Last week's sell-off in Brazil appears to be triggered by centrist presidential candidate Geraldo Alckmin's decline in polls, and signals a need for centrist political parties to unite behind one candidate.

Brazil's Bovespa index fell 8 % this week to its lowest level of the year, and the U.S. dollar rose 1.4% against the Brazilian real to 3.9043, its highest value since early 2016.

The sell-off appears to be triggered by newly released opinion polls showing that Alckmin, who is market-friendly, is in fourth place, unable to generate popular support.

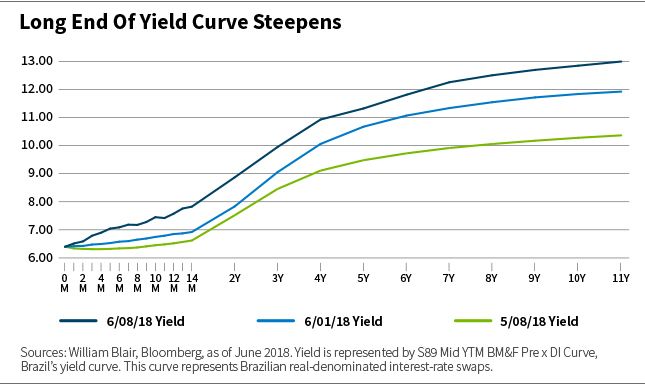

As a result of these polls, the fixed-income market moved aggressively to reprice political risk, such that the long end of the yield curve steepened by 92 basis points in the past week.

This, in turn, put downward pressure on the Brazilian real. The currency devaluation will likely increase inflation in the coming months, which suggests that the country's central bankers will hike interest rates, worsening debt sustainability dynamics. In other words, it's a vicious circle.

Exacerbating those worries are Brazil's recent labor strikes, including a nationwide truckers' strike in which drivers blockaded highways in a protest over soaring fuel prices.

The strike, which was organized and controlled through WhatsApp, further drove home the point that the presidential campaign is not being fought on television, where mainstream parties have an advantage.

In addition, the strike is likely to have materially affected second-quarter gross domestic product growth such that current forecasts for the year are no longer attainable and will be revised down.

The current market sell-off may serve to focus minds within the political establishment on the need for centrist parties to unite behind one candidate—but it remains unclear whether a strong enough candidate will emerge soon enough to win the popular mandate in October.

In regards to portfolio implications, this week's sell-off may turn out to be a buying opportunity if the Brazilian real can stabilize at current levels and first half 2018 weakness exacerbated by recent strikes turns out to be an air pocket.

Olga Bitel

Global Strategist

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: