"Any discussion of innovation would be incomplete without touching on artificial intelligence. Perception and cognition, visualization, and language processing are all becoming central to corporate innovation.

That is disrupting existing business models, placing new demands on infrastructure, and even breaking down societal institutions. This is not all positive, but understanding artificial intelligence is important for us as investors.

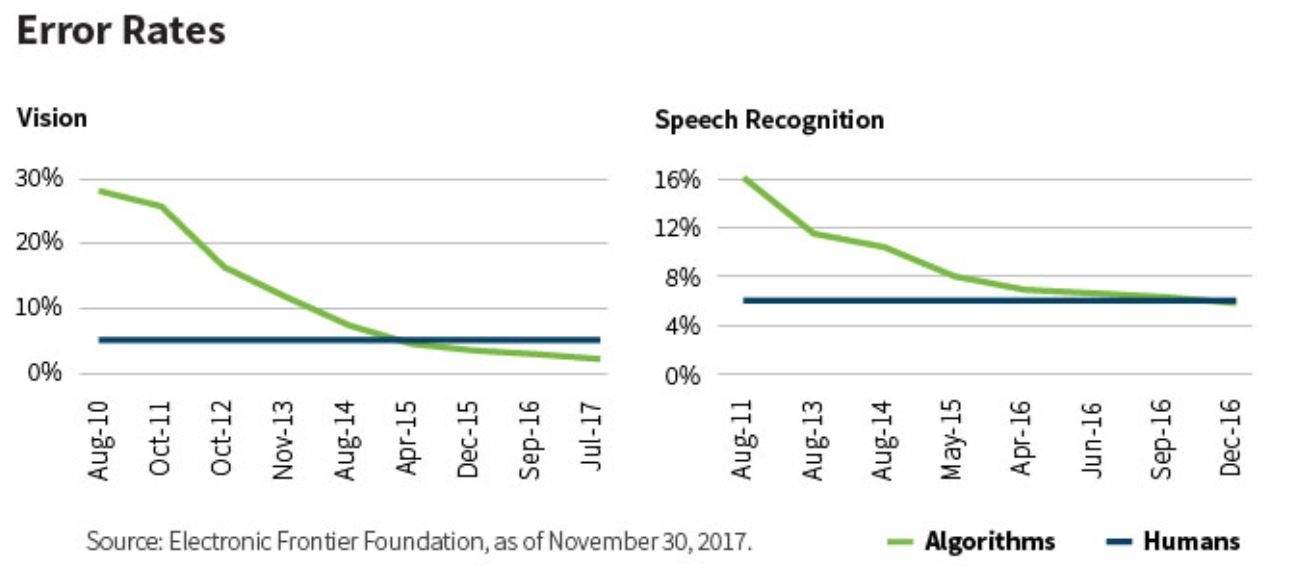

We are seeing artificial intelligence everywhere. In energy, it is helping us understand how we can use the grid more efficiently. In manufacturing, we are seeing increasing use of 3-D printing. And consider that machines can already detect errors in vision and speech faster than humans can. That has vast implications in areas such as medicine, where the visual element of cancer diagnosis could no longer be conducted by humans.

Even at William Blair, we are looking to machine learning to try to help us understand moves in markets and to make us better investors.

Artificial intelligence requires exponentially more processing power, and that is one reason we have seen semiconductors and equipment rewarded by the market. But valuation is important. The pixie dust from Silicon Valley is very influential, and we do not want to get carried away.

Still, most of the potential from artificial intelligence remains largely untapped. What we are living through today is not unlike the machinery revolutions we have experienced in the past.

Consider electricity, the steam engine, and more recently the proliferation of desktop computing in the 1980s. With artificial intelligence, the level and breadth of change across global industries are likely to be similar. Competitive sets will change drastically.

But there is no accepted blueprint. Every industry, every company, every manager must find a way to adopt and adapt to artificial intelligence. As a result, the process will be slow. This is one reason, from an economic perspective, we are seeing low productivity and low wage growth even though economic growth is strong.

Again, this is not an accident. We have seen it before, during the industrial revolution. Once the proliferation of a technology is substantial enough—when more than 50% of companies have adopted it—productivity growth emerges in spades, and with that, wage growth appears.

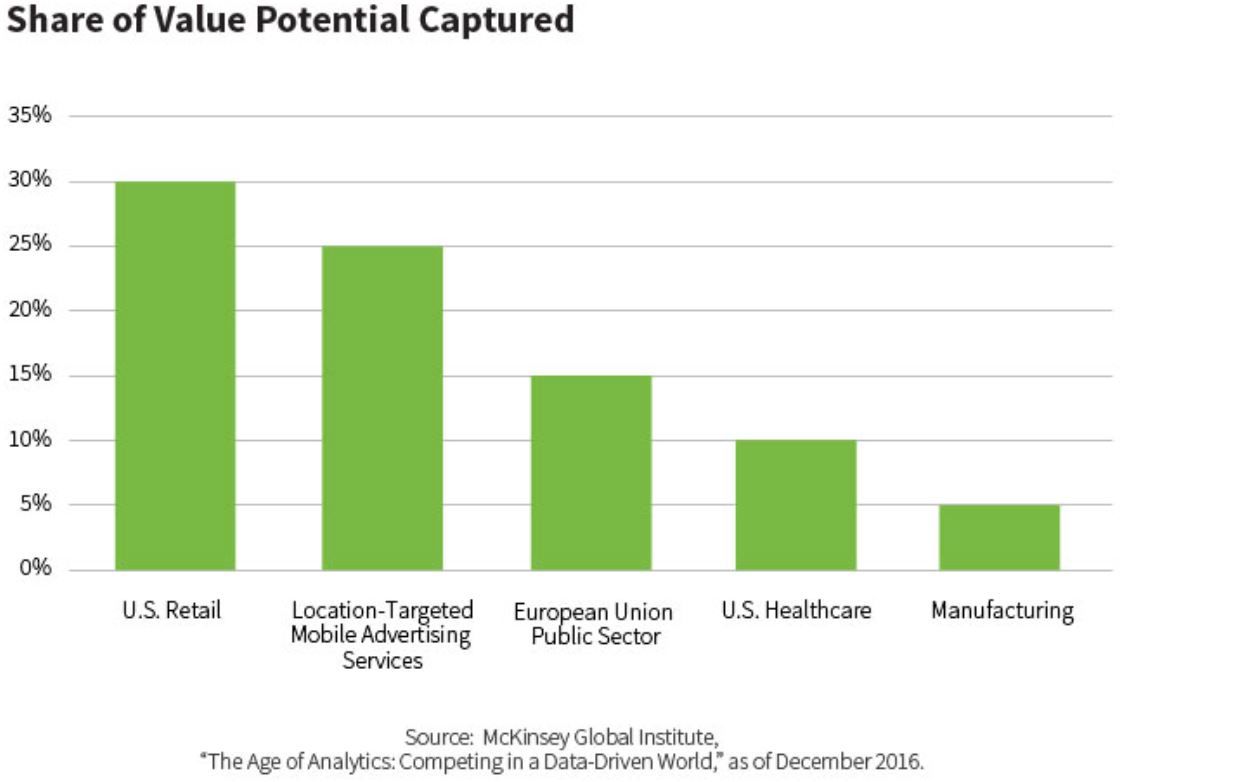

But we are not there yet. The share of artificial intelligence's potential value captured currently ranges from just 5% in manufacturing to 30% in U.S. retail, as the chart below illustrates.

As excited as I am about artificial intelligence, I don't want to overhype it. There are definitive and lasting limitations, which I'll discuss in another post."

Olga Bitel

Global Strategist

William Blair

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten