Since the increase in intensity and scope of sanctions on Iran, the price of energy has re-emerged as a significant influence on our investment analysis, particularly in the short- and intermediate-term.

We capture important nonfundamental macro influences through the creation of macro themes that are designed to identify factors materially affecting assets and currencies around the world.

The objective of our energy theme is to assess the influence that energy prices have on markets and currencies in our investment universe.

This assessment involves a number of considerations. Some, such as fracking and the United States pulling out of the Iran Agreement, are more obvious. Others, such as transportation in the natural gas space, are less so.

Because natural gas is generally a local commodity that is increasingly becoming a global commodity, differentials in natural gas prices are dissipating.

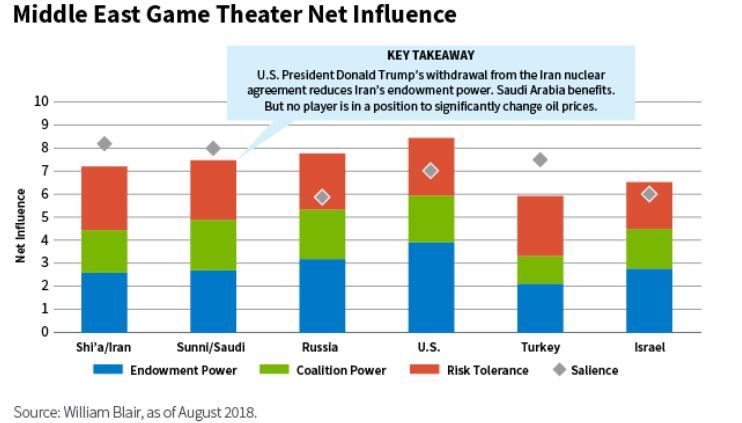

What is interesting about our energy theme is that part of the analysis comes from our Middle East game theater, which focuses on the dynamics among Iran, Saudi Arabia, Russia, the United States, Turkey, and Israel. (We describe how we use game theory and dimensions of net influence—endowment power, coalition power, risk tolerance, and salience—in another post.)

How do these dynamics affect our investment decisions?

Long-Term: Energy Attractive

From a long-term fundamental value perspective, the global energy sector is still very attractive despite outperforming broader equities a bit this year.

Comparing estimates for the intermediate-term price of oil (about three years out) to our longer-term estimates, prices are a bit above what we would establish as our equilibrium basis. Accordingly, we recently trimmed our energy sector exposure.

Shorter-Term: Prices Stable

On a shorter-term basis, the market is focused on the degree to which the United States will use sanctions to squeeze Iranian oil exports. That could limit overall supply and drive up prices.

But when we look at our Middle East game theater, we believe the aggregate supply and demand balance is likely to remain fairly stable—in part because we saw this playbook a few years ago with respect to Iran.

One thing that's different now is that the European Union is not fully on board with the sanctions, so we expect a bit less pressure on Iran than in the past. At the same time, China and Russia are likely to be fairly opportunistic, increasing imports to Iran.

Add the likely increase in production from other OPEC nations including Saudi Arabia, and the sanctions are counter-weighted such that we expect a stable balance.

As a result, we believe there is a low probability (about 25%) of Iran's crude oil and condensate exports declining by more than 1 million barrels per day at any time between now and the end of 2018.

It is also worth noting that we have seen a pickup in global energy sector earnings and expect it to continue. The sector has undergone a massive investment-driven cycle, with improved technologies leading to more elastic supply.

We are currently emerging from a trough in which companies re-equilibrated cost structures, and are seeing increased earnings and expectations as a result. We account for this in our current valuation expectations.

Brian Singer, CFAPartner & Portfolio ManagerWilliam Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten