About 250 million years ago, some 96 per cent of animal and plant species perished in what is considered to be the largest of the five mass extinction events on Earth.

Known as “the Great Dying”, the catastrophe was caused by a series of natural disasters – among them, huge volcanic eruptions in Siberia that blasted billions of tonnes of carbon dioxide into the atmosphere, raising global temperatures by 10 degrees centigrade.

Worryingly, scientists believe we are now living through the sixth extinction wave. And unlike the previous five, this one is being caused almost exclusively by humans.

A landmark UN report found human activities such as resource extraction and intensive agriculture are responsible for a catastrophic and unprecedented loss of biological diversity. The report warned a third of all amphibian species and reef-forming corals, 1,000 domesticated breeds of mammals used for food and agriculture and around 10 per cent of insects are in jeopardy.

All in all, one million species of all kinds are at imminent risk of extinction, endangering ecosystems that are critical to sustaining human life on earth.

The problem is that protecting biodiversity isn’t top of the list when it comes to business’s environmental priorities. Such has been the focus on reducing carbon emissions that most companies would not even consider species loss a corporate responsibility.

That’s extremely short-sighted. As our research shows, companies – and their investors – need to pay as much attention to biodiversity as they do to their carbon footprint.

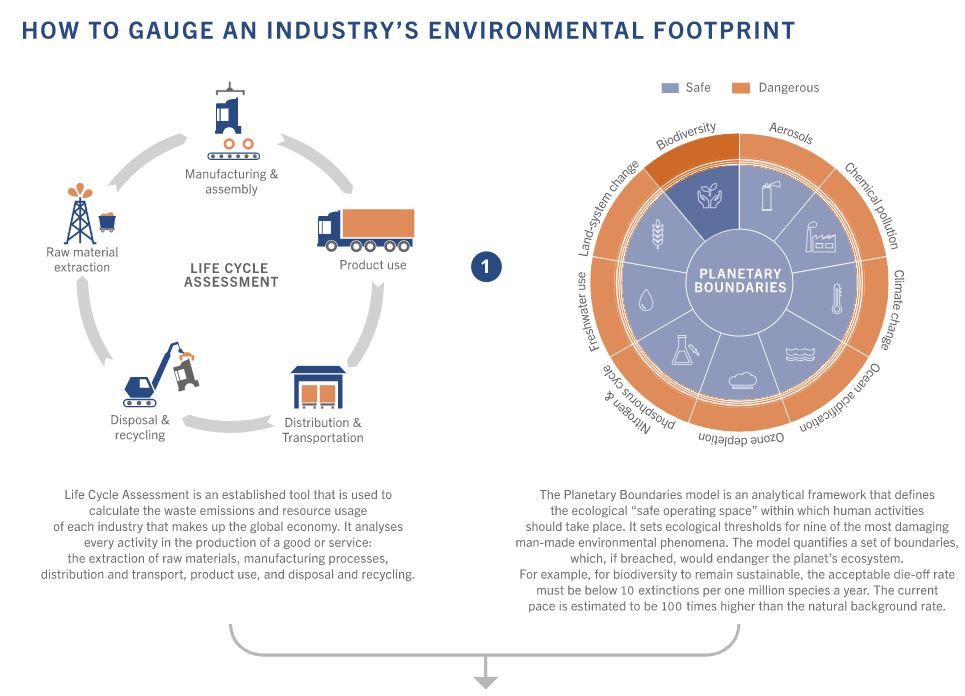

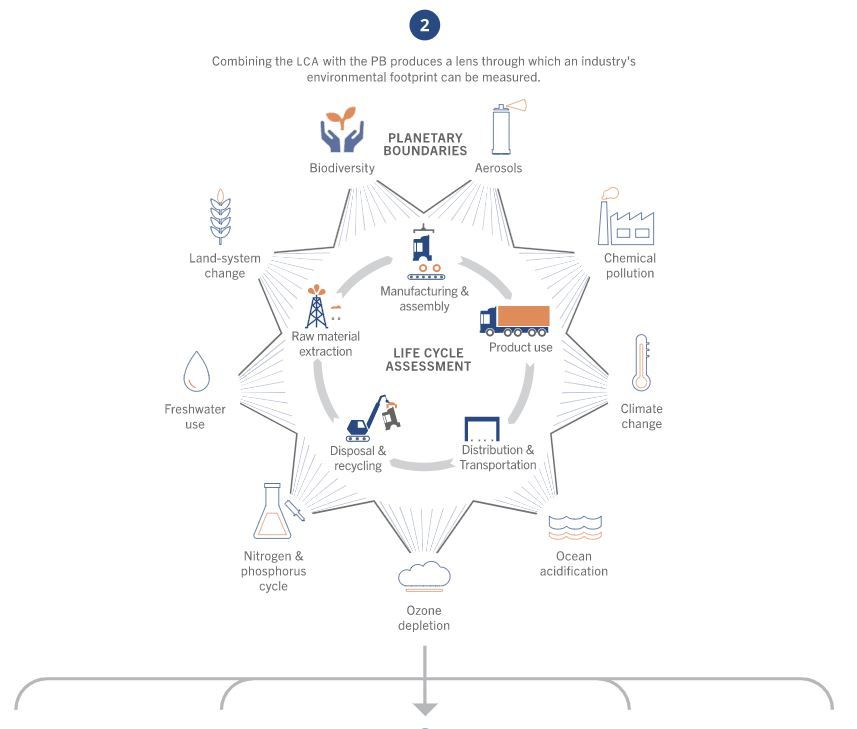

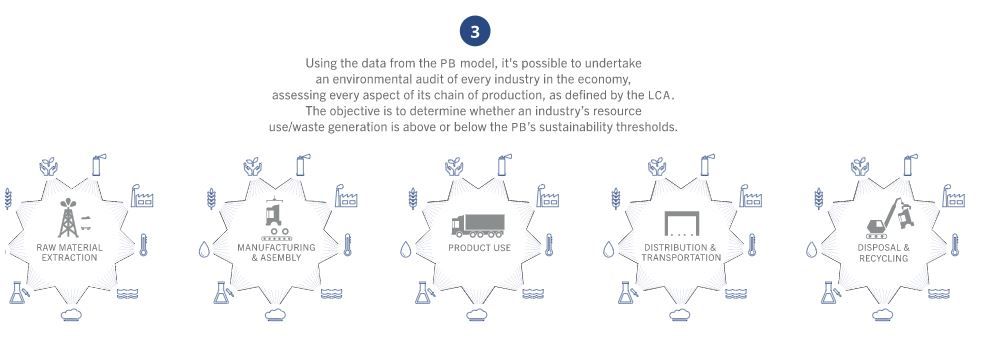

In our analysis, which is described in detail below, we deploy two globally-recognised environmental impact measurement tools – the Planetary Boundaries framework (PB) and Life Cycle Analysis (LCA) – to quantify the corporate world's contribution to species loss.

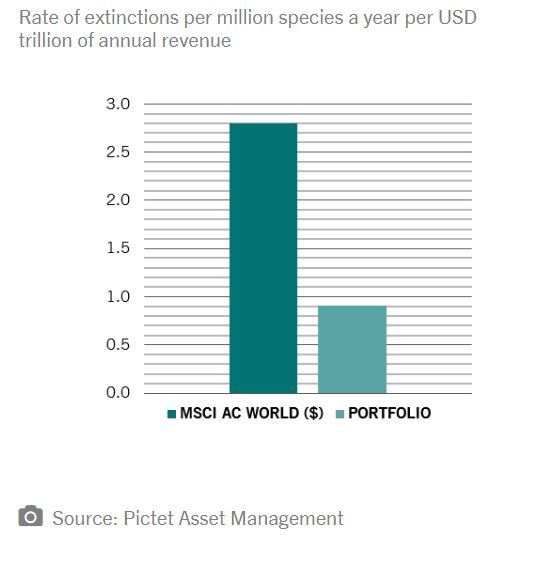

For changes in biodiversity to remain at natural levels, the model states that the annual extinction rate must be less than 0.13 per million species for every USD1 trillion of revenue generated. Applying this framework to the constituents of MSCI All-Country World Index – which together made more than USD30 trillion in revenue last year – we find that the world's biggest corporations are killing off animal and plant species at a rate that is 22 times greater than the threshold level.

The PB-LCA is the tool we use to guide the portfolio construction of our Global Environmental Opportunities strategy.

Our analysis showed some of the worst offending industries include leather, hide tan and finishing as well as biofuels.

Biodiversity impact

Stocks in the Pictet-Global Environmental Opportunity portfolio demonstrate a significantly lower biodiversity footprint than those in the MSCI All-Country World equity index.

Here's how Pictet-Global Environmental Opportunities strategy works:

- The strategy invests in the shares of companies that are making an active contribution to safeguarding the world’s natural resources.

- Investments are chosen from a broader universe consisting of the world’s 3,500 most environmentally-responsible publicly-held firms – companies that meet the criteria of our proprietary PB-LCA framework.

- The strategy is a concentrated portfolio of 50 to 60 stocks, operating in fields such as pollution control, water supply, renewable energy, waste management and sustainable agriculture.

- With a risk-return profile similar to that of a growth-oriented investment strategy, Pictet AM's Global Environmental Opportunities can be used to complement an equity allocation within a global portfolio.