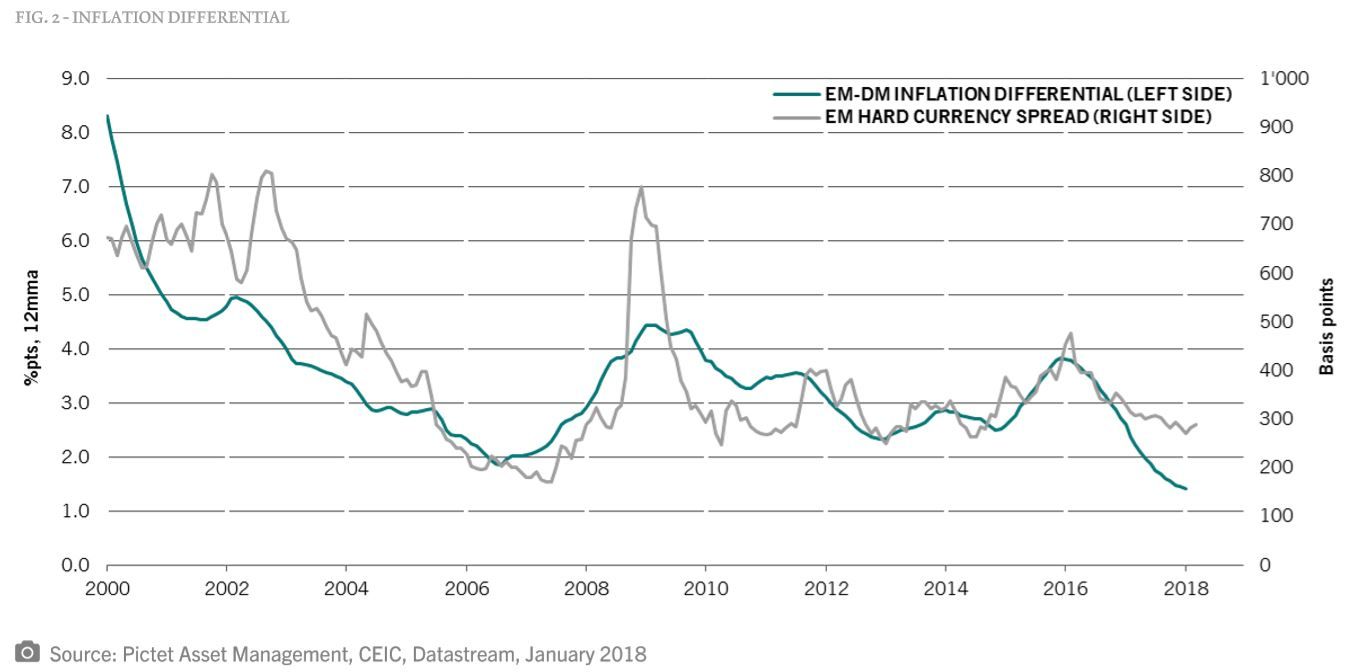

As Fig. 2 below shows, the inflation differential between developed and emerging markets and EM hard currency yield spreads appear closely linked. Even if inflation is expected to pick up modestly in emerging markets, we believe it will rise less than in developed markets, and this supports a further narrowing in emerging hard currency debt spreads.

The exception to the rule...

As mentioned, one cluster of countries bucking the falling inflation trend is the Central and Eastern Europe (CEE) markets of the Czech Republic, Hungary, Poland and Romania. This is mainly because of wage growth, which has ticked up in all four countries.

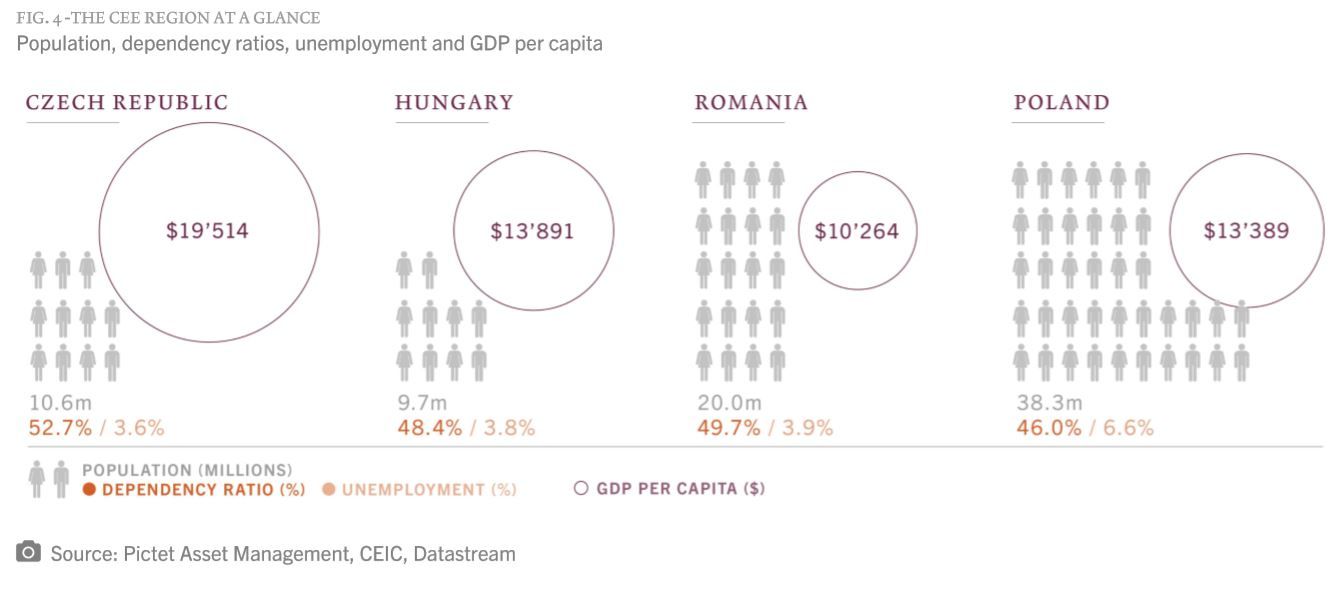

The four markets in the CEE region account for over a trillion dollars of GDP and around 80 million people. Poland is the region’s powerhouse accounting for half of GDP and half of the population. The richest market in terms of GDP per capita is the Czech Republic.

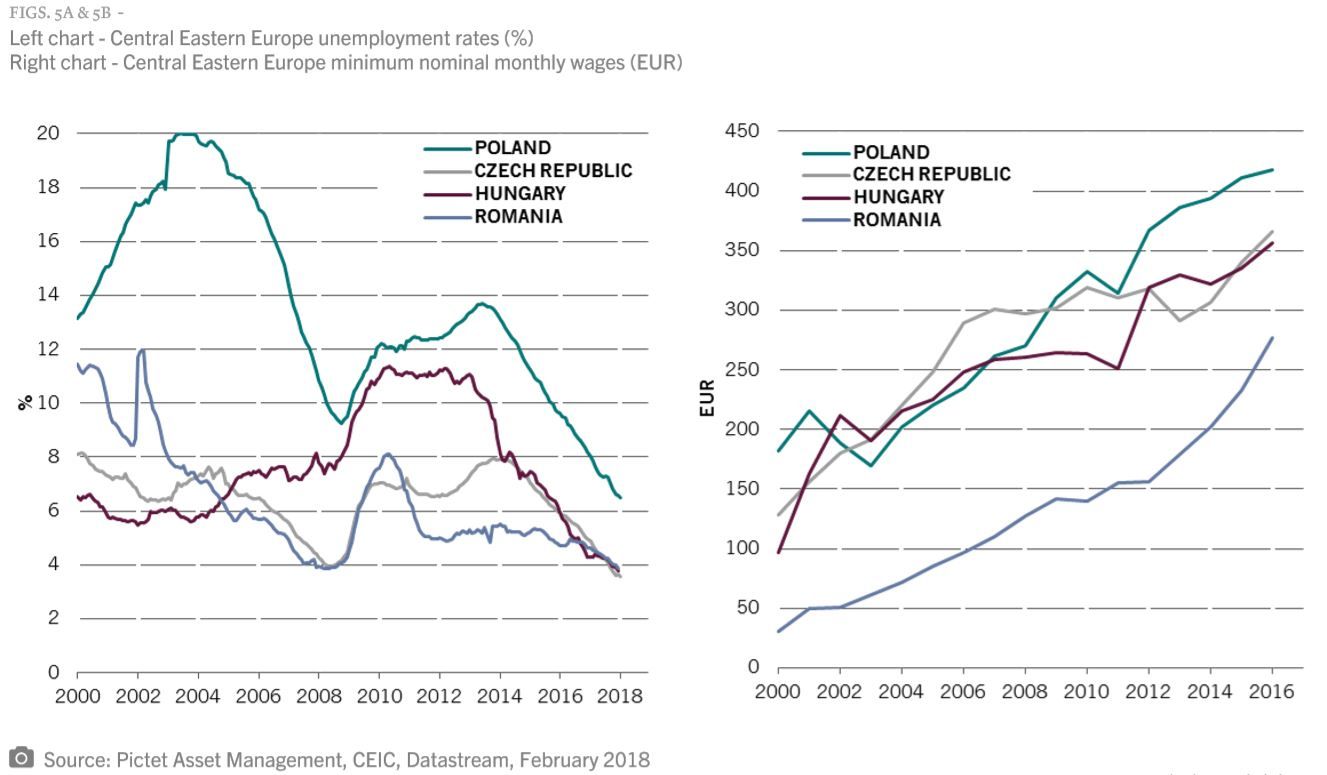

The charts below show two key drivers of wage increases in these four economies: record-low unemployment and increasing minimum wages.

You can depend on us...

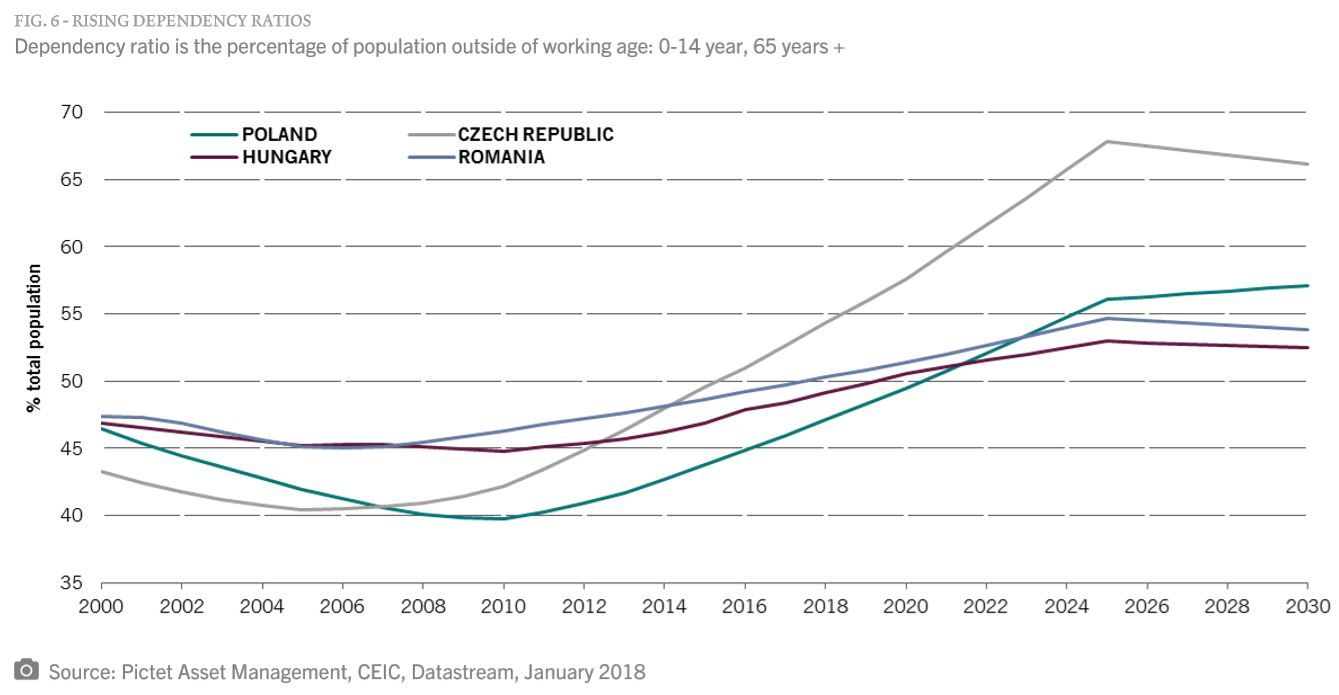

Wage pressure could continue to build in the CEE region as ageing populations and rising life expectancy cause the dependency ratio of non-working to working people to rise across all markets. As Fig. 6 shows this is especially the case for the Czech Republic.

Central banks behind the curve

What does this mean for debt investors? Although rising wage growth in the CEE is a sign of strong economic conditions, the risk of central banks falling behind the curve is a threat for the region’s local currency debt.

Overall CEE central banks have been slow to react to inflation. Poland and Hungary in particular have not started the tightening yet. The Czech National Bank was first to hike rates after the removal of the EUR/CZK floor in April 2017.

Although the Bank of Romania began hiking rates in February 2018, we believe the country is the most at risk. As Fig 7 shows it is the only market in the region with a ‘twin deficit’ – trade and current account - which is deteriorating. We believe this increases the pressure on CPI inflation through an expected depreciation of the currency, in addition to the rising domestic inflationary pressures. We expect a more rapid pace of rate increases in the year ahead.

Patrick Zweifel, Chief Economist & Nikolay Markov, Senior Economist, Pictet Asset Management