"When trade breaks down, everybody loses.

So investors should brace themselves for some fallout from the latest tit-for-tat trade dispute between China and the US, in which Beijing announced retaliatory tariffs in response to Washington’s move to increase duties on USD200 billion of Chinese goods.

Our calculations show a full-scale trade war between the world's largest and second largest economies has the potential to tip the global economy into a recession and lead to a sharp decline in world stocks.

Our model shows that if a 10 per cent tariff on US trade were fully passed onto the consumer, global inflation would rise by about 0.7 percentage points.

This, in turn, could reduce corporate earnings by 2.5 per cent and cut global stocks’ price-to-earnings ratios by up to 15 per cent.

All of which means global equities could fall by some 15 to 20 per cent. This, in effect, would turn the clock back on the world stock market by three years. US bond yields may fall, but the scale of decline will be limited due to an inflationary impact from tariffs.

Washington and Beijing may still be able to reach a deal at the June G-20 meeting. But should they fail, the planned tariff increases would cause both economies to suffer: we estimate that existing trade measures would reduce China’s growth by 0.5 per cent and the US’s by some 0.2 per cent.

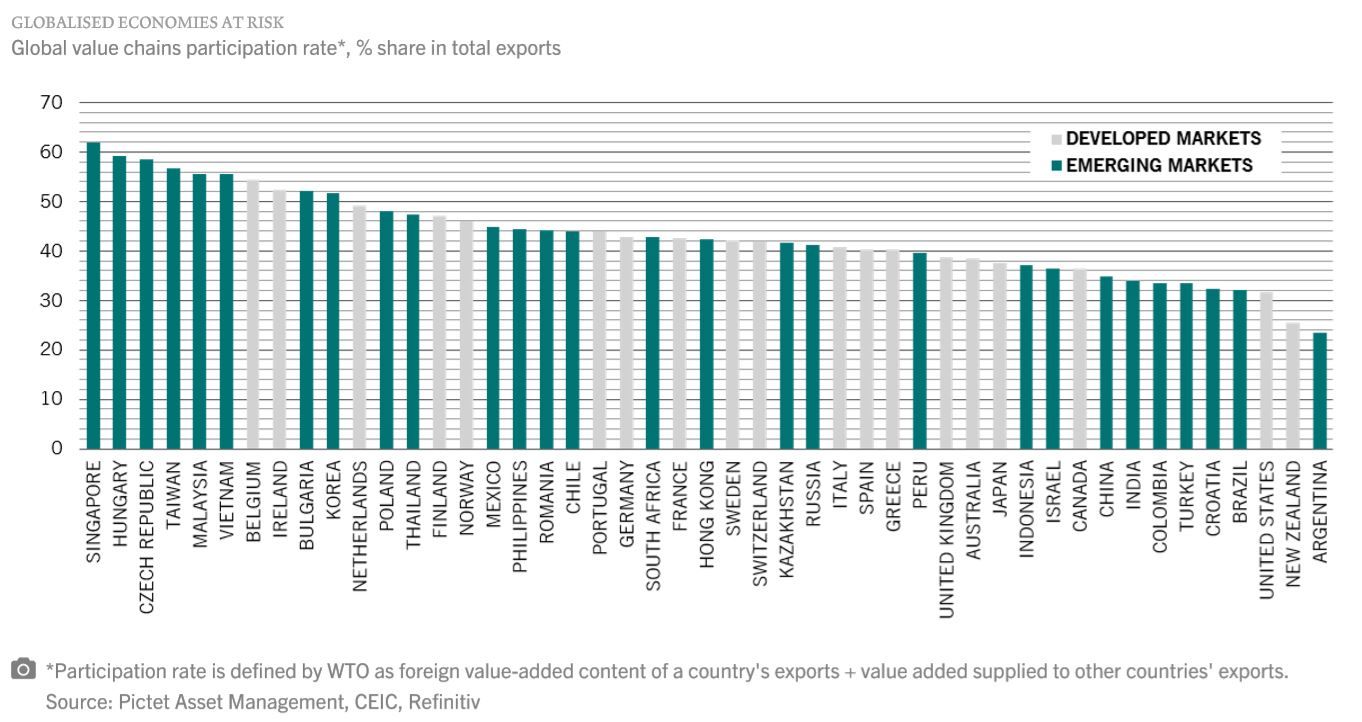

To make matters worse, the impact of a trade war will be felt far beyond the world's largest two economies. Open economies such as Singapore and Taiwan in Asia and Hungary, the Czech Republic and Ireland in Europe are potentially more vulnerable than the US and China (see chart).

As for equity markets, Wall Street would suffer more from an escalation in the trade war than other stock markets, contrary to conventional wisdom.

This is because the US is the most expensive market in our valuation model and its sector composition is more sensitive to changes in economic conditions. On a 2019 price to earnings basis, the US market trades about 30 per cent higher than its European, Japanese and emerging market counterparts.

Cyclical stocks, and, in particular, expensive sectors like consumer discretionary and IT, will probably suffer the most, while shares of Chinese exporters should also come under pressure.

Investors shouldn’t bet on the US Federal Reserve providing additional support beyond what is already anticipated – financial markets have already priced in the prospect of a 25 basis point interest rate cut by the end of this year.

The picture that emerges from our analysis is similar to what investors have previously experienced. The history of financial markets shows that the erection of trade barriers is bad for equity markets: the S&P 500 fell 10 per cent in the three months after US President Richard Nixon imposed a 10 per cent tariff on imports in mid-1971.

As experience unequivocally shows, no one wins a trade war."

Luca Paolini, Chefstratege & Patrick Zweifel, Chef-Ökonom, Pictet Asset Management