Foreign investors can now access rapidly growing parts of the Chinese economy that were not previously accessible, and these opportunities span sectors — capital goods, retail, healthcare, and consumer staples, among others.

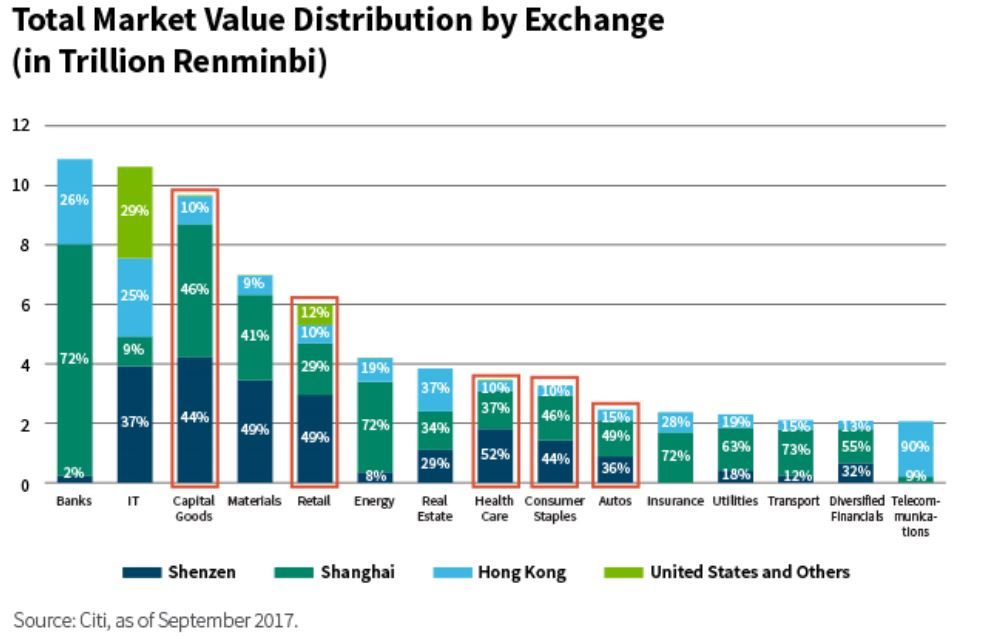

Looking at the investible market cap of China A-Shares by exchange Shanghai Stock Exchange, Shenzhen Stock Exchange, Hong Kong Stock Exchange, and American depositary receipts (ADRs)—it is readily apparent that China A-Shares listed in Shanghai and Shenzhen account for the majority of the investible opportunity set in China's domestic growth sectors.

The chart below illustrates. Hong Kong tends to host the majority of China's older-economy sectors, such as real estate, financials, materials, and heavy industry. And China's large IT companies are well represented in New York via ADRs.

But look at Chinese growth sectors. The Shanghai and Shenzhen stock exchanges represent 90% of the investible market cap in capital goods, 90% in consumer staples, 89% in healthcare, 85% in autos, and 78% in retail.

The opportunity is vast. China's equity markets are populated by many high-quality companies experiencing dynamic growth, making them ideal for quality growth investors.

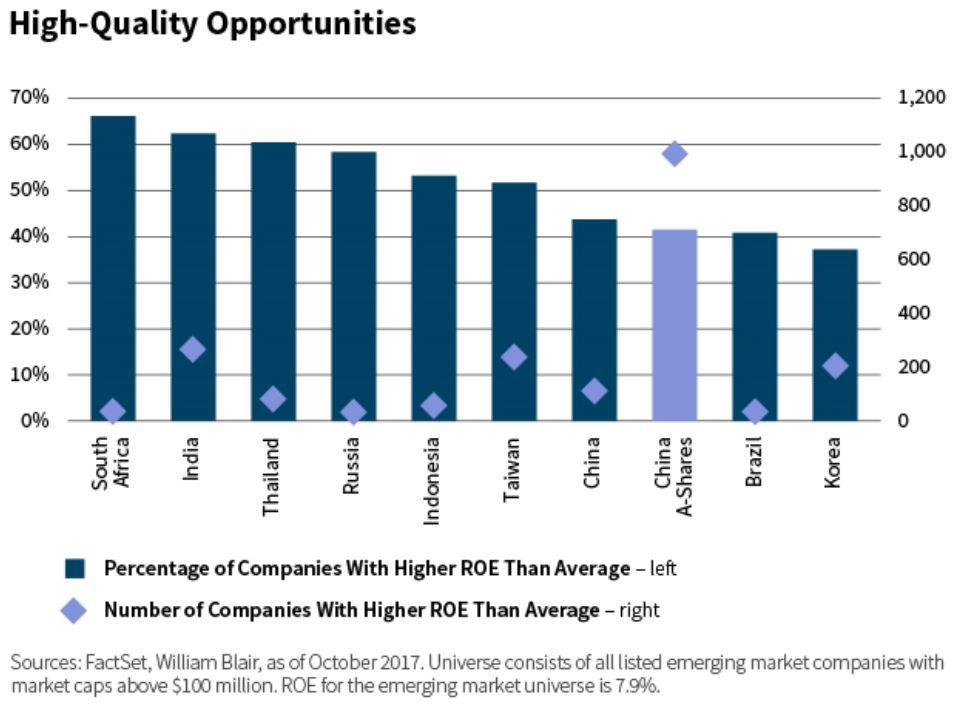

As the chart below shows, 70% of China A-Shares are growing faster than the emerging market average of about 12% annually—and that 70% represents 2,392 companies listed on the Shanghai and Shenzhen stock exchanges (versus less than 550 for each of the other emerging markets shown, and less than 100 for several).

Moreover, Chinese companies are high quality. Using return on equity (ROE) as a proxy for quality, China A-Shares are slightly below average in terms of overall profitability.

However, the number of companies that have a higher-than-average ROE than the emerging market universe is still significant—more than 1,000. India has just 263.

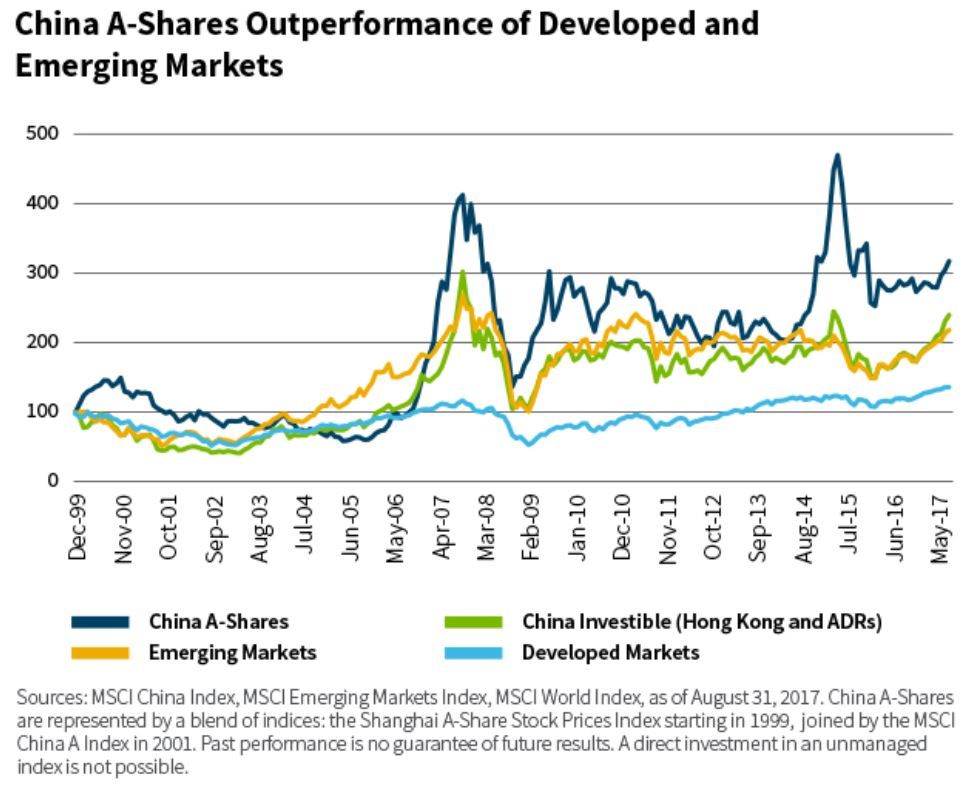

Over the longer term, the China A-Share market has also shown compelling performance. Indeed, China A-Shares have more than tripled in value since 1999, outpacing Chinese H-Shares and American depositary receipt (ADRs), emerging markets, and developed markets, as the chart below shows.

China A-Shares are clearly where investors can gain access to Chinese growth opportunities, giving investors access to potential winners in one of the most exciting growth jurisdictions available today.

In another post, I'll explain why I think active managers with experience in China A-Shares, in particular, have a rare opportunity.

Casey Preyss, CFA,

Partner & Portfolio Manager

William Blair

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten