The year has only just begun, and China is already dominating the headlines: its trade dispute with the US rumbles on; Beijing is once again acting to shore up growth; and tech companies are blaming slowing Chinese sales for earnings stumbles. All of which raise the critical question of whether investment opportunities arising from these developments outweigh the risks.

For us, as bond investors, it is a matter of finding the right balance between risk and prospective return – something that the Pictet-Absolute Return Fixed Income strategy specialises in by combining long-term strategic allocations with offsetting investments that act as a hedge against short-term risks.

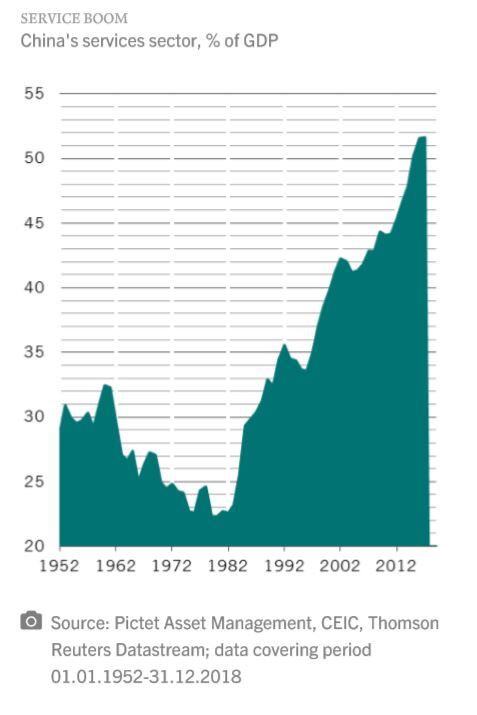

As fixed income specialists, we have always been attracted to the long-term potential of China. While growth there is bound to be slower in future, it should also be more stable as the economy slowly rebalances away from commodities towards services, and as the exchange rate is liberalised. China is moving swiftly up the manufacturing value chain from quantity to quality. Its bond market is increasingly mature, diverse and international while the renminbi is touted as a reserve currency of the future. Further boosting the market's appeal is the fact that Chinese bonds offer relatively high yields and returns that don't correlate especially strongly with those of other asset classes.

What is more, the government has in recent months pledged to adopt a looser fiscal policy alongside coordinated efforts to support domestic demand and GDP growth. It is cutting taxes for companies and households, as well as investing heavily in infrastructure. The People’s Bank of China is the only major central bank still administering monetary stimulus (see chart) and is expected to pump well over USD200 billion into the economy during 2019. Our economists forecast that Chinese gross domestic product (GDP) will grow by 6.4 per cent this year – twice as fast as that of the world as a whole, and more than three times faster than developed economies.

Where China succeeds, other emerging markets also tend to benefit. This supports our broadly positive view on dollar denominated emerging market corporate debt. We also see several specific opportunities within China's dollar bond market itself, where any weakness in the currency – such as that seen in mid-2018 – would potentially provide attractive entry points.

Chinese asset managers, which are seen as strategically important to the country, will be among the key beneficiaries of the stimulus measures. So will property companies, whose capital structures are already showing an improvement.

Crucially, we believe that valuations for corporate bonds issued by companies in these sectors don’t reflect this potential.

Always prepared

However, long-term potential aside, emerging markets are well-known for bouts of short-term volatility and China is no exception.

This is where our philosophy of balancing risks comes to the fore. And diversifying risk at every opportunity is a cornerstone of our investment process for the Pictet-Absolute Return Fixed Income strategy. To achieve this, we examine risks and correlations both within our individual investment themes and across the portfolio as a whole.

In broad terms, turbulence in emerging market debt tends to be accompanied by weakness in developing economies’ currencies. For us, holding a short position in a basket of such currencies represents an effective counter-balance to a long investment in emerging corporate bonds. We believe it is crucial to actively manage this currency position, though, given the idiosyncrasies of the countries concerned.

At the moment, holding short positions in Asian currencies offers a particularly compelling hedge against any temporary economic weakness in China.

We have also invested in Chinese sovereign credit default swaps (CDS) – instruments which insure against any deterioration in a bond issuer’s creditworthiness – to secure additional protection for our Chinese property positions. The possibilities for hedging our exposure are growing as the investment universe within China expands. For us, this makes the investment arguments even more compelling.

We have long believed that China’s transition from a manufacturing powerhouse to a more open and services-led economy will create diverse opportunities. Using all the investment tools available and focusing on balancing risks, we believe our approach to investing in China can both capture long-term value and limit the risks short-term volatility, thus ensuring the best possible risk-return balance for our investors. Such a flexible approach is outside the remit of many traditional fixed income strategies.

Patricia Schütz, Senior Client Portfolio Manager, Pictet Asset Management