Debt not the main issue

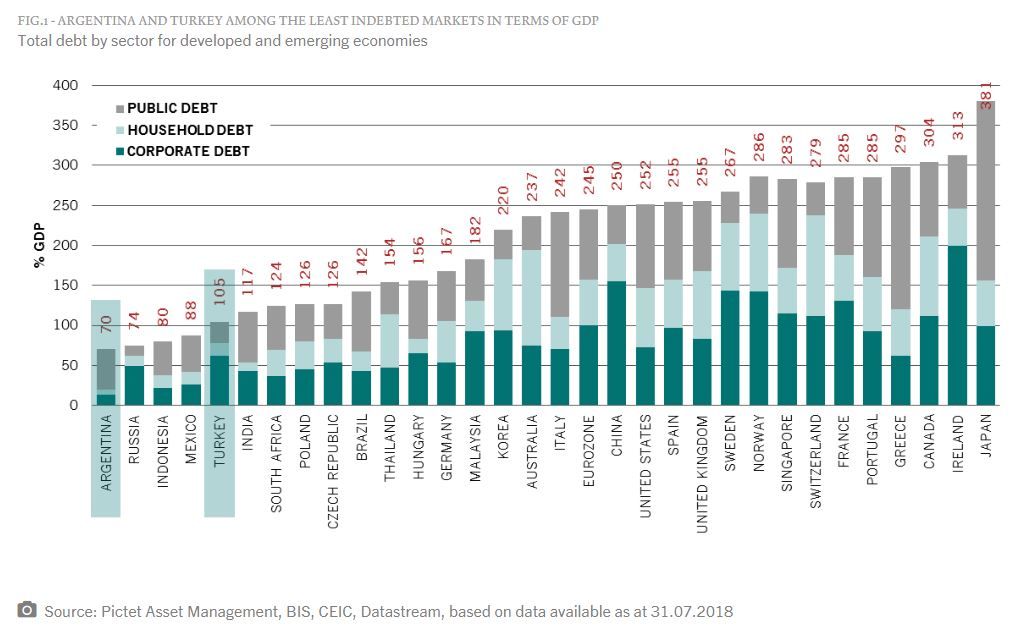

Argentina and Turkey share large fiscal and current account deficits. That said, debt is not the main issue; as Figure 1 below shows, their debt relative to GDP is relatively low.

The main issue is that investors have lost confidence in their ability to control inflation.

Glass half full

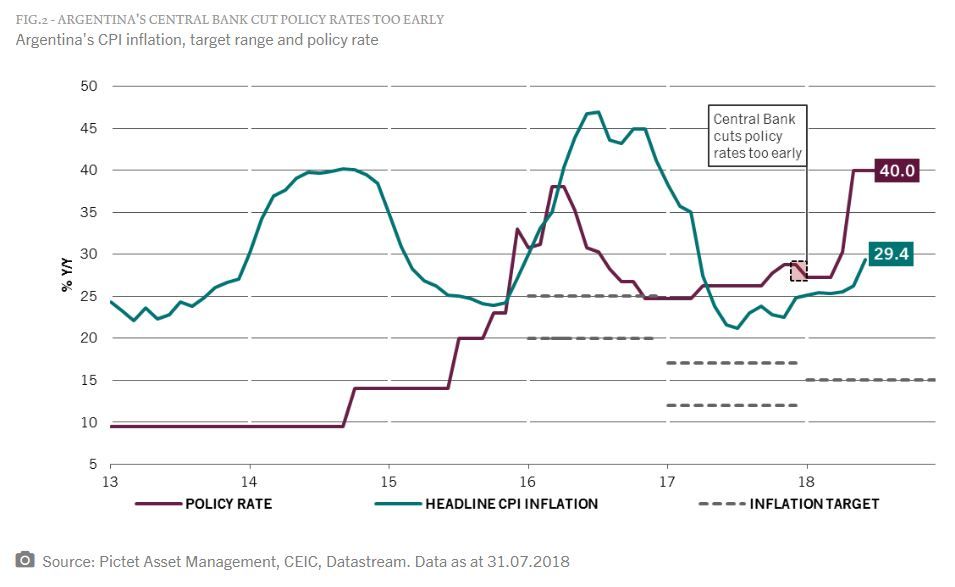

In Argentina, the Macri administration cut policy rates in late 2017, hopeful it would succeed in reducing inflation and mindful of 2019 elections. But it acted too early and caused loss of investor confidence in the central bank, which was forced to raise rates by around 13 percentage points to stem the currency's decline.

This, together with other policy mistakes, cost the governor of the central bank his job, and saw the country burn through significant foreign currency reserves. Growth forecasts have almost halved since, and Argentina had to request to be bailed out by the IMF.

However, we believe that the worst is over if the government commits to fighting inflation over the medium term. In our view, necessary fiscal reforms are justified but will require political stamina to implement, especially as they will in themselves be inflationary.

We also believe they need to establish a more credible target range for inflation, higher than their current 15%.

Glass half empty

We are a lot less optimistic about Turkey under the rule of re-elected President Erdogan.

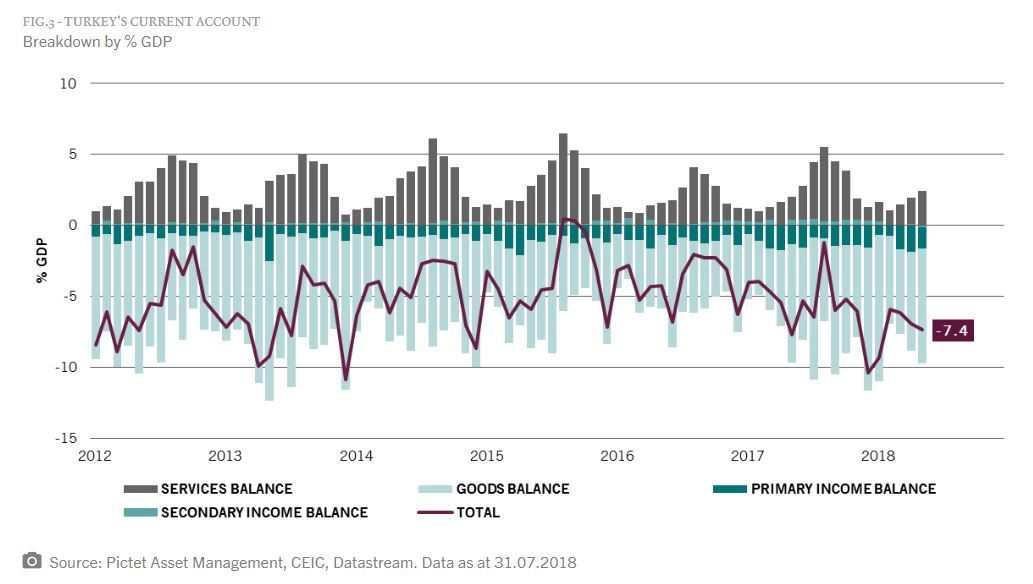

Firstly, as the chart below shows, there is a large and chronic current account deficit. Turkey's private sector (both households and corporates) is highly leveraged due to high domestic consumption and a low savings rate. The country has no choice but to finance its current account deficit mainly through foreign investments, and in USD, EUR or JPY as external investors' confidence in the lira has plummeted.

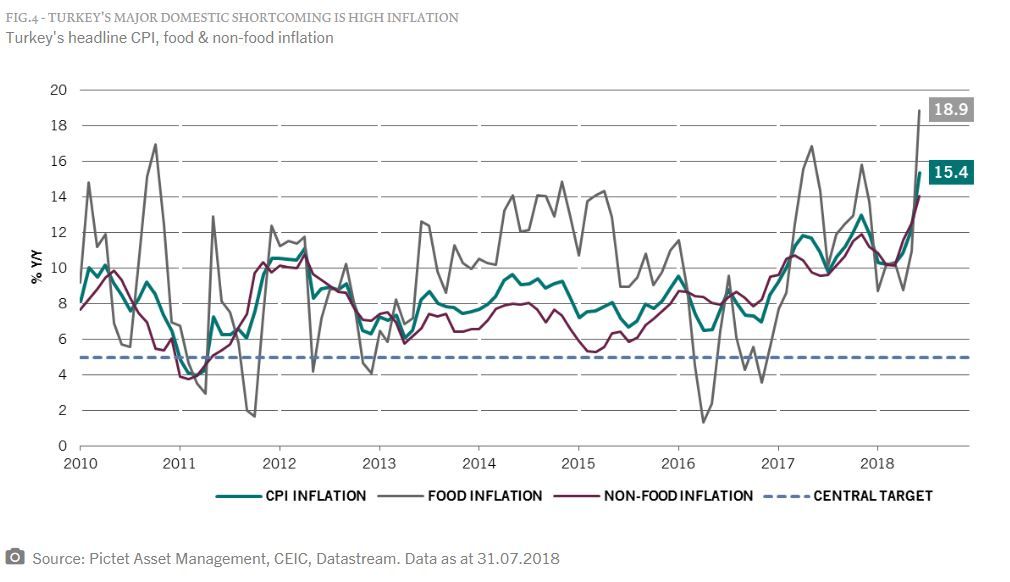

In addition to this external imbalance, the major domestic shortcoming is high inflation (see Fig.4 below), above 15 percent, and on a very steep trend. This is due to the lira's chronic weakness (down 56 percent against the dollar year to-date (Bloomberg, data as at 10.08.2018)) as well as rising energy prices.

With inflation expected to rise further, as the lira continues to depreciate, tighter monetary policy is urgently needed. However the Central Bank (CBRT) has disappointed by refraining from raising rates at its July meeting.

Unlike in Argentina, we have limited confidence in Turkey's political regime to make the right calls for the economy. A focus on growth-enhancing measures instead of inflation control appears to be undermining monetary policy.

What's more, the decision by President Erdogan to appoint his son-in-law to head the new finance & treasury ministry raises concerns about the independence of the central bank.

In conclusion we think Turkey’s macro vulnerabilities, coupled with political concerns, put the country close to a breaking point. In our view, all the macro ingredients are now present for a full-blown balance of payments crisis.

Anjeza Kadilli, Economist & Nikolay Markov, Senior Economist, Pictet Asset Management