Is ESG moving from 'nice to have' to 'must have'?

We think environmental, social and governance (ESG) is a megatrend that will have a defining impact in the long-term. Just as how the world has been taken by surprise by COVID-19, businesses will need to be ready to adapt to rapid changes in order to help them navigate such turbulent markets. It is in these challenging times, that companies with robust ESG frameworks in place around issues such as business continuity, employee health and safety and supply chain management will be more resilient.

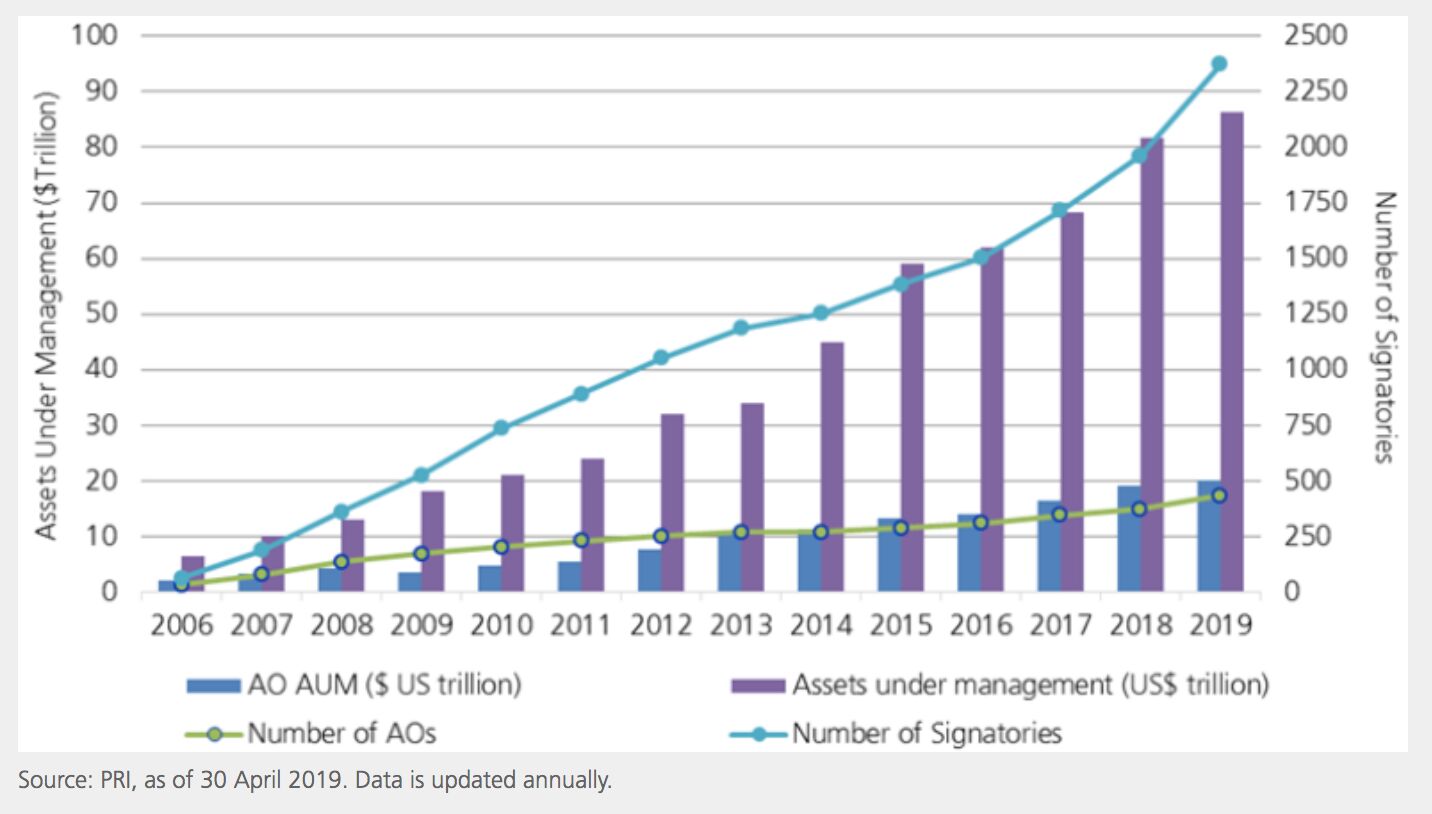

A survey carried out by Responsible Investor in conjunction with UBS-AM in 2019 found that 78% of asset owners globally are already integrating ESG into their investment processes. 17% of asset owners are interested in the topic and are considering measures to take into account ESG factors while only 5% are not interested.

Statistics aside, society is simply becoming more ESG aware. For example, the rising number of extreme weather events is focusing attention on the impact of climate change. According to the latest WEF Global Risks report, "from economic to environmental, climate now tops the risks agenda while the economy has disappeared from the top five."1

1WEF Global Risks Report 2020. Pub. January 2020

Firms will also face greater regulatory scrutiny that will require measures such as disclosing the proportion of fund assets invested in green activities and the methodology used to assess the sustainability impacts of these investments. All these point to one fact – ESG is here to stay.

Where do you think the biggest benefits of integrating ESG lie?

Investors are becoming more ESG conscious for a variety of reasons, be it social and moral considerations or the desire to generate more alpha. For us, it is common sense that only by investing in long term sustainable businesses can we generate long term financial returns.

Secondly, we must not underestimate the risks associated with not taking ESG factors into account, as this can result in financial, legal and reputational costs for companies. Furthermore, as we have seen in recent years, money flows have the ability to move markets. This is no exception when it comes to ESG investing.

Funds that own companies with strong ESG profiles have already seen an influx of assets. Companies with improving ESG profiles benefit from valuation premiums and enjoy a lower cost of capital. The opposite is true for companies with deteriorating ESG profiles or bad scores.

By combining material sustainability data with our fundamental understanding of companies, we are better equipped to make better-informed investment decisions.

Can a fund be ESG integrated but still own companies that operate in carbon intensive sectors, such as energy and utilities?

This is one question we often get asked by our clients, which is not surprising given the rapid progress on climate change.

We are supportive of the transition to a low carbon economy. However, we cannot expect decarbonisation to happen overnight. Energy and utility companies have legacy businesses that will take years to decarbonise. Many of them are already making progress toward reaching their emissions targets.

We need investments in electric grids to accommodate electric vehicles and less steady renewable energy production. In addition, the move away from a carbon intensive economy must be done in a way that minimises the negative impacts on stranded communities and workers.

According to the United Nations Framework Convention on Climate Change2 (UNFCCC), 1.5 billion workers globally are directly employed in sectors critical to climate stability, which will face significant disruption in the coming years.

As long as the world's population continues to grow and economies continue to expand, there will inevitably be a rise in the demand for energy consumption. The issue we currently face is a lack of commercially available energy efficient alternatives. We need more time for this energy transition. Therefore instead of excluding investments from these sectors entirely, we choose to invest in companies that are committed to reducing their carbon emissions and investing in less carbon intensive alternatives, such as renewables, or moving away from gases generated coal or heavy oil, to meet the growing demand for the future.

2 Morgan Stanley sustainability research paper titled "Decarbonisation: The Race to Net Zero", published 21 October 2019.

How closely do you work with the SI research team to ensure a focus on material issues and how is ESG is integrated into your decision making process?

We integrate material ESG factors into our bottom-up investment research and decision making process. Firstly, we monitor ESG scores of companies from a number of key data providers. Despite the low correlation of scores between these providers, we use several sources for the sustainability signal because we believe that the greatest sustainability risks can be identified when several ratings consistently score poorly.

Instead of relying solely on these ratings, however, we leverage the expertise of the SI research team to verify the materiality of these risk signals. Companies that are verified as high risk will either be sold or kept in the portfolio, depending on the risk/reward opportunity and engagement potential of the company.

Research has shown that companies with low ESG scores are likely to benefit more from activist engagements compared to those with already high ESG scores. Therefore, our aim is to carry out engagements to realise improvements that we believe will also contribute to our investment thesis.

Do you see differences in the level and type of interest from investors?

We manage around USD 15bn of assets on behalf of clients globally. Among them are some of the world's largest institutional organisations who keep a close watch on our ESG process and reporting activities.

In Asia, we have seen a greater focus on governance and engagement. In fact, recent years have seen asset owners in Asia at the forefront of the ESG uptake, so we can see why the potential for future growth in this region remains large.

In Europe, there tends to be a preference for norms-based screening based on international standards and exclusionary screening based on certain sectors or criteria. Investors in the US have started to join this trend and it is only a matter of time before ESG investing really takes hold.