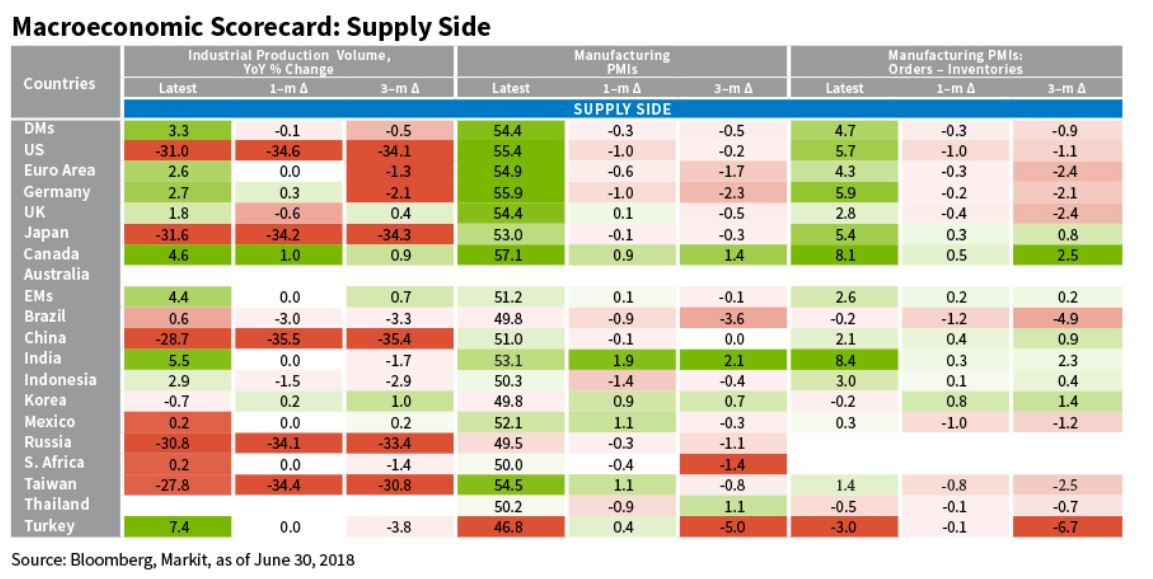

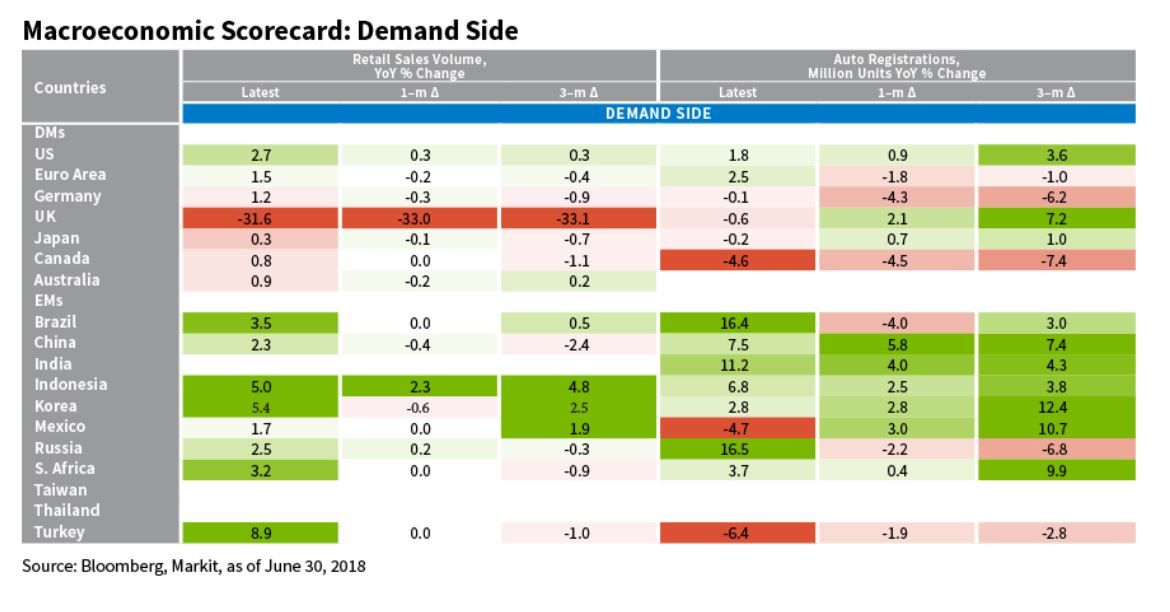

The scorecard provides an easy, real-time comparison of key economic indicators across most developed markets and major emerging markets. See below for a more in-depth description of our macroeconomic scorecard and more key takeaways from our analysis.

Here are our latest insights from the macroeconomic scorecard:

- PMIs have decelerated to the point of stabilizing.

- The one-month change in Japan is positive and inventory orders are nearly stable in the euro area.

- May data in Germany indicates both industrial production and orders were stronger than the first-quarter run-rate. - Retail sales growth remains relatively weak.

- The U.S. yield curve continues to flatten on the back of large U.S. issuance at the short end.

- Corporate earnings have been strong: net income grew by 16% year-over-year in the euro area and by 18.5% in the United States. Both rates are above the long-term average, and next-12-month (NTM) expectations are very stretched in the United States.

- Contrary to expectations in the more cyclical subsectors, we have not seen much contraction of multiples. Semis saw the largest contraction of about 5 percentage points in developed markets excluding the United States and about 3 percentage points in the United States.

- Cyclical positioning and tariff escalation suggest that quality as a factor is likely to be rewarded within the equities space. We have seen this in late June and early July.

- We have seen a flight to quality in emerging markets, where currency weakness leads to acceleration of inflation and a worsening growth/inflation trade off. This is jeopardizing second- and third-quarter earnings.

Scorecard Basics

Our macroeconomic scorecard consists of five panels, each of which details a single data series. The first three indicators deal with the supply side of the economy, and the last two deal with the demand side (consumer behavior). These indicators include industrial production, manufacturing purchasing managers' indices (PMIs), manufacturing PMI orders minus inventories, retail sales, and motor vehicle registrations. All of these indicators are high frequency (they come out monthly) and are available at the country level.

For each indicator, we show the annual growth rate as well as the one-month and three-month changes in that growth rate. The idea is to see whether the current rate of growth is decelerating or accelerating.

The Indicators

Industrial production. These figures can frequently move the markets because they are considered to be indicators of future inflation.

Manufacturing PMIs. This survey-based data provides clues not just about the health of the manufacturing sector, but about economic growth in general. Many investors use the PMI as a leading indicator for the growth or decline of gross domestic product (GDP).

Manufacturing PMI orders minus inventories. The most forward-looking component of manufacturing PMI, this data is a testament to how company managers think about their order books versus their current production trends. This gives us a predictable indicator of what future industrial volume growth is likely to be.

Retail sales. Retail sales are an important economic indicator because consumer spending drives much of our economy.

Motor vehicle registrations. Cars are an excellent indicator of consumer behavior. If consumers do not have sustainable income growth or credit growth, they are unlikely to purchase such a big-ticket item.

Olga Bitel

partner and global strategist on William Blair's Global Equity team

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten