The next to fall?

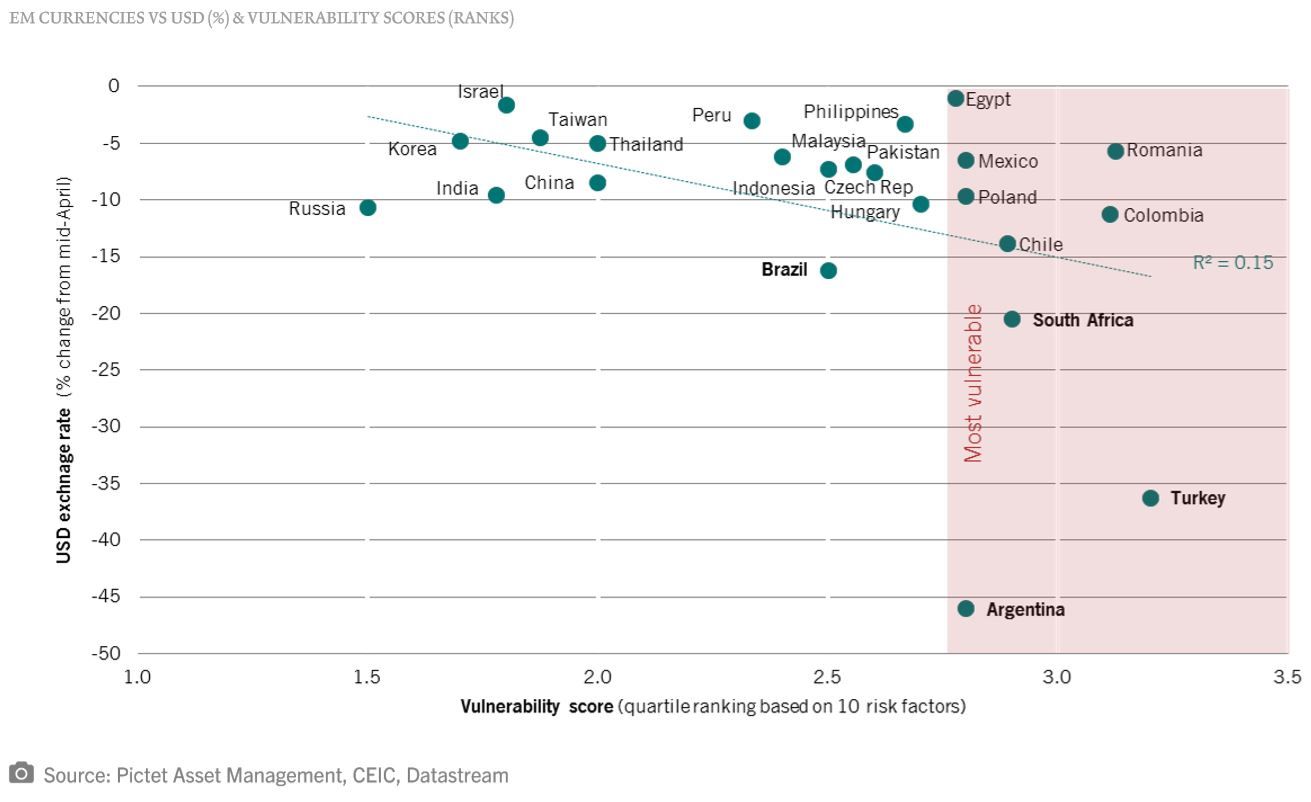

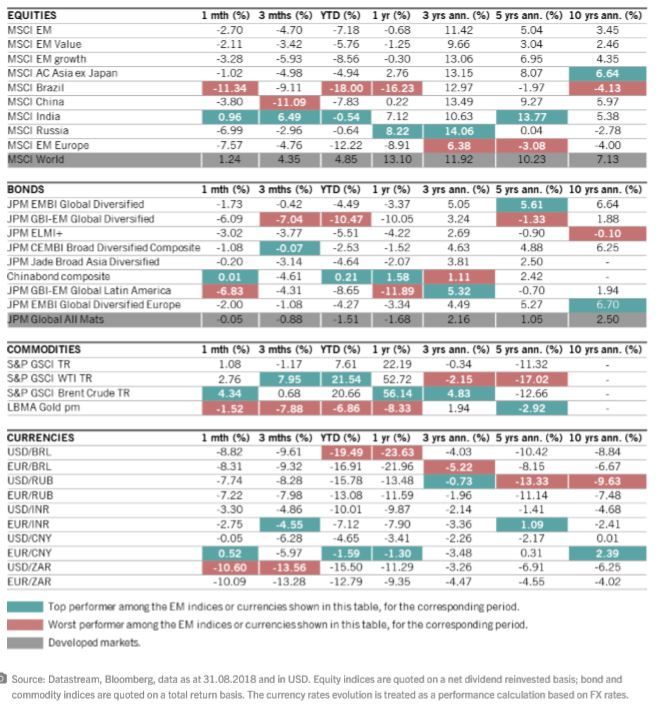

Our proprietary EM vulnerability score card shows that the correction may be justified for South Africa but less so for Brazil.

What is happening in these markets and should we expect more weakness from both currencies?

Brazil: fighting fit

Between the four markets, Brazil seems in best economic health. Whilst Argentina, Turkey and South Africa have significant current account deficits, Brazil’s is relatively narrow. Meanwhile, it has significant foreign currency reserves (USD370 bn) equivalent to 27 months of imports to defend its currency.

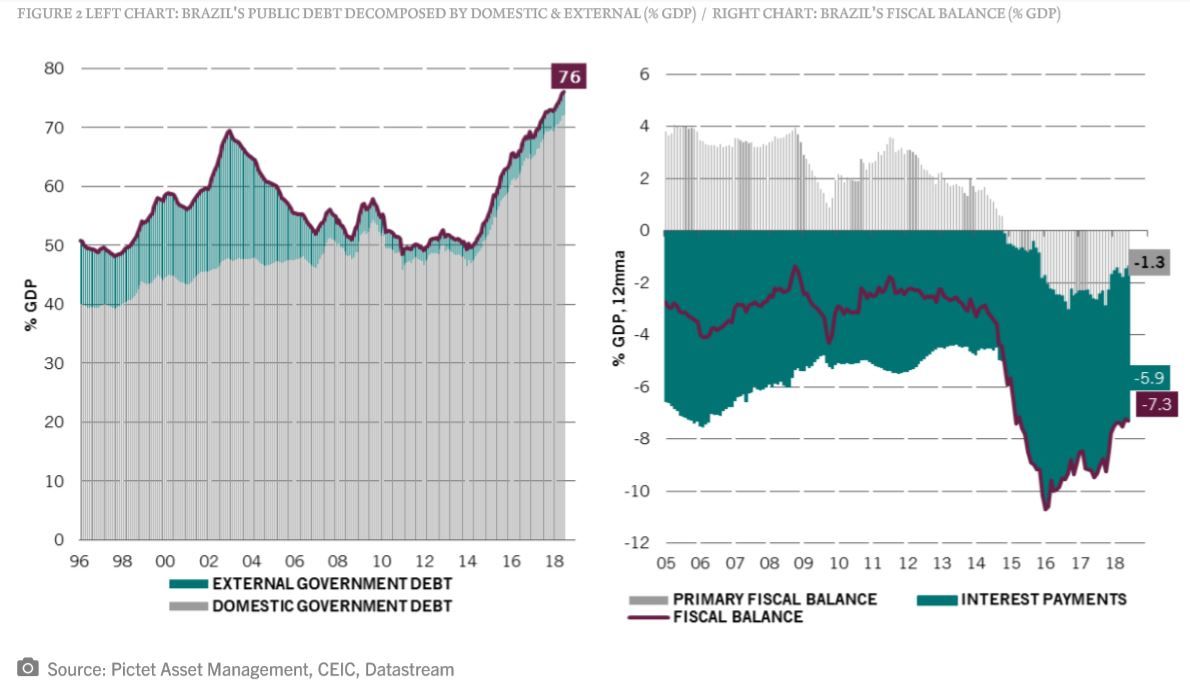

More of an issue is public debt of 76% of GDP (the second largest in EM after Egypt), which is expected to rise for a couple of years even in the most optimistic scenarios.

The mitigating factor is that roughly 95% of public debt is owned by domestic holders, who are more captive due to a range of factors, and therefore less volatile than debt owned by overseas investors.

Elections take centre stage

It appears Brazil’s vulnerability is largely due to the uncertain outcome of next month's elections (the first round is on the 7th October, the second on the 28th).

Candidates span the political spectrum. At this stage the two front-runners are Fernando Haddad (official candiate of the Workers Party backed by jailed former President Lula) and right wing Jair Bolsonaro, who was recently stabbed in the street whilst on the campaign trail.

We believe that regardless of who wins, the public debt issue will be addressed. The depth of the reforms will depend however on the political and personal profile of the winner.

South Africa: running out of steam?

Across the Atlantic, South Africa is arguably more vulnerable than Brazil to global developments due to its weak macro fundamentals and volatile political environment.

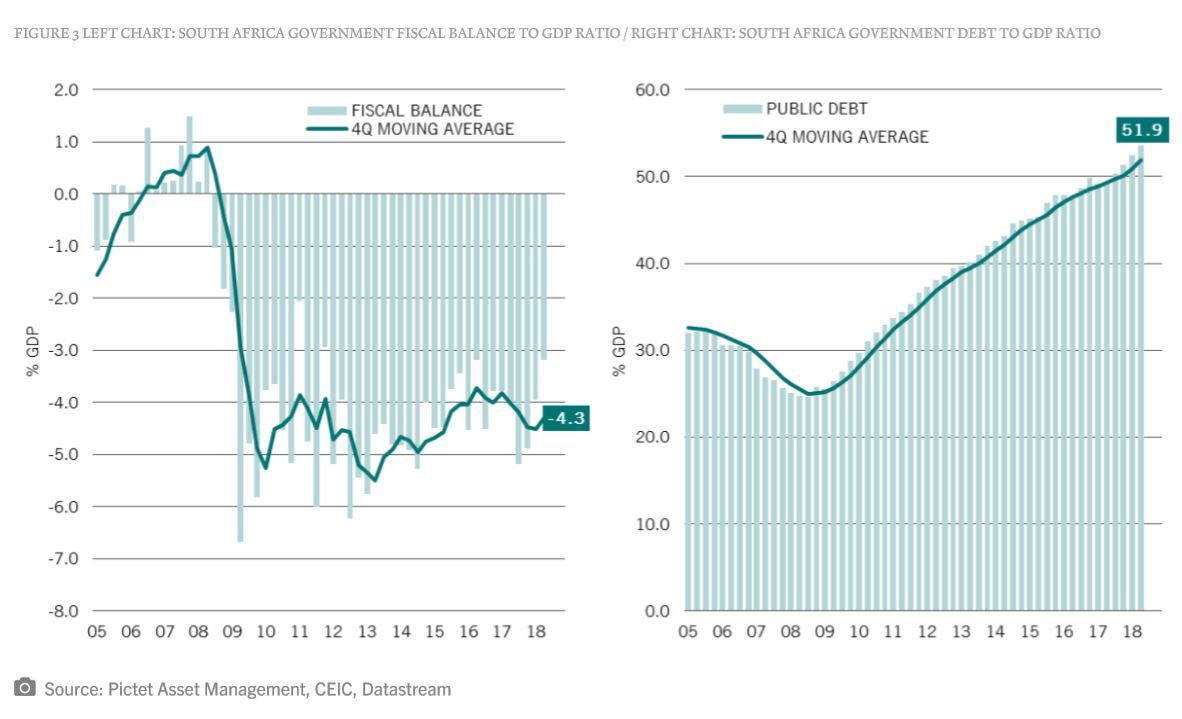

The honeymoon period President Ramaphosa enjoyed after his February election is now over and the currency has weakened again. South Africa technically entered recession in Q2 for the first time since 2009. The rand was also hit by concerns that a change in the constitution later this month could result in Zimbabwe-style land seizures.

On the domestic side, the fiscal deficit is significant. Announced tax increases are unlikely to curtail spiralling public sector expenditure exacerbated by struggling state owned enterprises (SOEs).

On the external front, the current account deficit remains high. This reflects weaker demand and is financed by volatile portfolio flows (stocks and bonds) prone to changes in global financing conditions and sovereign credit ratings. The depreciation of the rand is likely to push up inflation, which is already close to its upper target range. This would limit the central bank's scope for more accommodative monetary policy.

Final thoughts...

Both emerging markets need to be watched closely. But we believe South Africa is most likely to feel the heat in coming months. It is more globally exposed than Brazil, and vulnerable to trade issues and wider tensions between China and the US (its second and third trading partners respectively). We also feel uncertain political governance could increase the strain on its already weak fiscal position.

Sabrina Khanniche, Senior Economist & Anjeza Kadilli, Economist, Pictet Asset Management