There is currently a lot of hype about blockchain networks, in part because of the meteoric rise—and subsequent decline—of Bitcoin, a cryptocurrency supported by a public blockchain network.

Blockchain technology is important to understand for several reasons, in particular from a fundamental investing perspective because it can be applied to increase efficiency and reduce costs. It can even be applied to curtail widespread E. coli outbreaks.

Blockchain Meets Lettuce

Earlier this year, a deadly E. coli outbreak linked to romaine lettuce sickened nearly 200 people in at least 35 states while authorities struggled to identify the specific source of the tainted product, ultimately narrowing it down to Yuma, Arizona.

“Do not eat or buy romaine lettuce unless you can confirm it is not from the Yuma growing region,” warned the Centers for Disease Control.

But how do you know if your lettuce came from Yuma? Blockchain.

Blockchain Basics

Before we explain how blockchain technology can be used to curb an E. coli outbreak, it's worth understanding how blockchain works.

Many people associate blockchain with Bitcoin, but they're not synonymous.

Blockchains distribute encrypted information (typically a ledger) among network participants, who themselves authenticate the information.

Essentially, this is “a world without middlemen,” in the words of Harvard Business Review. It provides “nearly friction-free cooperation between members of complex networks that can add value to each other by enabling collaboration without central authorities.”

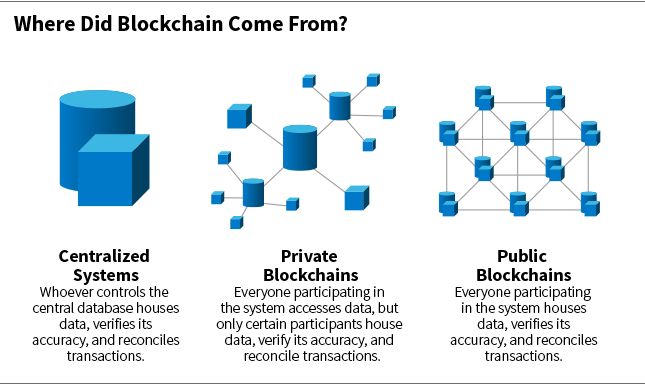

The need to exert greater control of information and improve data privacy in certain settings led to the bifurcation of blockchains into private and public networks, with the distinction driven by who controls the consensus function.

In a public blockchain, like the network that supports Bitcoin, every participant in the network houses data, makes decisions about the accuracy of data, and reconciles transactions. On the other hand, with a private blockchain, every participant in the network has access to data, but only a few participants have permission to verify and reconcile that data.

The Lettuce Connection

So what does this have to do with lettuce?

Blockchain allows for the efficient exchange of information among various nodes in a network, like a supply chain. And some large corporations are using it to do just that—more proficiently track goods from point A to point B.

Walmart, for example, is using blockchain to monitor portions of its food delivery supply chain. This can help Walmart avoid broad recalls such as its 2018 romaine lettuce recall. Blockchain can tell Walmart from which supplier a product came and on what date, in a way that is fully auditable and impossible to falsify.

That is such a significant advance that the vice president of food and safety at Walmart has said, “There's no question about it, blockchain will do for food traceability what the internet did for communication.”

But food delivery isn't the only industry that can benefit from blockchain; we are seeing adoption occur across industries.

Adoption Across Multiple Industries

Some banks, for example, are using blockchain to assist with cross-border payments and settlement/clearing of securities trades.

The U.S. Food and Drug Administration is testing a blockchain-based platform through which electronic medical records, data from clinical trials, and health data gathered from wearable devices could be better shared.

De Beers, a diamond miner and retailer plagued with questions about the origin and authenticity of its diamonds, announced in May that it had tracked 100 high-value diamonds from miner to retailer using blockchain, an effort designed to avoid imposters and conflict minerals.

And numerous governments—including those in Russia, Dubai, and Sweden—are either testing or piloting blockchain-based land registries that would digitize and verify information about asset ownership and store it in blockchain registers.

Case Study: Trucking Industry

The trucking industry is also poised to benefit from the use of blockchain, as moving goods from one point to another often involves a large number of simple transactions that need to be verified along the way. Typically, few parties are involved and it's easy to verify that the goods have arrived as intended.

However, the current verification process relies on email and phone calls, which can take days.

With 100 members, including UPS and FedEx, a consortium called the Blockchain in Trucking Alliance (BiTA) hopes to make that process more efficient by using blockchain.

As a shipment enters a truck, it will be scanned. As the truck moves from point A to point B, the GPS logs would ensure that it arrives at its intended destination. At unloading, the shipment would be scanned again.

When the truck arrives at point B, the data is reconciled—everything that was scanned on the way in is matched on the way out—the blockchain would know that the transaction is authentic and complete and remit payment immediately.

A community bank in Texas is even building a payment system to sit atop BiTA's blockchain. The bank provides factoring for U.S. truckers, meaning that they buy trucking companies' accounts receivable at a discount. Its biggest credit cost is fraud—a result of truckers providing fake invoices.

If this bank can build an automated system that is 100% accurate and verifiable, its operational costs should decline dramatically, and its profitability should increase significantly.

Mainstream Adoption by 2025

Although we are in the early stages of blockchain development, real blockchain solutions are already being developed and implemented quickly. Accenture predicts blockchain will enter the mainstream by 2020, and we will see mainstream adoption by 2025.

However, some data suggest that it may happen even faster than anticipated: The Depository Trust & Clearing Corporation (DTCC), for example, is poised to start clearing and settling the trades of all swaps on a blockchain in the first quarter of 2019.

There are challenges, of course. Research firm IDC projects worldwide blockchain spending will reach $10 billion by 2021, but not all spending will be successful. According to Gartner, approximately 80% of enterprise blockchain applications whose goal is to save money will fail.

From our investment perspective, active management provides a distinct advantage as we can assess the potential implications of blockchain on a company-by-company basis.

As part of our fundamental analysis, we consider which companies can harness and benefit from blockchain (like the Texas community bank mentioned above) and which companies have the potential to be disrupted.

This is the nexus of fundamental research and assessing management teams' strategic vision for the future. We are focused on first making sure we understand blockchain conceptually, then applying that perspective as we determine which companies might be most affected (positively and negatively) as one component of our in-depth, fundamental research.

- “The Promise of Blockchain Is a World Without Middlemen” (Harvard Business Review)

- “De Beers Tracks Diamonds Through Supply Chain Using Blockchain” (Reuters)

- “A Brief History of Blockchain” (Harvard Business Review)

- “The Future Will Be Decentralized” (TED)

- “How Does a Blockchain Work?” (YouTube)

- “Bitcoin: A Peer-to-Peer Electronic Cash System” (Satoshi Nakamoto)

Michael Hubbard, research analyst on William Blair's U.S. Growth Equity team & Daniel Hill, CFA, research analyst on William Blair's Global Equity team

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten