Despite near term pressures on India's equity market from rising oil prices, rising bond yields, and U.S. dollar strength, I believe India has one of the best long-term growth trajectories among emerging markets.

Compelling Demographics

One reason is that India has the best demographics among emerging markets. China, Korea, and Brazil have declining working-age populations, which make it difficult to have strong growth.

India's working-age population is not going to peak until 2030. Roughly 220 million Indians (the entire population of Brazil) will enter the work force between 2010 and 2030.

Supportive Flows

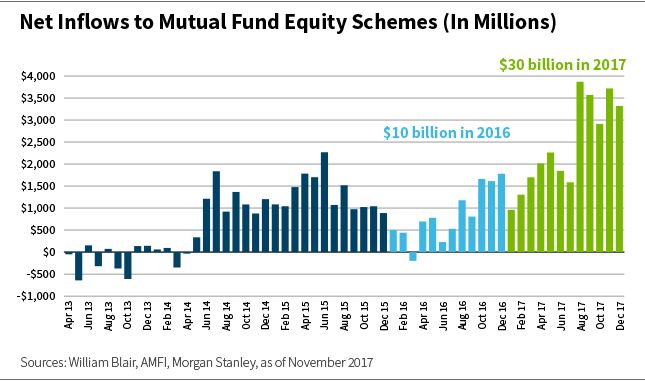

One of the most unique factors supporting Indian's equity-market performance is mutual fund flows from retail investors. The chart below illustrates.

Net flows began increasing in 2014, after Prime Minister Narendra Modi was elected. Locals voted with their money, and began investing about $1 billion per month in mutual funds.

Those investments accelerated in 2017, when India implemented systematic investment plans (SIPs), which are similar to the automatic investment plans that gained popularity in the United States in the 1990s: You simply connect your bank account to your fund and transfer a set amount each month.

Now, locals are investing more than $3 billion per month in mutual funds.

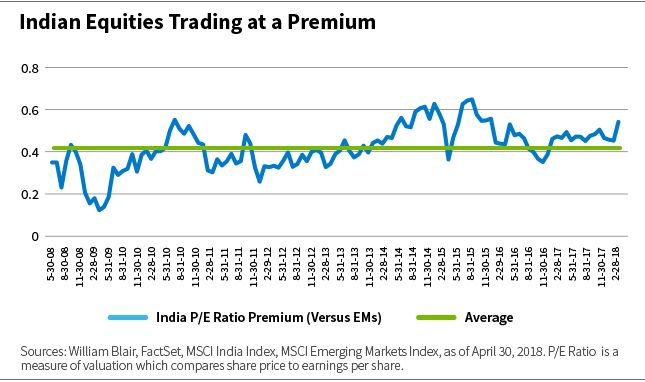

That makes a case for higher multiples in India. If the markets decline for a few days, it's easy to see locals buying. The 10-year average price-to-earnings ratios of Indian equities has been at about a 40% premium to emerging markets as a whole since 2006.

Risks

Investing in India, as in any emerging market, isn't without risk. Some economic disruption occurred with demonetization and the implementation of the goods and service tax in 2017 (although we believe these were positive developments for the Indian economy in the longer term).

And locals are unnerved by the budget providing too many goodies for rural areas in a vote-seeking effort (although that should resolve after the election in 2019).

Given that India is a net importer of commodities, rising oil prices have driven up inflation, increasing pressure on India's central bank to raise interest rates. That generally slows growth rates and depresses market returns.

Outlook

All factors considered, I think India stands out as one of the best long-term growth stories in emerging markets. The country has one of the fastest-growing economies supported by a pro-business, reform-oriented government, and favorable demographics with improving living standards, and benefiting from technological advances.

Moreover, there are abundant quality growth companies in India, and this positive backdrop provides additional tailwinds to earnings growth.

In my opinion, some of the underperformance year to date is due to market rotation. India has been the belle of the ball over the past few years, and investors have been overweight and they move away as other countries started to show signs of recovery.

While the recent broad foreign exchange and macro headwinds are painful, they do not derail the fundamental long-term growth story.

Todd McClone, CFA

partner & portfolio manager William Blair's Global Equity team

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten