As interest in renewable power generation grows, investments in wind energy should surge because it has become one of the most affordable forms of electricity today.

Advancements in technology are driving the economics of wind power. Aggressive research and development programs have led to taller wind turbine towers, lighter blades, and intelligent controls, all of which provide for better wind capture.

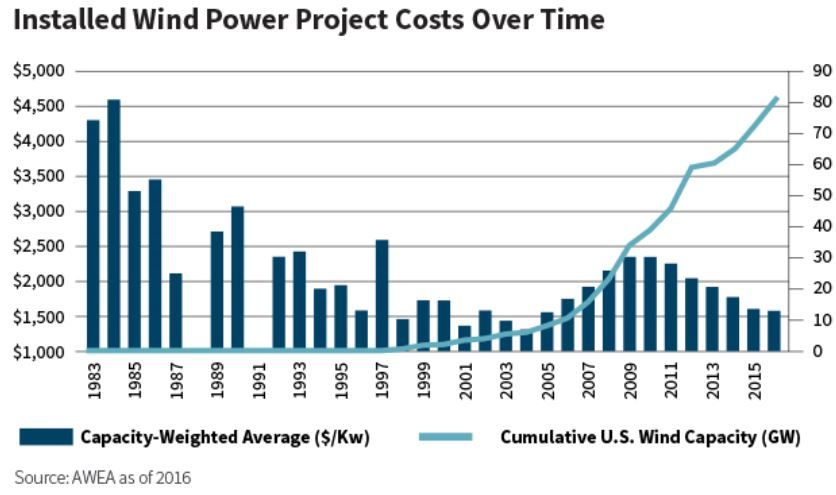

According to the U.S. Department of Energy's (DOE's) National Renewable Energy Laboratory, wind energy costs have fallen 66% since 2009, and could decline by another 50% by 2030. As a result, the DOE predicts the levelized, unsubsidized cost of wind energy will fall from $55 per megawatt hour in 2015 to $31 per megawatt hour in 2030.

Improved wind project financing structures could push that cost even lower, to $23 per megawatt hour.

With this as a backdrop, power-generation companies are using unique business models to facilitate growth. One large Scandinavia utility, for example, is targeting an installed capacity of 11 to 12 gigawatts by year-end 2025, up from 3.5 gigawatts currently.

To achieve this growth, this utility employs a “farm-down” model, which involves selling 50% of the project to a partner during the construction phase. The proceeds compensate the utility for taking the development and construction risk of the projects, and are recycled into the development of new wind farms.

As a result, income from farm-downs funds the utility's intermediate-term growth ambitions, eliminating the need for raising new equity or project finance.

A key component of success in wind power generation will be storage. You can't easily store 90 days of wind. European countries such as Denmark, Spain, Ireland, and Germany have successfully integrated large amounts of wind energy without having to install new energy storage resources.

But, the need to store even more wind is driving investment in battery technology. That technology is also used by electric vehicles, so there is significant research and development going into it at the moment.

Turbine technology and battery technology work together to improve the efficiency of renewables in general and wind more specifically. Our team structure promotes extensive collaboration across sectors to help us better dimension these opportunities, which increasingly expand beyond traditional industry boundaries.

As we research renewable power generators for potential inclusion in our portfolios, we look for durable businesses franchises. For example, earlier this year we became interested in a U.S. clean energy provider that owns an electric utility.

The renewable energy segment of its business is forecast to grow earnings 11% from 2017 to 2020, and the electric utility is expected to grow net income by 9% over the same period. The combined growth is expected to generate group-level earnings-per-share growth of 6% to 8% through 2020, among the highest in the U.S. utility space. That's a compelling opportunity, in our opinion.

We also look at the environment in which a company operates. Catalysts for growth may include factors such as supportive utility regulation, tailwinds from increased renewable development in the region, and the retirement of old and relatively more expensive power generators that will need to be replaced by new resources.

Alaina Anderson, CFApartner & research analyst Global Equity teamWilliam Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: