Since the failure of a major solar-panel company in 2011, President Barack Obama's $80 billion clean-technology program looks like a bust. But when we think about the outlook for renewables, we have to think of different parts of the supply chain. There's equipment, there's generation, and there's distribution. Let's look at the first two in more detail.

Equipment: Less Competitive

Some solar-panel companies have failed because U.S. renewable equipment manufacturers don't have a competitive edge versus many emerging market counterparts. U.S. solar panel manufacturers, for example, have struggled to compete as Chinese manufacturers have slashed solar panel prices, leading U.S. energy companies to buy abroad.

Today, China controls more than half of the $40 billion global solar-panel manufacturing industry. China's solar-panel industry has grown an average of 18% annually in the past five years versus just 0.4% growth in the United States, according to IBISWorld.

In response, two U.S. solar panel manufacturers appealed for tariffs on Chinese solar-panel imports.

In September, the International Trade Commission, which advises the U.S. government on trade issues, ruled that Chinese solar panel imports threaten American manufacturers, allowing the White House to impose a tariff on solar-panel imports.

That's likely to occur, because it's politically appealing to say we have supported the solar industry in the U.S. by limiting imports of cheap solar panels.

But, such tariffs would dramatically increase the cost of solar panels in the United States, making solar less competitive with fossil fuels such as natural gas and coal.

Generation: Cost Competitive

Renewable power generation is another story.

If equipment costs rise, pressure also rises on renewable power generators who have to buy that equipment. But, those generators have something else working to their benefit: technology advances that have made them very cost competitive in the United States.

Turbines, for example, are getting larger and moving offshore, improving their generation ability.

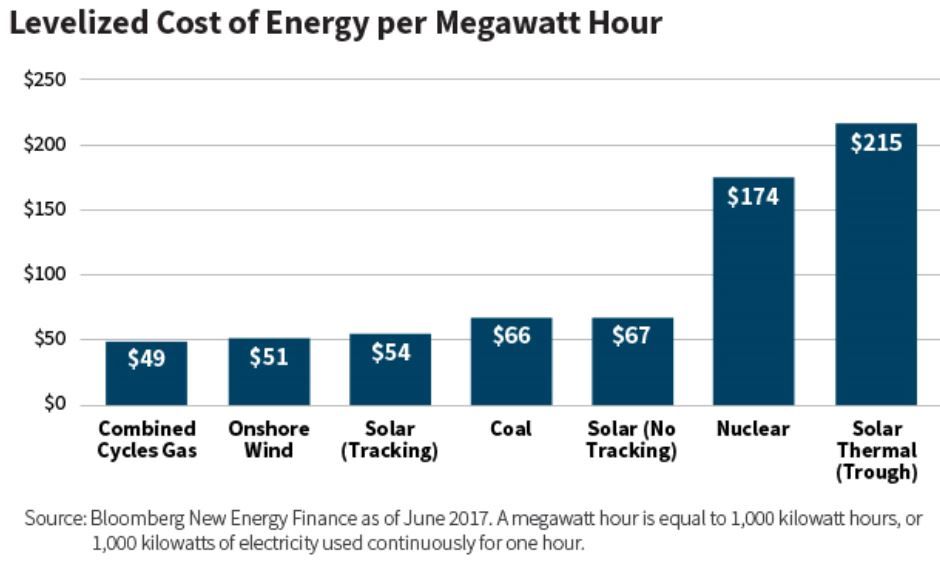

The chart below shows the levelized cost of energy (LCOE) in the United States per megawatt of different types of power generation. LCOE attempts to compare different methods of electricity generation on a consistent basis. It includes the initial capital cost as well as the costs of continuous operation and maintenance.

Nuclear is expensive at $174. To understand why, just think about all that's involved in running a nuclear power plant, including the number of skilled people you have to hire and the regulations you have to adhere to.

Gas, on the other hand, is cheap, as are onshore wind and solar (tracking), which uses technology that allows the panels to move to capture the most sun (and is most often implemented utility-scale).

Certainly, you can argue that wind and solar power generators have been helped by the tax credits they currently receive that help them compete with fossil fuels in terms of price. In late 2017, the U.S. Congress passed a tax bill that left production tax credits in place on renewables. Additionally by 2022, when the subsidies were originally scheduled to end, wind and solar should be cheaper than coal—without the subsidies.

Bloomberg New Energy Finance expects renewables to grow significantly faster than the 2.5% compound annual growth rate for nonrenewable power generation from 2016 to 2040, so it's a growth sector—and because we're growth investors, we have to be there.

Alaina Anderson, CFA, Partner

Global Research Analyst

William Blair

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten