In our view, the sell-off in EM currencies since mid-April is not comparable to the 2013 taper tantrum that was triggered by a classic balance-of-payments crisis. Rather, we think it is due to four global, idiosyncratic factors that impact the currencies of both current-account-deficit (CAD) and current-account-surplus (CAS) countries:

- Rising global rates/stronger USD (affecting mostly CAD)

- Trade tensions (affecting mostly CAS)

- Renminbi (RMB) contagion (affecting CAS & commodity exporters)

- Rising populism (affecting all)

Is the correction in EM currencies justified?

Observation 1 - A broad sell-off

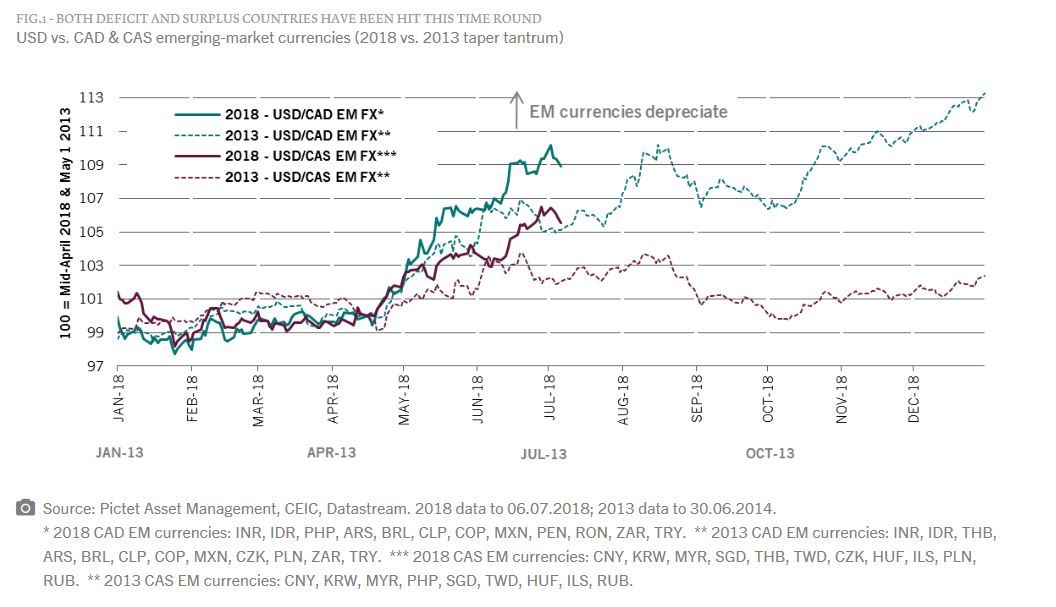

EM currencies have lost 10 per cent this year, compared with 4 per cent in 2013 (Fig.1). The main difference with the 2013 taper tantrum is that the sell-off is broad-based, hitting both deficit and surplus countries.

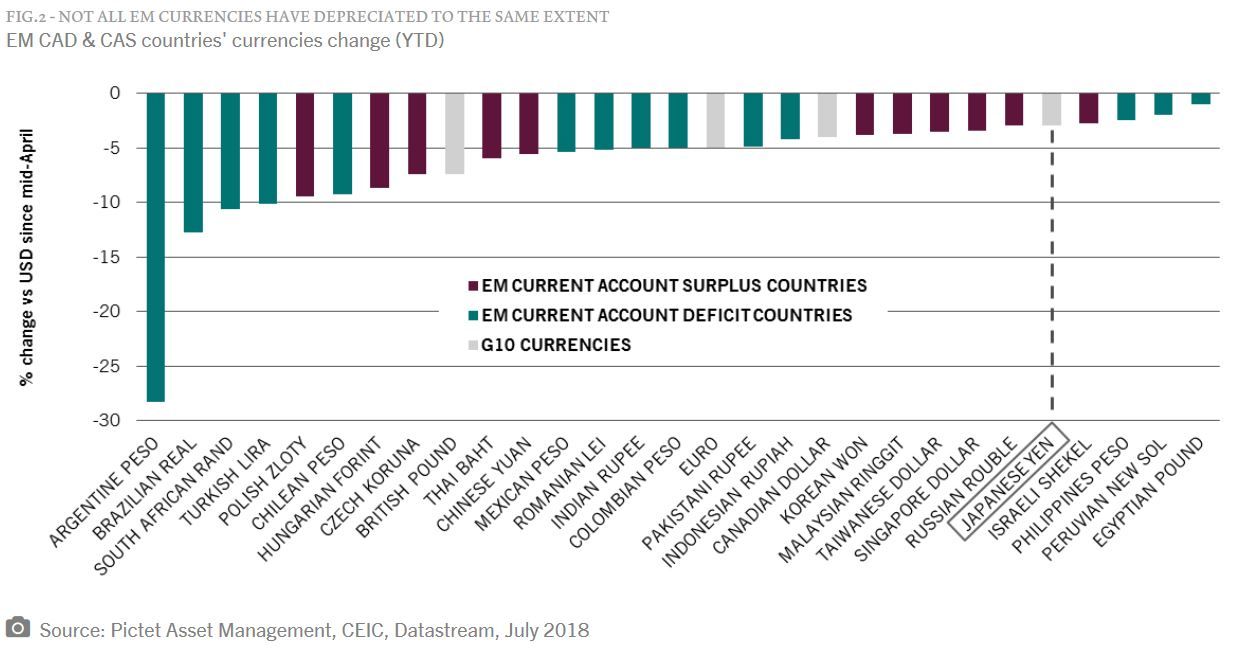

Countries running a current account surplus have not been sheltered from the sell-off, but this is no contagion. We think it is due to trade tensions, and exposure to China and a weak renminbi.

Observation 2 - Current account positions are much stronger across the board than 5 years ago

However, although countries with larger current account deficits (a proxy for higher external financing needs) typically have weaker currencies, not all CAD countries have seen their currencies depreciate as heavily this time. The main culprits are Argentina and Turkey, which exhibit genuine balance-of-payments fragility.

A point to note is that the two countries are the exception - current account deficit countries have sharply reduced their external financing needs, and appear much better placed to cope with higher rates.

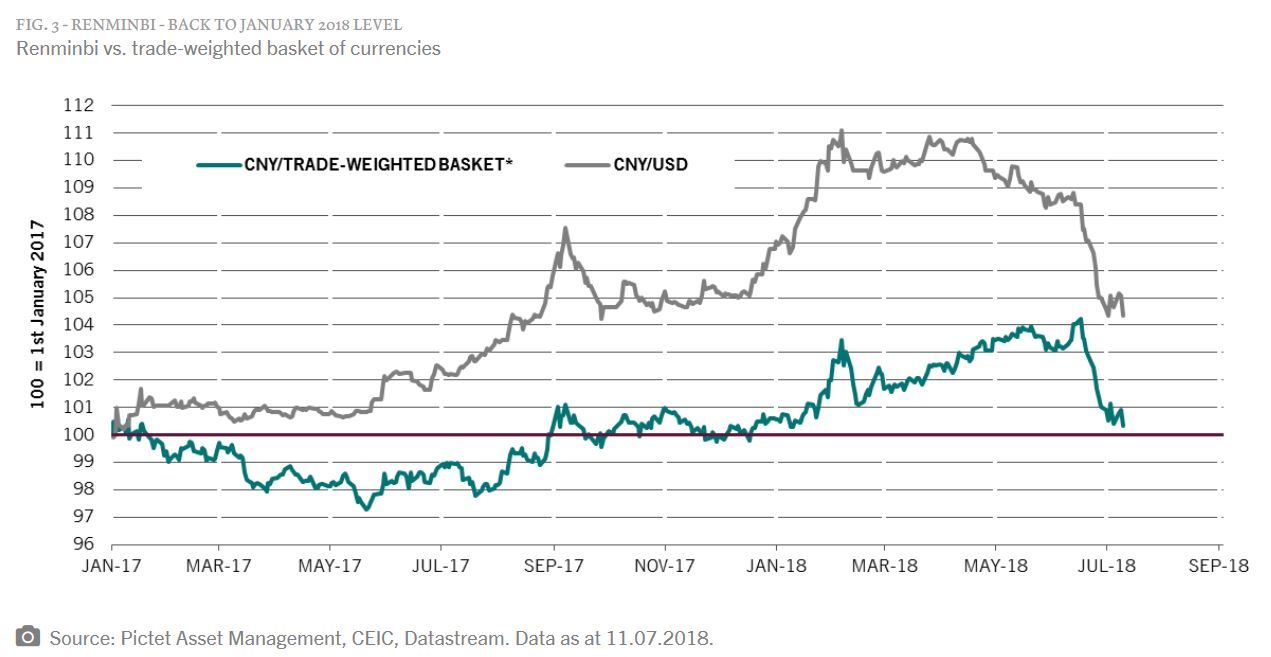

Observation 3 - No contagion to fear from China

A reassuring factor is that net capital outflows have been very limited year-to-date thanks to China’s improving fundamentals. Capital controls in place are also stricter since January 2017, notably on overseas direct investment, and this has reduced the risk of capital-flight panic.

Conclusion

Many emerging countries have reduced their current account deficit in recent years, putting them in a much better position to withstand external shocks. And although growth is slowing in China, its economy's fundamentals are stronger than in 2013.

Trade-related tensions remain, and the risk of a populist government is a concern in Brazil. But in our view, the correction in emerging market currencies has gone too far.

Patrick Zweifel, Chief Economist, Pictet