Trump-Xi trade discussions: a blessing in disguise?

The gap between China’s nominal exports and imports to the US is the largest ever, as Fig.1. below shows. This is the argument used by President Donald Trump for raising import tariffs on Chinese goods.

While the move has sparked tensions between the two countries, we believe a positive side-effect is that it could well accelerate the opening of China's services sector to overseas participation. China has promised to open its economy further – in particular promising to speed up the pace of ownership reforms for the country’s financial sector with a timeline for implementation of just a few months, which could help avert a trade war.

Overall however, Trump’s plan for a drastic rise in tariffs is unlikely to reduce the US trade deficit with China. The US simply cannot produce the goods currently imported from China at competitive rates, at least not in the short term. For now, it will have to continue importing these goods and higher import tariffs will make them more expensive, pushing up inflation in the US.

How can Trump’s trade agenda impact other emerging regions? The case of Argentina and Brazil

Economist Anjeza Kadilli is just back from Argentina and Brazil where she met with policy makers.

She believes Brazil and Argentina could be the big beneficiaries of the trade tension between the US and China. Both Brazil and Argentina already account for a large part of soybean exports to China. Their share will be even bigger if China decides to stop imports from the US. This new pattern would open opportunities for investors not only in agriculture, but also in related sectors such as manufacturing, infrastructure and machinery.

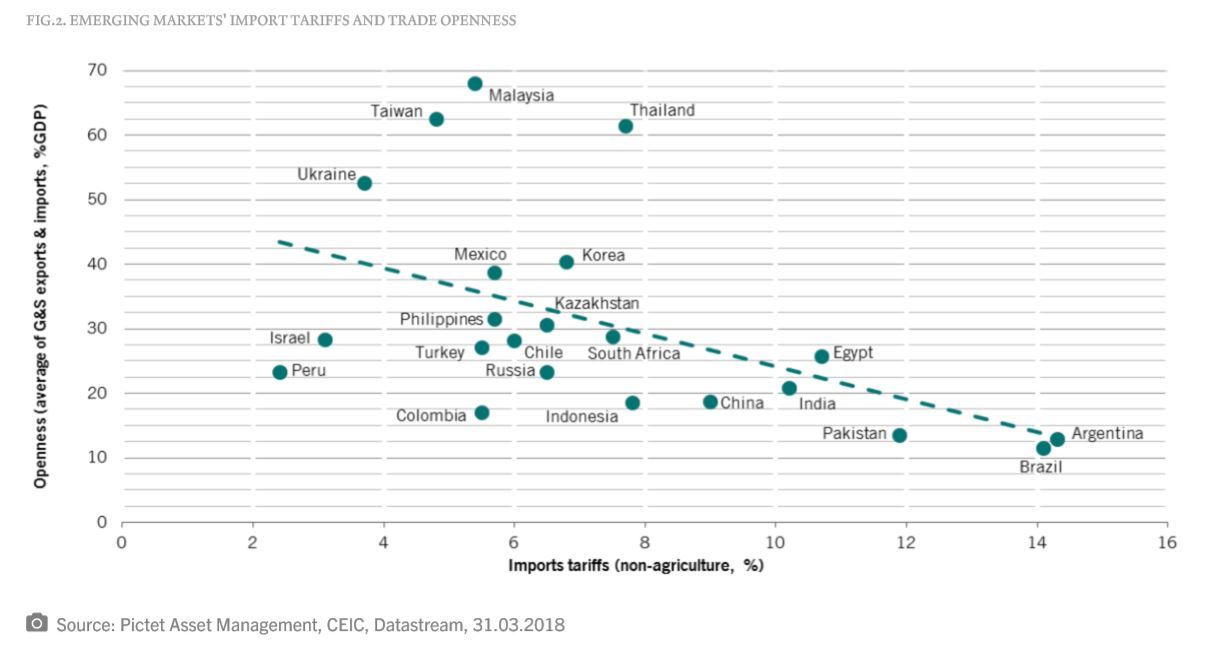

One obstacle is that Brazil and Argentina currently have the highest import tariffs (14.1% and 14.3% respectively, excluding agricultural products) and are also fairly closed economies (see Fig.2). FIG1

However, from what she heard during her trip, Anjeza feels there is a strong will, from Brazil in particular, to reduce tariffs even if this means doing it unilaterally. Policymakers would focus domestic production on segments where they have real added value (e.g. agriculture), and reduce tariffs in areas where they cannot reasonably compete with overseas competition (e.g. industrial sectors). This would be a positive development for the efficiency of these markets.

Asia’s growing intra-market trade offers new opportunities

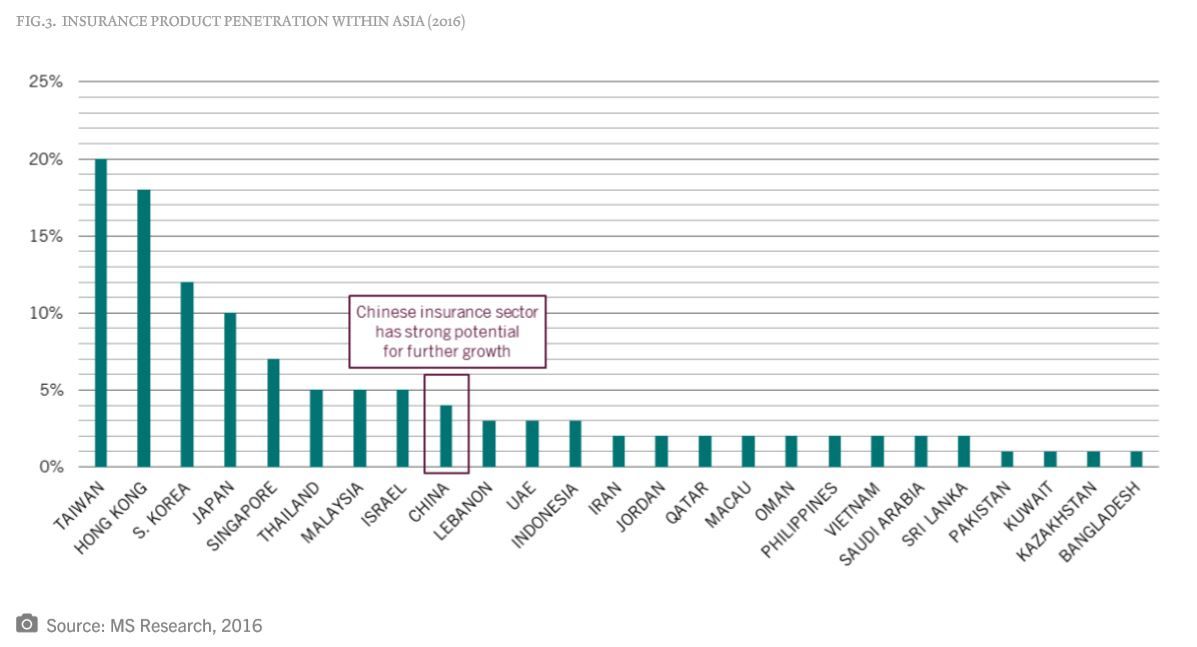

While China is fighting off new protectionist measures from the US, encouragingly intra-market trade within Asia has been increasing. To capture this encouraging trend in our portfolios, we are playing the continuing opening-up of the region’s financial sectors, in particular via Chinese insurers or Indian banks, where market penetration is currently low.

Patrick Zweifel, Chief Economist, Pictet Asset Management