We believe that electric vehicles present an opportunity for active managers to uncover value for their investors.

And investors don't need to look past the next few years to see how the development and adoption of electric powertrains is creating threats to incumbents and opportunities for new entrants.

To examine the opportunities and threats for investors, we published a white paper about innovation in the automotive industry.

Based on that paper, we're also publishing a three-part blog series on the topic. In the first two blog posts, we discussed advanced driver-assistance systems (ADAS) and ridesharing. In this post, we will focus on electric vehicles.

Most original equipment manufacturers (OEMs) are committed to developing electric vehicles over the next decade, and world governments are pushing the automotive industry in this direction through a combination of tighter emissions standards and subsidies.

Producing electric vehicles is no longer a science question but a supply chain and manufacturing one. This leads to an even bigger question facing the automotive industry today: How quickly will electric vehicles penetrate the market?

We believe that by 2030, electric vehicles will represent between 15% and 30% of global vehicle sales, with significantly higher penetration rates in China because of government mandates.

The years of 2020 to 2025 should be a critical period in determining the trajectory of electric vehicle penetration. During this period, many OEMs will be introducing full lines of electric vehicles across various price points.

This period will also see continued improvements in battery range and reductions in costs.

Key Questions

The rate at which electric vehicle penetration occurs is a function of several questions, all of which are interrelated.

How quickly will battery costs decrease?

Manufacturing vehicles powered by internal combustion engines is an inherently inflationary exercise. Because of rising regulatory standards, heightened consumer expectations, and competitive pressures, OEMs are continually trying to make internal combustion engines more fuel-efficient, more powerful, and more environmentally friendly.

This is an incredibly demanding, and expensive, engineering challenge.

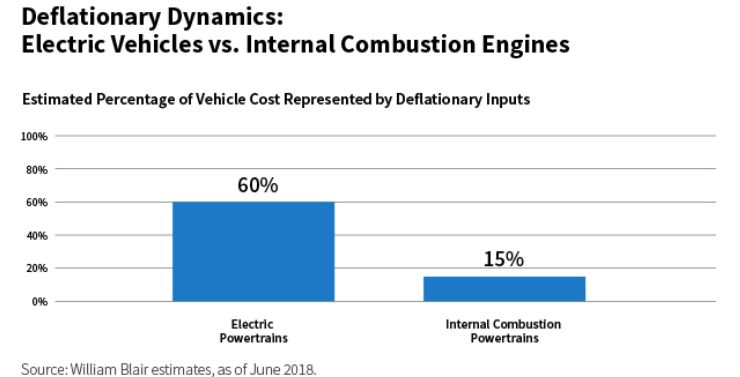

Manufacturing electric vehicles, on the other hand, is largely deflationary.

Batteries benefit from economies of scale, which results in a virtuous cycle for consumers. As more consumers buy electric vehicles, more batteries will be produced. As more batteries are produced, the cost per kilowatt hour (kwh) goes down. As the cost per kwh goes down, electric vehicles get cheaper and more consumers convert away from internal combustion engines.

Once the average sticker price for electric vehicles becomes lower than internal combustion engine vehicles, consumer adoption of electric vehicles will reach an inflection point. We project these prices to reach parity by 2025.

Can the supply chain keep up with production demands?

Across the automotive supply chain, companies will need to drastically expand and adjust their capabilities to meet the coming demand for electric vehicles.

To meet demand projections for 2026, production of the four main raw material inputs for batteries—lithium, cobalt, nickel, and graphite anode—will need to increase by factors ranging from 2x to 8x.

The resulting higher prices for these inputs, particularly with lithium and cobalt, will certainly be a headwind to lower battery costs. But rising materials costs won't overwhelm the aforementioned savings from economies of scale and chemistry improvements.

Which new entrants will emerge?

Building electric vehicles is a fundamentally different—and in most ways, less complex—engineering process than building cars powered by internal combustion engines.

From OEMs' perspective, it is more an exercise in supply chain management and assembly than precision engineering.

Much of the most technically demanding engineering is done by the battery manufacturers, as well as by the companies creating the software and processors that manage the power stack and serve as the powertrain's central nervous system.

As a result of these smaller competitive advantages, the shift toward electric vehicles creates opportunities for new entrants to emerge across the automotive supply chain.

How will the industry address consumers' “range anxiety?”

The newest electric vehicles have ranges of approximately 300 miles per charge. While this significantly exceeds the daily range needs of a vast majority of drivers, the fear of running low and not being able to find a nearby charging station is a major impediment to consumer adoption.

Can appealing models be created at all price points?

The growth of the electric vehicle market will be limited until appealing models are created for the mass market. This will accelerate over the next several years as OEMs around the world are preparing to introduce full lineups of electric vehicles at varying price points.

Electric Vehicles' Impact on the Value Chain

In evaluating the investment risks and opportunities facing OEMs, suppliers, integrators, and raw materials producers, one must delineate between transitory, short-term forces and longer-term changes that create opportunities for sustainable value creation.

OEMs: The growing importance of electric vehicles creates near-term headwinds to OEMs' profitability and jeopardizes their position in the value chain over the long term.

OEMs are being pulled in multiple directions. They have to climb a steep learning curve when it comes to electric vehicles while making continuous improvement to internal combustion engines to meet increasing fuel economy and emissions standards.

The investments being made to ramp up electric vehicle capabilities are hurting OEMs' profitability, and the need to manage supply chains for two different types of powertrains is adding complexity to OEMs' business models.

Over the longer term, the shift toward electric vehicles could put OEMs' position in the value chain somewhat at risk.

Suppliers: The shift to electric vehicles, and OEMs' outsourcing of many of the most technically demanding engineering functions, should strengthen suppliers' position in the value chain.

With electric vehicles, much of the most valuable engineering work occurs at the supplier level. This is especially true for battery manufacturers and the makers of the processors, operating systems, and other components that are essential to managing the power stack.

According to Benchmark Mineral Intelligence, global battery demand is projected to exceed supply by nearly 30% by 2026. (Benchmark Mineral Intelligence, “Into the Light—Lithium Ion Battery Supply Chain in 2018,” as of January 2018) This bottleneck will give battery manufacturers that have earned OEMs' trust increased pricing power and volume growth.

Integrators: As OEMs try to manage electric and internal combustion engines supply chains simultaneously, solutions-oriented integrators have more opportunity to add value.

OEMs have their hands full as they try to enter the electric vehicle arena while continuing to improve their internal combustion engine capabilities. Producing electric vehicles requires higher levels of outsourcing and new expertise in quality control and production scheduling.

As a result, integrators will enjoy new opportunities to add value for OEMs by offering expertise and solutions rather than just products.

Raw materials producers: Surging battery demand has created investable bottlenecks across the supply chain.

The growth in battery demand has caused the entire supply chain to become tight. This is especially true for the four main raw materials that go into batteries for electric vehicles: lithium, cobalt, nickel, and graphite anode. As noted previously, global production for all of these materials will need to increase by 2x to 8x by 2026 to meet demand projections.

Implications for Portfolio Positioning

When thinking about the portfolio-positioning implications of electric vehicles and two other trends shaping the automotive industry—ADAS and ridesharing—delineating between short- and long-term implications is paramount.

We believe investors also need to incorporate the following factors into their portfolio strategies: sustainable value creation vs. transitory opportunities; developed markets vs. emerging markets; growth vs. substitution effects; and isolated developments vs. grand unified theory. We discuss these more in our white paper.

Andrew Siepker, CFA & Anil Daka, CFA, Global Research Analyst, William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten