My recent trip to Japan provided insight into the workstyle reforms being pursued in the labor-challenged nation, but didn't dissuade me from my view that the country faces challenges. That means active management is essential to Japanese equity selection.

As background, in September 2016 Japanese Prime Minister Shinzo Abe held the first meeting of the Council for the Realization of Work Style Reform to address a number of labor-related issues, including the need to change working conditions and hours.

I witnessed how important this is on my recent trip to Japan, where, as a global research analyst covering real estate, utilities, and infrastructure-related companies, I met with the Japanese Federation of Construction Contractors and Ministry of Land, Infrastructure, and Tourism, among other organizations.

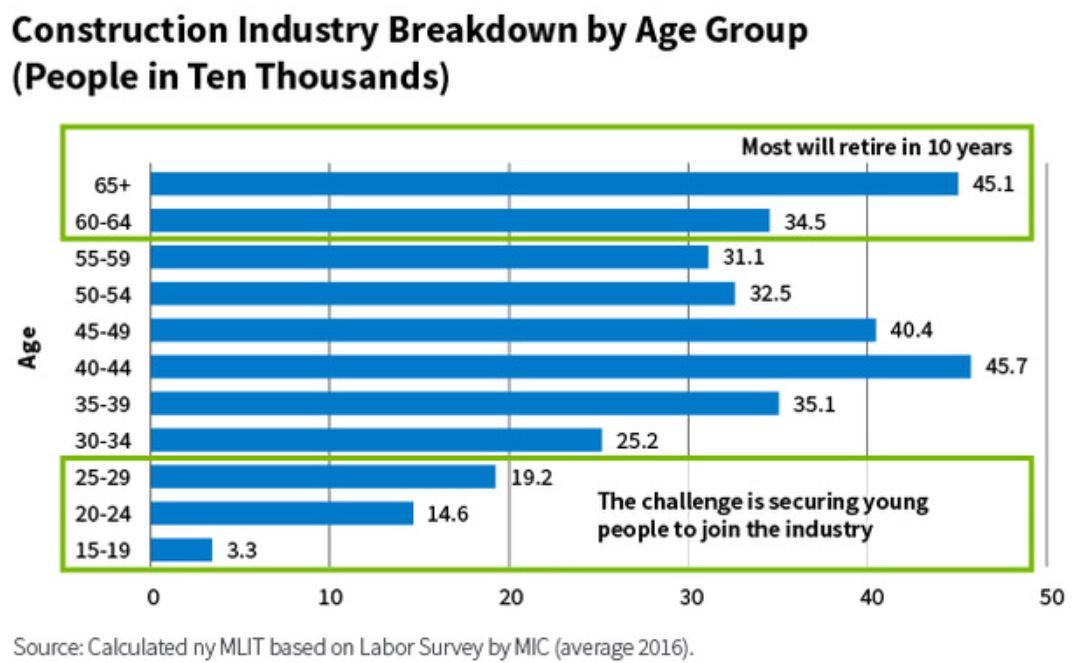

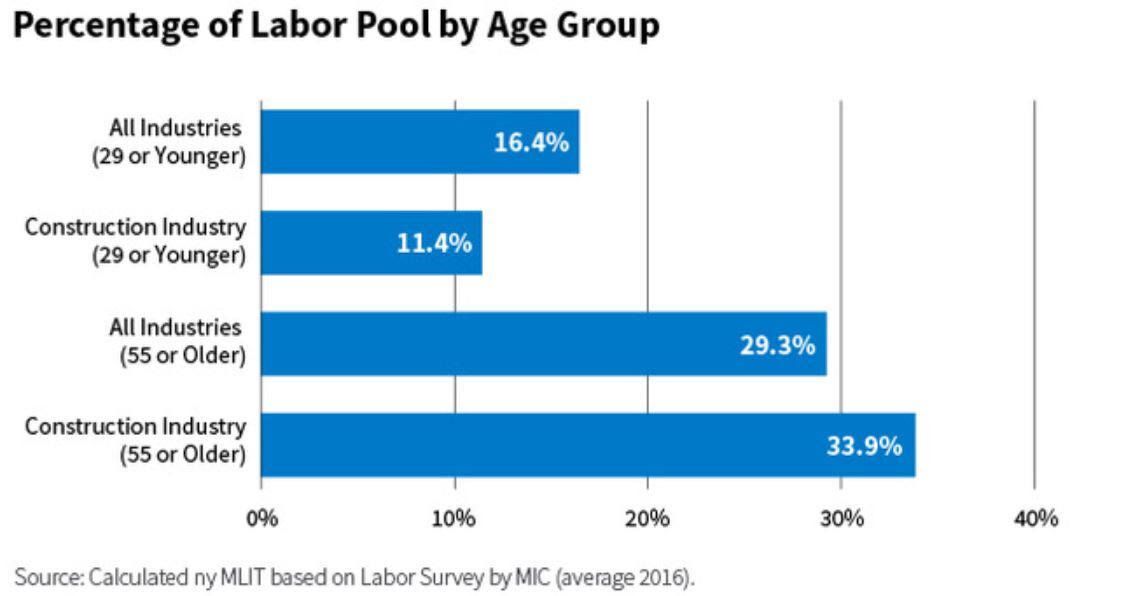

Officials from these organizations spoke to me about the country's challenging demographics. Japan has one of the most rapidly aging populations in the world, with individuals ages 65 and older accounting for more than one-quarter of the population.

Given the shortage of labor, construction projects are written assuming a six-day work week. And the wage is poor relative to other industries. Clearly, the Japanese have to re-think how they employ and pay labor in the construction industry.

Immigration is not a viable solution. Japan has a relatively small foreign-born population: 1.6% versus 7.0% for the United States, 7.7% for the United Kingdom, and 9.3% for Germany, according to the Organization for Economic Co-Operation and Development (OECD) as of 2013.

And the Japanese like it that way: They're proud that they have limited crime and civil unrest relative to other developed nations, and they attribute that to limited immigration.

While the country's foreign-born population grew by about 150,000 to 2.3 million in 2016, according to the Ministry of Internal Affairs and Communications and Ministry of Justice, the influx of foreigners is seen by the Japanese as temporary. The government expects most foreign workers to stay in the country for only a short period of time. You can visit, but you can't stay.

But how will Japan solve its workforce challenges if it doesn't allow immigration? Speaking to the Japanese, it's clear that they view automation as one potential solution. The question is, will it happen? Certainly, Japan has some of the most cutting-edge technology in automation, and some very strong Japanese companies export these solutions all over the world.

But I'm not certain to what extent that technology is being leveraged at home. I visited the 2020 Summer Olympic site, for example, and there was a significant opportunity to increase the level of automation employed onsite.

That speaks to why active management is so important in Japanese equity selection. What happens if the Japanese fail to adequately automate while maintaining a bias against immigration? At some point, I would expect to see the profitability of Japanese companies decline, ultimately affecting Japanese equity returns.

In such an environment, it will be essential for investment managers to use fundamental, on-the-ground research to discriminate between those Japanese companies that are struggling and those that can potentially outperform.

Alaina Anderson, CFA, Partner

Global Research Analyst

William Blair

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten