Healthcare is underdeveloped in China relative to its global peers, in both total and per-capita spending. This creates the potential for growth—and makes healthcare spending just one of two interesting themes that is creating opportunities for quality growth managers in the China A-Share market.

Rising Disease, Underserved Market

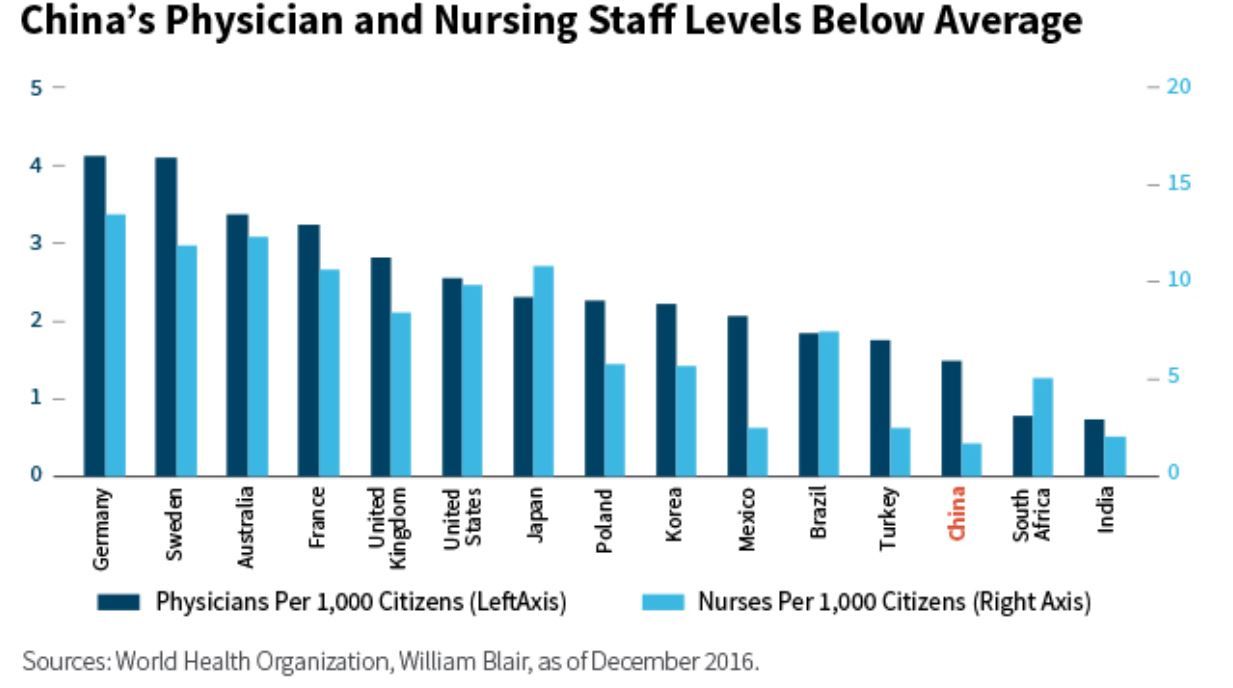

The prevalence of chronic diseases in China—such as diabetes, hypertension, and cancer—has risen significantly in the past two decades. Yet China is a largely underserved healthcare market, with the number of physicians and nurses per 1,000 citizens among the lowest in the world. The chart below illustrates.

Not surprisingly, the Chinese healthcare industry has grown rapidly over the past decade, with an estimated compound annual growth rate of 17% from 2006 through 2018. The total industry market value is expected to reach nearly $800 billion in 2018. (World Health Organization, as of December 2016)

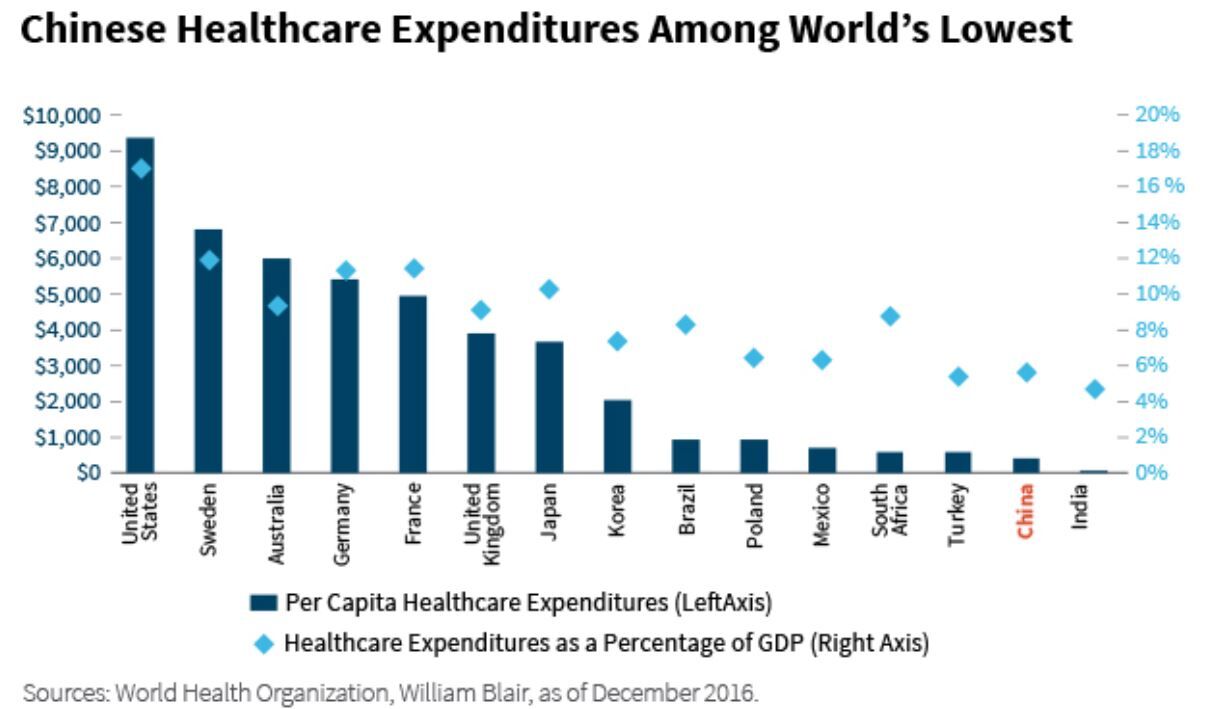

We expect this robust growth to continue, underpinned by China's low healthcare spending. As the chart below illustrates, Chinese citizens on average spend only a few hundred dollars per year on healthcare, among the lowest in the world, and a small fraction of the United States' nearly $10,000 per-capita healthcare spending.

Total healthcare spending is also low, with its contribution to gross domestic product about 5%, one of the lowest in the world.

It is also notable that the China A-Share market has nearly 90% of the market cap of listed Chinese healthcare companies (Citi, as of September 2017), making the China A-Share market particularly attractive to investors who want to take advantage of the secular growth in China's healthcare spending.

Example: A Frontrunner in Innovative Medicine

An innovative drug manufacturer in China has been consistently growing its revenue and net profit by more than 20% per year for more than a decade.

Cancer drugs contribute to 43% of its total sales, reflecting the increasing prevalence of cancer in China over the past decade, which the Chinese government has sought to fight with an accelerated drug-approval process.

The company is a leader in R&D; R&D spending as percentage of total revenues rose from 8.9% in fiscal 2014 to 13.0% in fiscal 2017. Its large R&D spending has led to a strong product pipeline, with 10 major drugs under development and most expected to reach the market over the next two to three years.

Active Management Essential

In summary, we believe China offers a number of compelling investment themes, thanks to its burgeoning new economy and secular growth in consumption. But to capture the potential via China A-Shares, active management is essential.

We believe fundamental research with a quality focus is key to exploiting this attractive opportunity while limiting some of the risks inherent in the asset class.

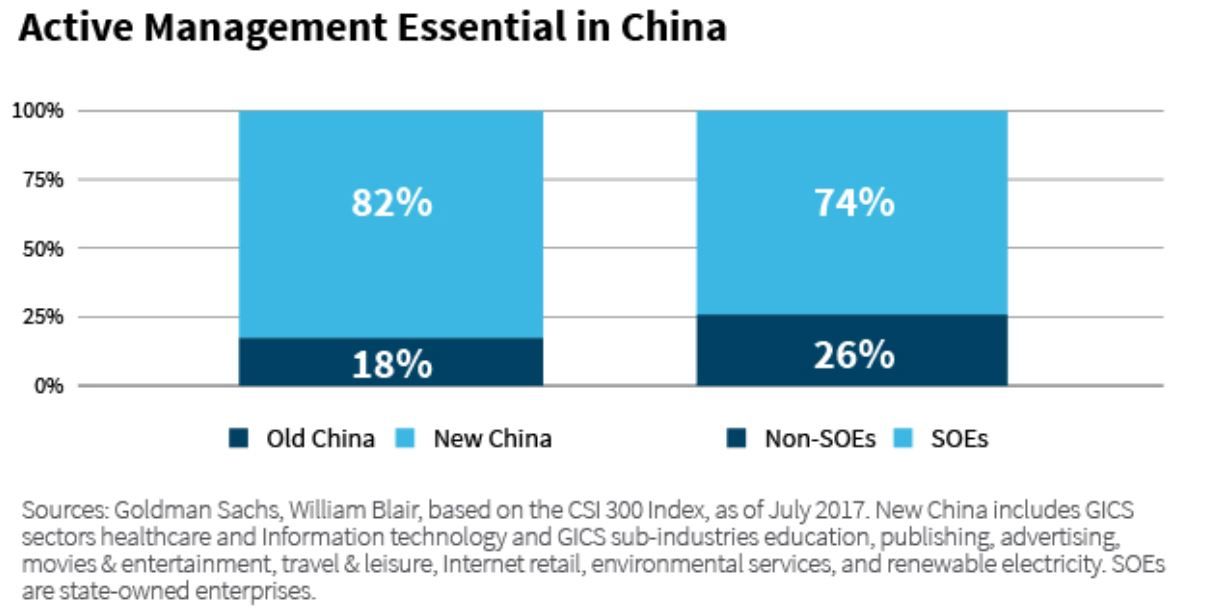

China's new economy accounts for less than 20% of the CSI 300 Index from a market-cap perspective, as the chart below illustrates, and the old economy (including many state-owned enterprises, or SOEs) still accounts for a large part of the index.

Moreover, we believe fundamental research with a quality focus is key to exploiting this attractive opportunity while limiting some of the risks inherent in the asset class.

Seeking high-quality companies with sustainable growth characteristics is paramount. Such companies may perform well in up markets, protect in down markets, and produce attractive, risk-adjusted returns, as the chart below illustrates.

Vivian Lin Thurston, CFA

portfolio manager and research analyst Global Equity team

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten