Hurricane Laura and Typhoon Bavi left heartbreaking trails of destruction last week, triggering fresh headlines around the connection between severe weather and climate change—and fresh debate about the right climate policy in the midst of a pandemic.

During those dark days of the coronavirus crisis this spring when job losses literally fell off the charts, there were calls to set the climate crisis aside in all-out pursuit of getting as many people back to work as possible. But as the tortuous path to recovery comes into view, climate concerns look set to shape the next phase of global economic growth more than ever, amid new work patterns, generous government spending and corporate priorities that have shifted significantly since the last time the global economy cratered in 2008.

Beneath what remains of the debate over the causes of climate change, especially in the United States, global investors have increasingly understood that the money they put to work is increasingly affected by environmental regulations that restrict carbon emissions, by innovative technologies that provide cheaper and cleaner sources of energy, and rising social attention to sustainable practices. Political agendas aside, increasing insurance costs, falling coastal property values and the expanding share of renewable energy sources all testify to the growing importance of climate concerns on investment returns.

But the Great Lockdown suddenly overwhelmed these dire-but-distant worries as it threatened to tip the global economy into depression. The Trump Administration’s Environmental Protection Agency announced it would “exercise enforcement discretion” with regard to violations of environmental laws due to the pandemic. Quarantines and travel restrictions delayed further international climate talks. Restaurants struggling to stay in business shifted to paper napkins, Styrofoam boxes and dreaded plastic straws.

Yet as the path to recovery comes into view, whether it continues as a sharp V or sags into a limp U, climate not only remains on the policy agenda but may have even risen a couple of notches on the world’s list of priorities.

While the quarantine measures themselves have had only minimal impact on carbon emissions, the pandemic surge in telework and virtual conferences looks lasting. Transportation accounts for roughly 14% of the world’s greenhouse gas emissions, most of which come from cars and trucks. Still, fewer daily commutes (assuming trust returns to public transportation) and a sharp decline in business travel may make a dent.

A much bigger boost to green practices will come from the massive amounts of money the world’s governments are injecting into the economy to drive the rebound. The European Union’s expanded budget in response to the pandemic includes as much as €550 billion in investments that specifically help reduce emissions and envisions taxes on plastic waste and tariffs on imports deemed to be polluting.

Since the collapse of Lehman Brothers, many of the worlds’ central banks have expanded efforts to ensure the banks they supervise are girding to meet the rising potential costs of climate change, from either severe weather damage or stranded carbon assets as demand shifts to renewables.

In the United States, the political landscape is much more divided on climate, with President Trump arguing that excessive environmental regulations hurts growth, while Democrats promise generous spending to support “green jobs.” Public opinion reflects this partisan divide, but majorities of Republican respondents back tax credits to encourage carbon capture and tougher standards on power emissions, even at the height of this spring’s COVID-19 concerns.

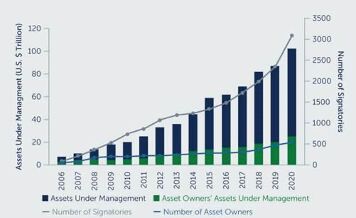

And this ignores a far more important driver to the green recovery in the United States and around the world: corporate behavior. Environmental, social and governance issues started gaining momentum just before the last crisis, with the United Nations Principles for Responsible Investing claiming signatories of $18 trillion of assets under management in 2008. That number is $120 trillion today.

However long it lasts, the coming global recovery will be shaped by giants like Amazon focusing its next growth phase around a goal of net-zero carbon emissions by 2040 or Microsoft working towards its carbon negative goal by 2030. Even more head-turning are oil companies that have announced net-zero goals, albeit with varying definitions of what that means.

The pandemic has, if anything, accelerated the economy’s shift to carbon footprints that start to shrink, public and private infrastructure that will be more resilient and banks that will start asking hard questions about the climate consequences of new loans. Investors take note.

PRI GROWTH 2006-2020

Source: PRI. As of August 1, 2020.

Source: PRI. As of August 1, 2020.