In another post, I explained why the China A-Share market structure and characteristics present unique opportunities for active managers. Here, I'd like to go into detail about how those opportunities are being driven by the well-documented growth in China's middle class combined with its innovation boom.

The Ongoing Chinese Consumption Story

China now has the largest middle-class population in the world, with 109 million adults (versus 92 million for the United States and 62 million for Japan). And it's growing.

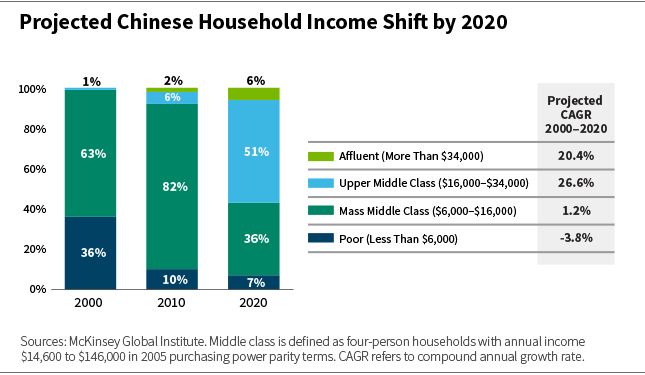

In 2010, roughly 8% of Chinese households were classified as upper middle class or affluent—a number that is forecast to grow to 57% by 2020. That is a compound annual growth rate of more than 20%, as the chart below illustrates.

China's Innovation Boom

China is commonly characterized as a smokestack economy, addicted to debt, infrastructure investment, cheap manual labor, low-value exports, and polluting industries.

But this is inaccurate, in our view. An ongoing innovation boom is quickly transitioning “Made in China” to “Invented in China.”

In regard to some of the most innovative technologies and growth industries—financial technology, virtual reality, artificial intelligence, robotics—China is comparable to the United States today in terms of venture capital investment.

Another example is China's e-commerce market, which is now twice as large as that of the United States. China's two leading mobile payment apps now process $10 trillion in online payments annually, more than Visa and MasterCard combined. China is also the world's largest market for electric vehicles, solar power, and wind turbines.

The level of innovation has clearly accelerated from five years ago, and has done so far quicker than most envisioned.

Why Is an Active Approach Necessary?

We believe an active approach is a necessity when accessing the China A-share market because benchmark indices do not provide a fair representation of real growth opportunities in “new China.”

First, state-owned enterprises (SOEs), which tend to be less efficient and less profitable than their private-sector peers, make up a vast majority of the market: 63% of the MSCI China Index and 74% of the CSI 300 Index. This is particularly notable given that SOEs account for less than

10% of Chinese GDP and 5% of Chinese employment. Clearly, SOEs are overrepresented in these equity indices.

Second, the “old China” sectors—the financial, real estate, commodity, heavy industry—dominate Chinese equity indices, accounting for 82% of the CSI 300 Index. The “new China” sectors—healthcare, IT, media, and renewables—account for just 18% of the CSI 300 Index.

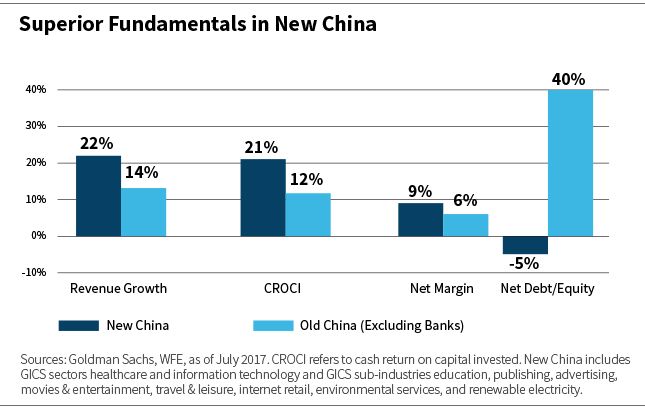

This is significant, because old China tends to have lower growth, lower return, and more debt, as the chart below illustrates. New China, meanwhile, has delivered almost double the revenue growth of old China, with lower leverage and higher market returns. We expect these trends to continue as new China continues to deliver stronger fundamentals.

China A-Shares for Broad Exposure

China A-Shares offer the broadest exposure to the Chinese consumption and innovation stories. Chinese companies in the home furnishings, white goods, advertising, and media sectors, for example, are mainly listed on the Shanghai and Shenzhen stock exchanges, which have been historically difficult for foreign investors to access.

And, as one of my colleagues will explain in another post, enhancements made to safeguard China A-Share investors' interests have made the China A-Share market much more appealing.

Casey Preyss, CFA

Partner & Portfolio Manager

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: