As a manager of a global equity strategy, I am often asked if globalization has peaked.

It's a common notion: even The Economist has suggested that we are reaching the apex of globalization and along with it the demise of the multinational corporation.

If true, that could have a significant effect on portfolio construction, because the globalization of trade over the past few decades has underpinned global investing.

We have shifted from an era in which the primary focus was on country and currency exposures to an era in which corporate performance is a key portfolio consideration, regardless of domicile.

The simple reason is that the world has become increasingly interconnected—including supply chains, resources, end-markets, customers, and employees. If that global interconnectedness were to slow dramatically or revert, investors may need to take a different approach.

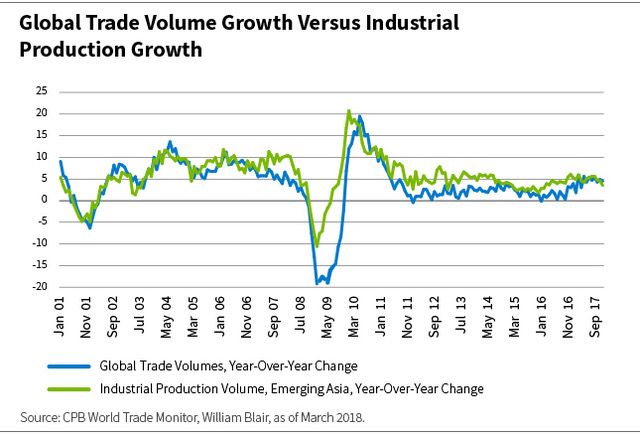

Certainly, by some measures, globalization appears to have peaked. Growth in global trade volumes did, in fact, begin slowing around the time of the global financial crisis.

But much of that slowdown can actually be attributed to the subsequent dramatic decline in Chinese industrial production—the monthly raw volume of goods produced by industrial firms such as factories, mines, and electric utilities.

Leading up to the global financial crisis, Chinese industrial production growth accelerated, and after the global financial crisis, it fell precipitously—from 15% to 6%. That affected trade volume growth, because you can't trade what you don't produce.

The chart below illustrates how closely China's industrial production growth resembles global trade volume growth before and after the crisis.

A number of trends do support globalization—perhaps the most significant of which is the increasing prevalence of technology. And this growth is very real—not the result of hype, as it was in the 1990s.

In 2017, technology companies were among the strongest generators of cash flow return on invested capital (our preferred metric for corporate quality) and among the fastest growers of cash flow, across both developed and emerging markets.

Clearly, then, something more significant and structural is afoot, as my colleague Simon Fennell noted in Technology Story Here to Stay.

I believe we're entering a fourth industrial revolution in which a range of new technologies fuse the physical, digital, and biological worlds, affecting all disciplines, economies, and industries.

Klaus Schwab of the World Economic Forum has associated it with the “second machine age” in terms of the effects of artificial intelligence on the economy. This ongoing innovation and disruption will continue to be borderless, driving further globalization.

So no, I don't think globalization has peaked, and this is important for global investors. Innovation creates new market leaders, and as market leaders change, investment decisions must keep up.

And the best way to ensure that investment decisions keep up is to focus on corporate performance rather than regional or country positioning. That's the domain of active managers.

Ken McAtamney

Partner & Portfolio manager Global Equity team

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: