The start of the week again saw a big decline in Chinese equities. This comes on the back of large drops in recent weeks, triggering policy reaction and market intervention. The real economic consequences are as yet unclear though the drop in the index since its peak tells us something about the change in the assessment of the Chinese economic environment and outlook. Big declines in the Chinese markets can have repercussions abroad via a confidence channel: investors elsewhere face increased uncertainty, e g on the real consequences of the drop in the Shanghai and Shenzhen indices, so investors may decide to reduce risk. A second channel is more direct. It concerns a reassessment of the Chinese growth outlook and what this means for corporates exporting to China. Finally there could also be an impact via interest rates: investors could be of the view that turmoil in Chinese markets could eventually push the Fed to postpone its first rate hike in this cycle.

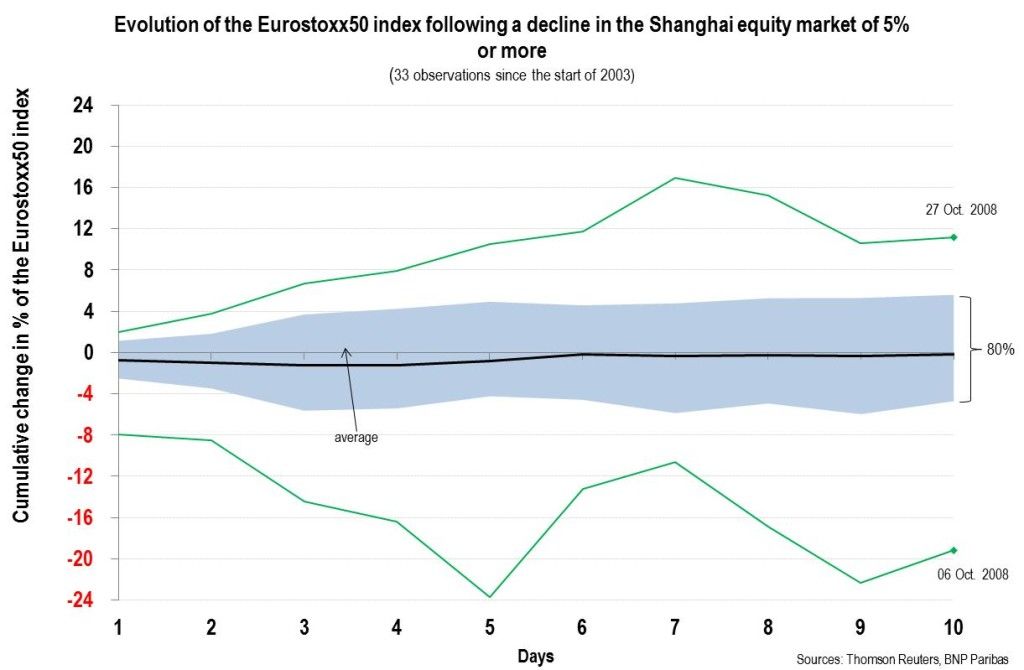

The following chart shows the cumulative evolution of the Eurostoxx50 index after a big drop, defined as 5% or more on a given day, of the Shanghai stock market index. Since the start of 2003, 33 big declines have occurred. The chart shows the ‘same day effect’ and the cumulative effect after 2, 3 etc days.

On average the impact is very small. In 80% of the cases (shown in the blue area) the impact is between -4% and +4% and it occurs within 3 to 4 days. The best performance was achieved at the end of October 2008: a big drop in Shanghai was completely disregarded by Europe: 10 days later the Eurostoxx was up close to 12%. The worst performance was in the same month, after the drop on 6 October 2008.

William De Vijlder, Group Chief Economist, BNP Paribas