It's important for global investors to heed the technological disruption occurring around the world. It's even more interesting to focus on the relationship between that disruption and the emerging market investment opportunity.

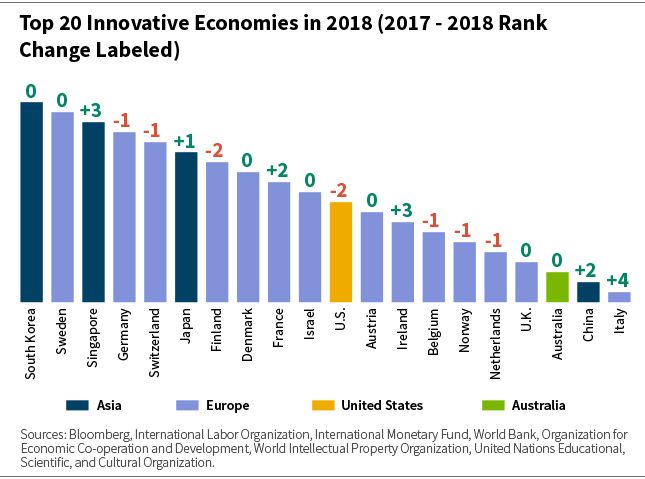

Disruption can be evidenced by the pace of innovation. Bloomberg recently published a multi-factor innovation model showing innovation by country. The breadth of innovation around the world is surprising, and is certainly not just a U.S. or Chinese phenomenon. Asia more broadly dominates, and Europe is well represented, as the chart below illustrates.

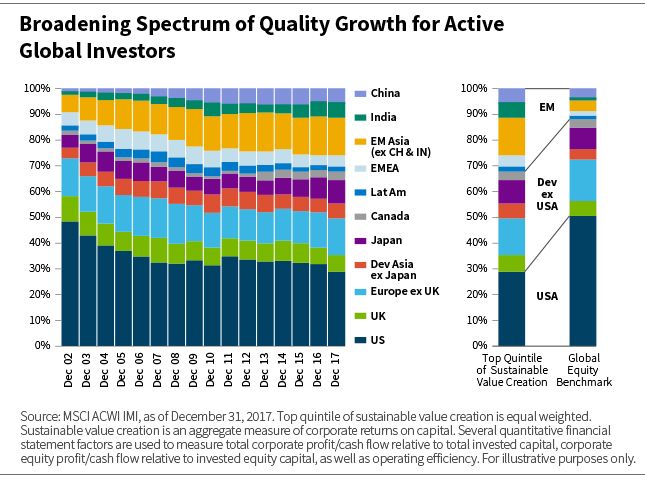

The concept of innovation is a consideration in our proprietary quality growth model, which we use to determine the sustainability of corporate performance. In 2002 a full half of the top-quintile quality-growth companies around the world were in the United States, and only about 15% were in emerging markets.

Since then, there has been a broadening of superior corporate performance: today, the United States is home to a third of sustainable-value-creating companies, while a full third are now found in emerging markets. The chart below illustrates.

We believe this change in market leadership is an important consideration in favor of active management. As innovation changes, market leaders change, and as market leaders change, investment decisions must be rooted in corporate performance rather than benchmark positioning.

This makes active management essential. As active investors, we seek to allocate capital where the innovation leaders are, company by company, around the world.

Ken McAtamney

Partner & Portfolio Manager William Blair's Global Equity team

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: