The China A-Share market presents a compelling opportunity for quality growth managers, thanks in part to its growing new economy. In this series, we discuss two investible themes in China: a growing middle class and growth in healthcare spending.

Rising Middle-Class Incomes and Savings

The growth of China's middle class is a well-known theme among emerging market investors, and we believe there is still substantial growth potential in Chinese domestic consumption.

Chinese households classified as upper middle class or affluent are projected to constitute 57% of total households in 2020, up from less than 10% in 2010 and less than 1% in 2000.

Complementing this income growth, savings rates among Chinese citizens are high, exceeding those of the United States and Japan, and are growing quickly. (Maybank, as of June 2017)

This should translate into a continued increase in Chinese domestic consumption over the next few years. China's middle-class consumption is second only to that of the United States, and it is growing at a rate second only to that of India. In 2020, China's middle-class consumption is expected to be the largest in the world. (McKinsey Global Institute, as of June 2017)

Key Opportunities

With this as a backdrop, there are a number of consumer-related opportunities in China, including cars, spirits, travel, and personal care.

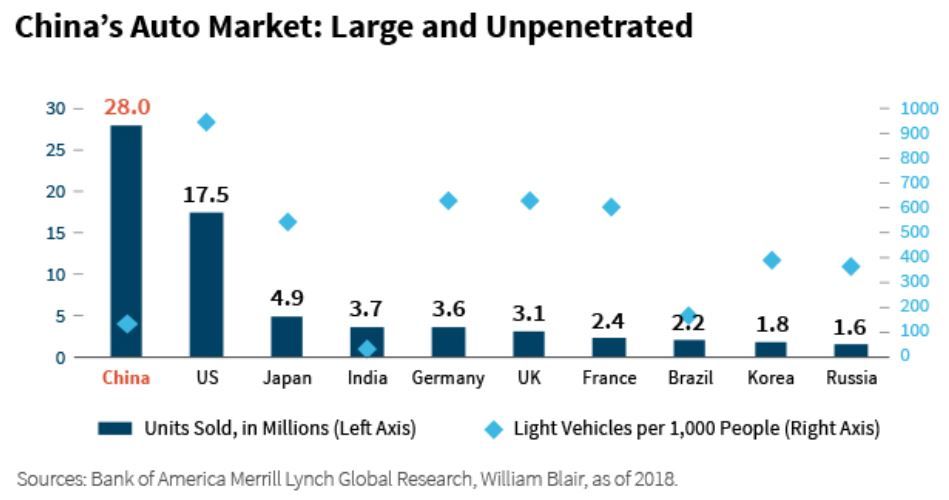

Cars. China has the largest auto market in the world, with nearly 30 million cars sold each year. This is substantially higher than in other countries, including the United States. Yet China's market penetration, measured by vehicles per thousand people, is one of the lowest in the world, implying further growth. The chart below illustrates.

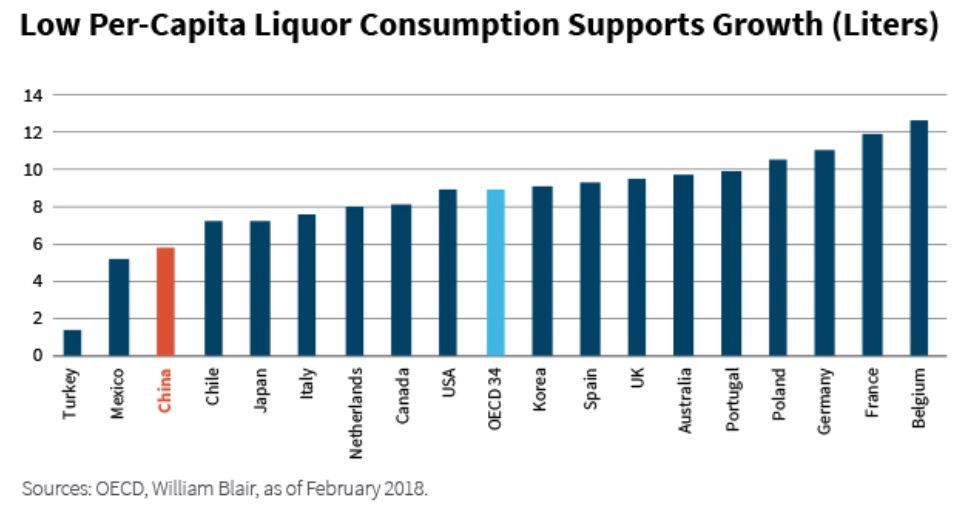

Spirits. Per-capita consumption of liquor in China is low compared with the world average, as the chart below illustrates. But the potential for growth—and returns—is high. And the China A-Share market provides unique exposure to the Chinese liquor companies.

Travel. Growth in outbound Chinese tourism has been explosive over the past decade. But there is room for it to grow, as only 9% of Chinese citizens hold passports (Jing Travel, as of January 2018), compared with 42% in the United States. (S. State Department, as of January 2018)

Personal care. The rise of China's consumer class has presented a massive, fast-growing market of people who want to buy expensive personal-care products. And the runway for growth in this sector is huge, with China's per-capita spending on beauty products just 15% of the United States'.

Example: A Leading Liquor Producer

The largest liquor company in China by volume, retail value, and market capitalization is the kind of company that could benefit from China's domestic consumption story.

A producer of the traditional Chinese liquor Baijiu, this company has a famed heritage dating back more than 500 years, and maintains a strong brand. Indeed, it produces the only Chinese liquor served at national banquets hosted by Chinese presidents for visiting foreign dignitaries. The 500-milliliter bottles cost $250 to $3,000, depending on vintage.

This company has surpassed the world's largest multinational liquor company in terms of market cap, net profit, and margins, as figure 4 illustrates. Its market cap is substantially higher than that of the world's largest multinational liquor company, yet it operates in a fragmented market where its share is only 6%.

This company's revenues have grown at nearly 25% per year over the past 20 years, driven by both volume and average selling price increases.

In our opinion, limited supply, a strong brand, pricing power, and a relatively small market share, against a backdrop of Chinese consumers' growing appetite for premium goods, make this company a compelling investment opportunity.

Vivian Lin Thurston, CFA

portfolio manager and research analyst Global Equity team

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten