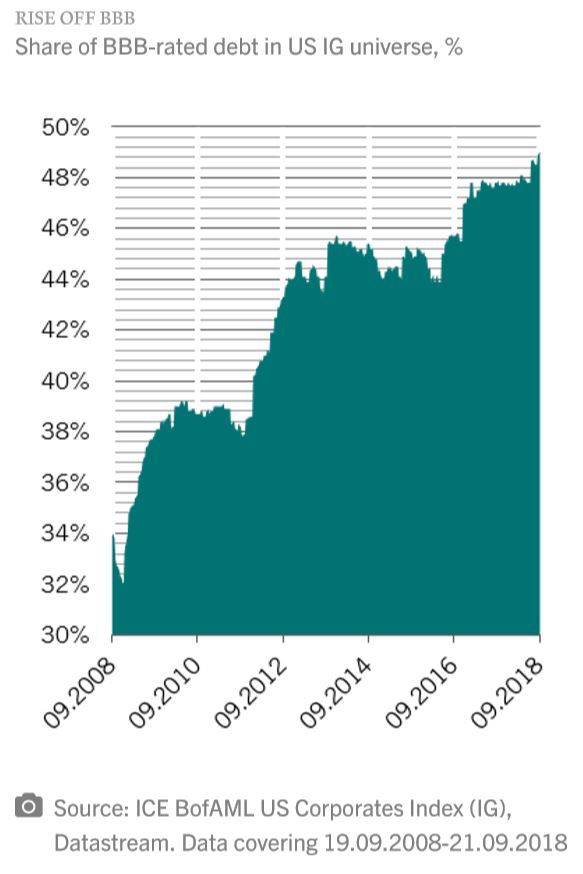

History doesn’t always repeat itself. A profound shift in the US corporate bond market will likely make the next crisis – whenever it comes – look quite different to previous ones. Compared to previous cycles, the proportion of bonds with the lowest possible investment grade rating (IG) – BBB – is exceptionally high, having increased sharply over the past decade. BBB-rated debt now accounts for around half of the whole market in both Europe and the US (see chart).

One reason for the increase is that more firms have been turning to the credit market for funding as banks have scaled back lending in response to tougher regulations. At the same time, companies have been borrowing heavily to fund acquisitions – indeed firms operating in the telecom and consumer sectors, which have been particularly active in M&A, make up a substantial proportion of BBB-rated bonds – each sector accounts for around 8 per cent of the universe. Meanwhile, there has also been an increase in debt-funded buybacks and dividend payouts.

Consequently, today’s investment-grade bond market is, in aggregate, significantly more risky than in the past.

This is a problem because in periods when economies slow, or default rates rise, a significant proportion of BBB-rated borrowers tend to be downgraded as their finances deteriorate. This pushes them out of the investment-grade universe and down in to the high yield market. Sectors that are more defensive and have struggled to keep up with the broader pace of earnings growth would tend to be hit hardest. Portfolios which mostly or exclusively focus on investmentgrade debt would therefore be forced to sell.

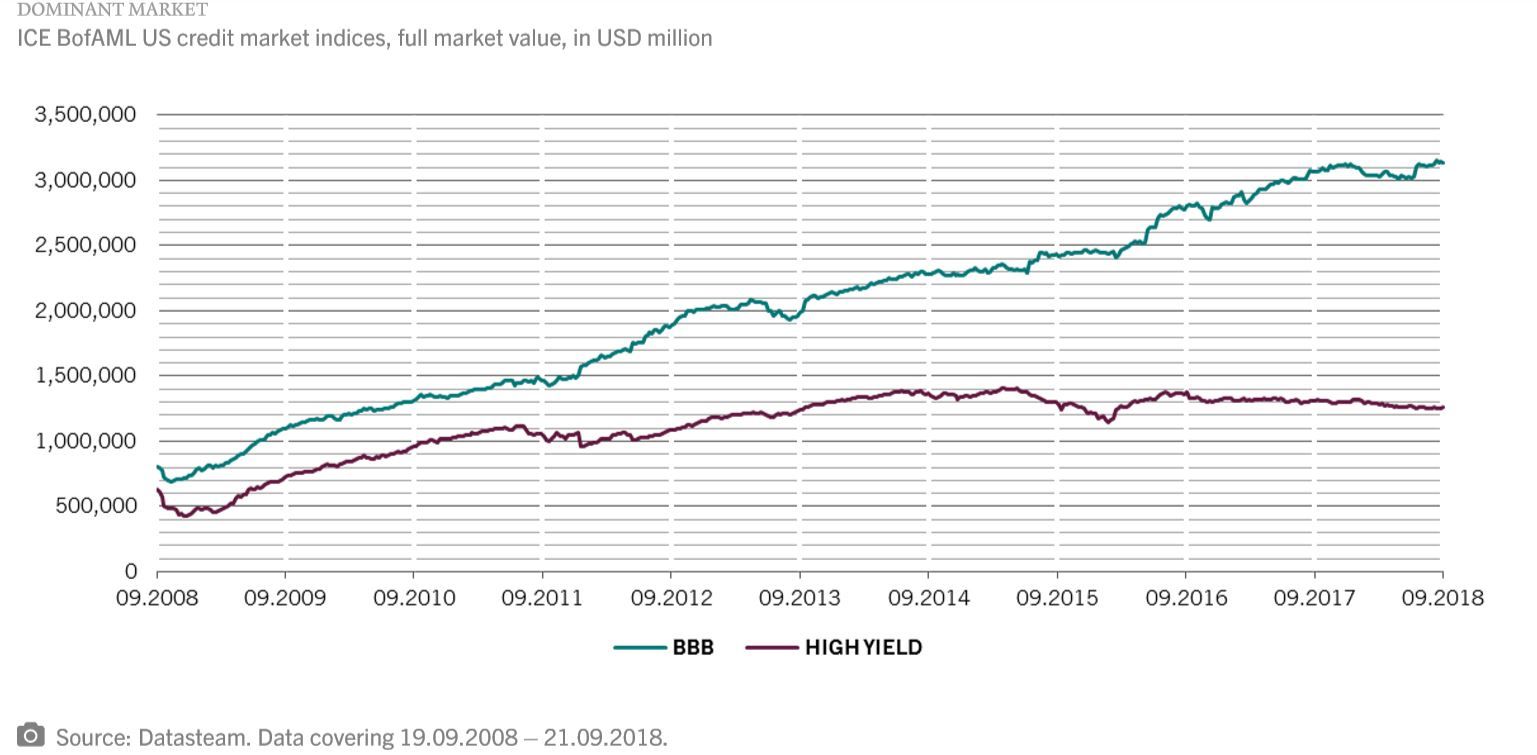

That would clearly have serious repercussions for the market as a whole. But, arguably, the impact on the high-yield segment would be even greater as that market is forced to absorb a large volume of newly-downgraded paper. During previous credit downturns, around 5-10 per cent of BBB-rated US debt was downgraded, worth around USD60-80billion on average. Based on today’s USD3.1 trillion BBB-rated market, any equivalent downturn would create at least USD 150 billion of these fallen angels. That would be a huge amount for a USD1.3 trillion high yield universe to soak up.

The only way for this mass of fallen angels to be absorbed by the market at a time when liquidity conditions are likely to be strained is through price. This will also affect new issuance, as costs for borrowers rise.

Consequently, we think both investment grade and high-yield bonds are riskier than their yields currently suggest. While we do not anticipate an imminent end to the credit cycle, as it grows ever longer in the tooth ever more stresses will appear. We think the predominance of BBB-rated paper make investment-grade bonds among the least attractive parts of the debt market.

Shaniel Ramjee, Senior Investment Manager, Pictet Asset Management

Supriya Menon, Senior Multi Asset Strategist, Pictet Asset Management