With the birth of the so-called “Greenspan Put,” the 800-pound gorilla of U.S. monetary policy unleashed itself on capital markets. Today, there isn't just one 800-pound gorilla manipulating capital markets; there's a troop of gorillas in the form of central banks around the world.

As central banks now embark on an unwinding of their balance sheets, we add to these uncharted paths material concerns about the proliferation of rules-based strategies, the Volcker Rule, and uncoordinated circuit breakers.

While the ultimate compounding effects of these concerns are as of yet unknown, but the likelihood of market disruption is elevated. In this series, we explain how these factors will not only lead to a day of reckoning, but also present unique opportunities of which skillful investors may be able to take advantage.

Easy Monetary Policies Curtail Fundamental Influence

Our story begins with periods of easy monetary policy and the resulting malinvestment that has prevented fundamentals from fully exerting their influence on prices for more than a decade.

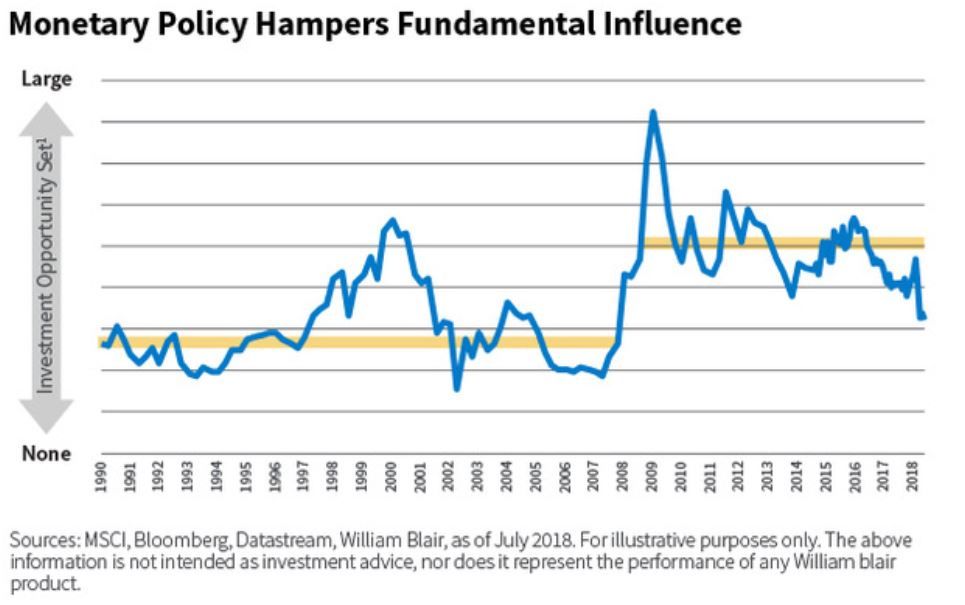

Today, we live in a period of elevated investment opportunities, where discrepancies between prices and fundamental values across our investment universe are relatively large. You can see this in the chart below.

Roughly speaking, the opportunity set represents the aggregate dispersion between fundamental value and price for various markets and currencies calibrated to our portfolio risk budget and constraints. The further prices are from fundamental value in aggregate, the larger the opportunity set, and the closer prices are to fundamental value, the smaller the opportunity set.

The Effects of Stimulative Central Bank Policies

Markets have a history of repeated cycles of euphoria, crashes, and recoveries. Storms are followed by periods of unusual calm that breed complacency and excessive risk-taking until a bubble emerges and ultimately bursts.

To understand why these cycles recur, in this series we will look at the evolution of market movements and their connections to central bank and government policies.

This will reveal that stimulative central bank policies are associated with rising prices of risky assets, reduced asset price volatility, and more systematic-driven (and less fundamental-driven) markets, all of which sow the seeds of future crises.

Typically, easy monetary policies lower real interest rates and stabilize risk premia, initiating and protracting bull markets.

The persistence of stimulative monetary policy forces fundamental investors to struggle against interest rate and asset price manipulation. Meanwhile, quantitative strategies emerge to exploit temporal common-factor momenta. If policies are sustained long enough, asset price bubbles occur.

The end of the cycle begins with central banks unwinding easy money policies. While this allows prices to revert to normal, this often, too, leads to an over-adjustment, which lands in a crash. Monetary and other policy makers counter this decline with new policies and a cycle begins anew.

Too often, the surfeit of regulatory, monetary, and fiscal responses that follow crises is misguided. Not only do policy makers fight the previous war, but they also neglect the fragilities of the resulting order. Well-intended policies and regulations create unintended distortions that have real consequences, often revealed in subsequent crises.

Even in hindsight, corrective measures often would not have prevented—and would sometimes even have exacerbated—the previous crises.

The past decades reveal three such waves of policy and asset price interaction that culminated in the crashes of 1987, 2000, and 2008. In each case, central banks were instrumental in propping up bubbles and catalyzing crashes through swings between loose and tight monetary policies.

Our study required an assessment of monetary policy, which we consider loose when central banks engage in unsustainable stimulation of the economy. Often, this is manifested in low or falling interest rates. Other times, it is a failure of the central bank to dampen an overheating economy.

An Unprecedented Period of Loose Monetary Policy

We now find ourselves in an unprecedented period of loose monetary policy. The resulting market distortions combined with rules-based strategies, the Volcker rule, and complex circuit breakers are setting the capital markets up for a probable bear market likely to be punctuated by periodic liquidity crises.

We believe that the next market downturn will be driven by illiquidity, not the leverage that was at the heart of the Global Financial Crisis (GFC) a decade ago.

The most illiquid assets, such as private equity, loans, debt, and infrastructure, show classic signs of late-stage bubble activity. We anticipate that in a market downturn, forced selling of assets will come against constrained liquidity, echoing the misfortune of Black Monday in 1987.

As macro investors, we must be cognizant of the risks these distortions impose and stand ready to navigate market landscapes that both influence and shape new policies—because the bear market could also present large fundamental opportunities.

To understand these risks, we embark on a series that begins by looking back at the four waves of loose monetary policy.

Lesen Sie mehr im vollständigen Dokument

Brian Singer, CFAPartner & Portfolio ManagerWilliam Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten