More growth-supportive fiscal and monetary policies should lift China’s GDP growth next year.

CHINA REACTS TO US TRADE TARIFFS

In the face of US trade tariffs, we expect China’s fiscal and monetary policies to become more growth supportive, providing a lift to GDP growth by some 0.5 per cent next year. Yet, we think Beijing’s stimulus is likely to take longer to work and be less impactful than in previous easing cycles.

Trade policy

Whilst China has already hiked tariffs up to 25 per cent on USD 110 billion of US imported goods, it has cut the import duties it charges to Chinese importers / corporates / consumers and plans further moves. Including additional cuts on most favoured nation (MFN) tariffs due on 1 November, China will have reduced its average MFN tariff from 9.9 per cent to 7.5 per cent, easing the burden on those facing higher US tariffs by lowering duties charged on other countries' imports.

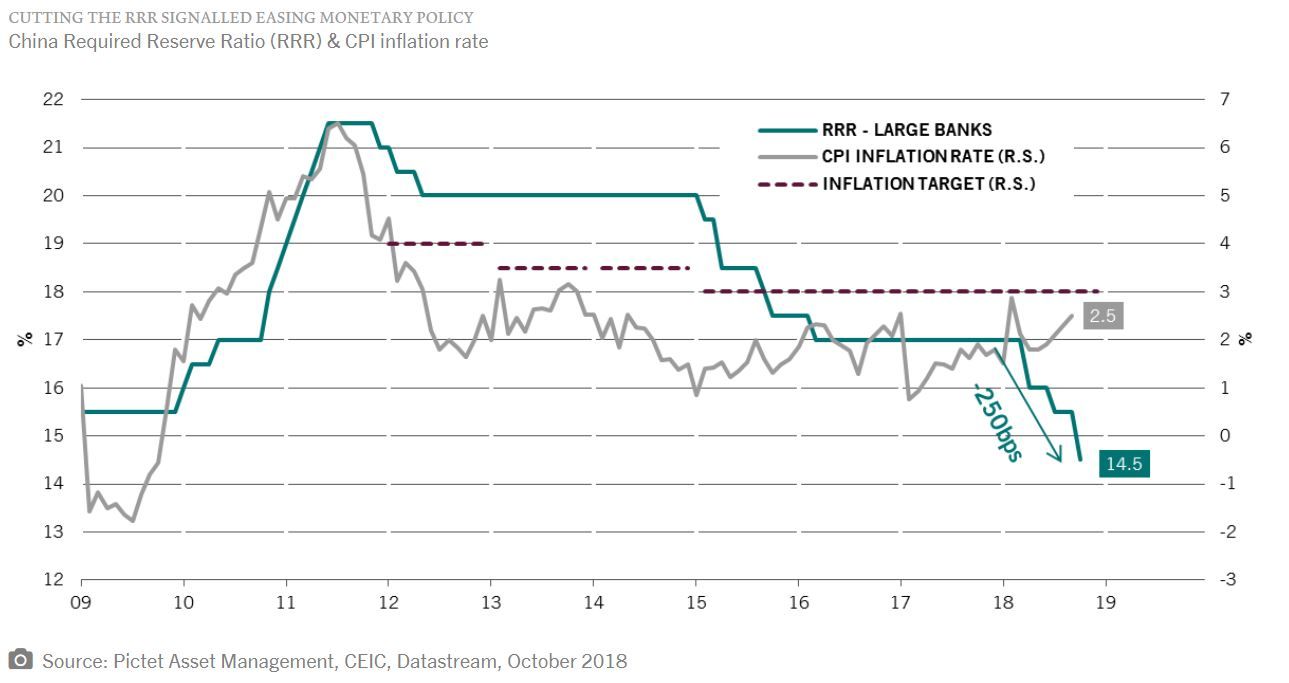

Monetary policy

By cutting its reserve requirement ratio (RRR) by 250bps since April, China has sent a clear signal. Already, investment spending has accelerated in real estate and manufacturing in Q3. We think there will be another 100bps RRR cut by March 2019.

Fiscal policy

Also part of the arsenal is a more proactive fiscal policy in the form of tax reduction of RMB1.3 trillion for the whole year. This represents nearly 2 per cent of 2017 GDP, of which some RMB500 billion comes from a cut in individual income tax effective since 1 October.

More measures are expected in 2019, in particular fiscal support for infrastructure investments, cuts in VAT and corporate income tax.

A ROAD FULL OF OBSTACLES: CAPITAL OUTFLOWS, INFLATION & DELEVERAGING

China faces three major hurdles in extending fiscal & monetary stimulus:

- China-US interest rate spread (10 year bond yield spread at a 7 year low at 40bps) & capital outflows risk

- CPI inflation at a 7 month high

- Deleveraging: total social financing at a record high

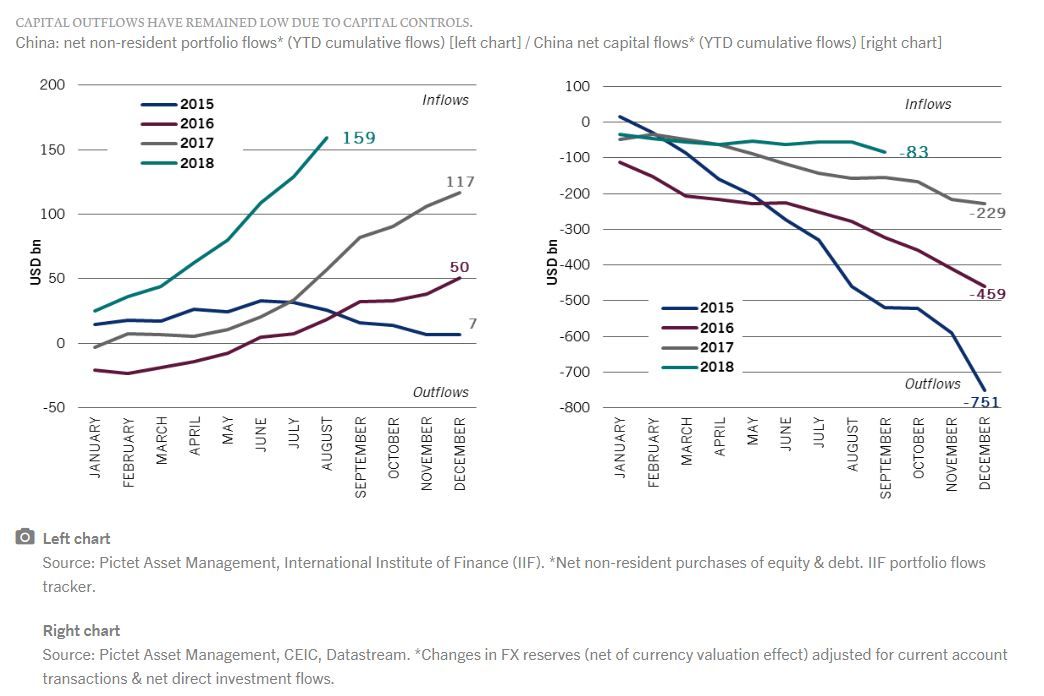

China has already tightened capital controls to deal with the first hurdle. On inflation, policymakers view the rise as temporary and below the 3% target, so not their prime concern. Finally on deleveraging, it should only resume when trade tensions fade as short-term growth has become the top priority.

So far, measures seem to be working and investors have remained on board. Although China’s capital outflows rose in September, they are still low due to capital controls, representing only half the levels observed in 2017 (right chart). What’s more, over the same period foreign inflows are three times larger last year (left chart).

Added to the expected inclusion of Chinese financial markets into broader market indices, this shows that investor confidence in China remains high.