If you were to draw up the ideal scenario for active managers looking to generate alpha, you would start by identifying a systematically important industry that presents a massive, global opportunity set.

You would also want an industry that is being reshaped by multiple, interrelated disruptive forces that are shifting profit pools across the value chain, resulting in many winners and losers. To top it all off, you would want the industry to be solving problems that have broad implications for society.

In short, you would be looking for the automotive industry.

We believe that today's automotive industry—more than at any other time in its history—presents ample opportunities for active managers to uncover value for their investors.

With more than 95 million vehicles sold annually around the world and an overall profit pool in excess of $1 trillion, the automotive industry represents a massive ecosystem that involves the raw materials, industrial, technology, and consumer sectors.

The most intriguing aspect of the automotive industry for active managers, however, is the importance of being able to identify which parts of the value chain—original equipment manufacturers, integrators, suppliers, and raw materials producers—will be gaining and losing profitability over the next several decades, as well as the specific companies that are well positioned to capture that value.

Three powerful trends—advanced driver-assistance systems (ADAS), ridesharing, and electric vehicles—are dramatically changing the trajectory of the industry. Each of these trends creates immense threats to established players and opportunities for incumbents and new entrants alike.

To examine the opportunities and threats for investors, we published a white paper about innovation in the automotive industry. Based on that paper, we're also publishing a three-part blog series on the topic.

In this first of a three-part series, we discuss ADAS, the development and proliferation of which are raising many questions for investors as they think about the future of the industry. Is autonomous driving around the corner?

The Advent of ADAS

Over the last several years, safety features such as automatic emergency braking, lane-keeping assistance, and blind-spot detection have become increasingly common in new cars. Meanwhile, companies across the automotive and technology industries—from incumbent original equipment manufacturers (OEMs) to technology behemoths and start-ups—are aggressively touting their progress toward developing fully autonomous vehicles.

Short- and Intermediate-Term Impact

While many of the reports coming out of the auto industry's epicenters of Detroit, Munich, and, more recently, Silicon Valley suggest that the advent of fully autonomous (L5) driving is right around the corner, the reality is that its arrival will occur across a much longer time frame.

The release of fleets of “robo-taxis,” or cars with no drivers and no steering wheels, in any widespread commercial application is likely 10 to 15 years from becoming a reality.

Major advancements in data capturing and machine learning— as well as major regulatory decisions—will need to occur before L5 can be used extensively across a range of settings. In the meantime, L5 vehicles will initially be used in very limited, geo-fenced situations, such as at airports to drive passengers between terminals and parking garages.

While lower levels of ADAS may not capture the public's imagination like fully autonomous driving, the growing adoption of L2 and L3 should certainly capture investors' attention.

Technology that enables “hands off” partial automation involving steering and acceleration (L2) and “eyes off” conditional automation in more predictable settings such as highways (L3) is already available. It is also relatively affordable and demanded by consumers.

The “active safety” features that define L2 and L3 have reached an inflection point in adoption. In addition to growing consumer demand for these features, regulators around the world are beginning to push for making this technology more common.

Today, fewer than 20% of new vehicles in developed markets include automatic emergency braking systems, according to Mobileye, an Israeli company owned by Intel that creates software, sensors, and other inputs central to ADAS. But in Europe, for example, vehicle models released after 2017 will need to include automatic emergency braking, road-edge detection, and lane-keeping assistance in the base price to achieve a four- or five-star safety rating.

Adoption of L2 and L3 technology should be a profitable tailwind for companies across the automotive supply chain.

OEMs: For OEMs—the companies such as General Motors, Ford, Fiat Chrysler, and Honda that are manufacturing automobiles— L2 and L3 represent a “sweet spot” in the ADAS evolution in terms of monetizing the value created by this technology.

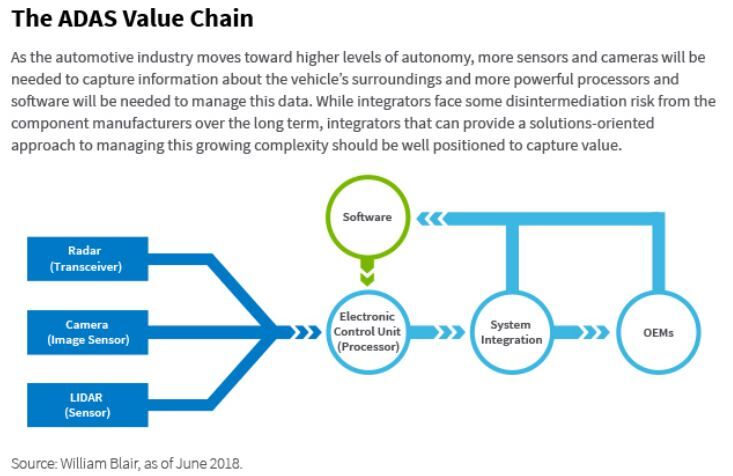

Suppliers: Manufacturers of sensors, cameras, processors, software, and other components that go into ADAS will benefit from the higher volume of content—and the growing complexity of that content—that will be required as the industry moves up the autonomy spectrum.

Integrators: Companies such as Bosch, Valeo, and Continental that integrate systems and components that are built by other suppliers have a more valuable role in the value chain than many industry commentators may believe.

Long-Term Impact

Although the widespread deployment of L5 is still 10 to 15 years away, the day is coming when fully autonomous cars become commonplace. And when fully autonomous cars arrive, they will have the ability to dramatically shift the value chain in the automotive industry.

Andrew Siepker, CFA

Research Analyst Global Equity Team

William Blair Investment Managament

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten