Developed markets have long been leaders in renewable power generation, but data suggests they will soon be overtaken by emerging markets.

Today, emerging economies total installed capacity of wind and solar is 307 gigawatts and 272 gigawatts, respectively. That's 51% and 53% of global capacity, according to Moody's.

China accounts for most of that increase, thanks to having a strong central government that allows the country to mobilize resources easily. Because utilities are all state-owned enterprises, when China wanted to provide a cleaner environment, it was able to do so rapidly—possibly too rapidly.

Overcapacity Creates Challenges

Emerging markets, including China, have built out their renewable capacity based on an anticipated gross domestic product (GDP) growth rate of around 7%, but those growth rates have not materialized in the wake of the global financial crisis.

In addition, the composition of GDP has changed in emerging markets. Growth in electricity was at one time 0.7 times GDP, but has fallen as emerging markets become more service-oriented, because service-oriented companies require less electricity.

So, when many emerging market countries made a decision to invest in renewables 15 or 20 years ago, they were looking at a different economy and a different growth rate—and now they have overcapacity in renewable power generation.

China's substantial overcapacity is also the result of a lack of investment in infrastructure. Wind farms located in the northwestern China generate energy, but consumption occurs in the southeast, and there hasn't been enough investment in the transmission lines to get the power from where it's generated to where it's consumed.

As a result, while the nation has the world's largest renewables fleet, that fleet suffers from the world's largest curtailment, which is wasted energy.

India, meanwhile, has significant overcapacity in solar, and Brazil in hydro given their geography.

That overcapacity will get absorbed; it will just take time.

China, for example, is studying the timing of a proposed ban on traditional-fuel vehicles, and it wants all electric vehicle batteries to be made in China, which would create new electricity demand. There are also technological advances on the horizon that will speed up the process.

As the cost of storing power in batteries comes down, for example, the overcapacity problem could be overcome. Until then, however, overcapacity and will be disruptive to operators' profitability.

Growth Still Pronounced

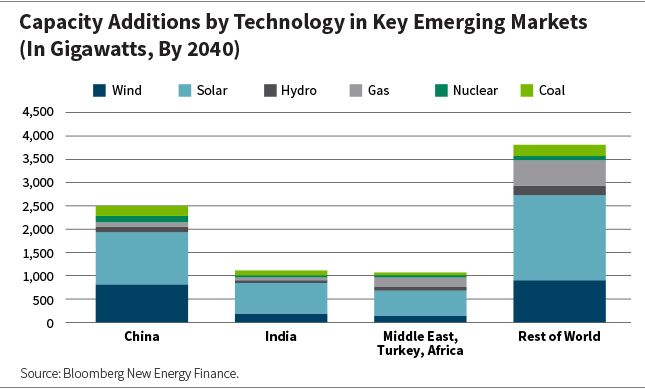

Still, growth opportunities in emerging market renewables are pronounced, as the chart below highlights.

By 2040, China is expected to add 2,522 gigawatts of capacity, 82% of it renewable (wind, solar, and hydro); India is expected to add 1,119 gigawatts of capacity, 82% of it renewable as well; and the Middle East, Turkey, and Africa are expected to add 1,068 gigawatts of capacity, 72% of it renewable.

Together, those key emerging markets will add 3,744 gigawatts of renewable capacity versus just 2,940 for the rest of the world.

Alaina Anderson, CFA, Partner

Global Research Analyst

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: