Given investors' surging interest in combining financial return objectives with environmental, social, and governance (ESG) factors—a concept known as “blended value”—some may be tempted to dismiss this as a transient trend.

But our journey to incorporate ESG factors into our fundamental analysis has reaffirmed our belief that the emphasis on blended value will reshape the asset management industry and the sectors that comprise the global economy for decades to come.

Long-Term Trends Underpin ESG Focus

Shifting demographics and other long-term trends are underpinning the growing importance of ESG factors.

Demand comes from a broad investor base, including large pension plans, endowments, foundations, and individuals—in particular women and millennials, who are controlling more wealth and have a higher interest in sustainability than other groups. Japan's $1.5 trillion Government Pension Fund, for instance, is placing more emphasis on sustainable investing.

Growing concern about climate change is also prompting greater perception of its risk by investors and corporate executives.

During the financial crisis in 2008, the top risk factors identified by corporate executives were mostly economic, including asset-price collapse, a slowing Chinese economy, and the oil and gas price spike, according to the World Economic Forum's Global Risks Report. Fast forward to 2018 and four out of the five top risk factors are environmental or societal: extreme weather events, natural disasters, failure of climate-change mitigation, and water crises.

In short, we're seeing ESG risks become higher priorities for corporate executives. This is influencing long-term corporate strategy and how investors view the risks and opportunities facing companies.

Overcoming Hurdles to ESG Integration

While there is still some hesitation among investors about the value proposition of ESG integration and some perception that it may conflict with their fiduciary duty, a growing body of research debunks the idea that there is a tradeoff between financial performance and sustainability.

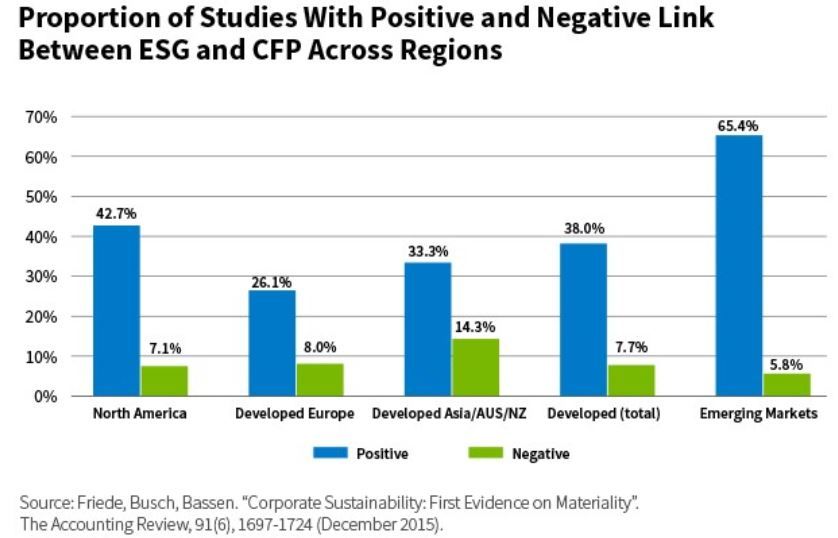

A meta-study from Deutsche Bank and the University of Hamburg showed that 90% of 2,200 individual ESG studies show a neutral or positive link between good ESG practices and corporate financial performance, with a large majority of positive findings across regions. In all, this study showed that 38% of studies in developed markets showed a positive link between ESG and financial performance.

Similarly, Harvard Business School Professor George Serafeim and colleagues found that companies investing in material ESG issues see higher growth in profit margins and superior risk-adjusted stock returns.

Another headwind to further ESG integration is concern about the quality of data on companies' sustainability practices. More investors are relying on third-party sustainability ratings frameworks that are based largely on corporate disclosures. But some investors question whether this growing body of data is financially material or helpful in making decisions.

Not surprisingly, because these ratings are largely disclosure-driven, with less emphasis on corporate behavior and forward-looking strategy, average ESG scores tend to skew strongly toward larger companies with an inherently backward-looking bias.

In addition to being market-cap biased, ESG ratings tend to skew more favorably toward regions where corporate sustainability reporting is more common, such as Europe.

Opportunities for Active Management

ESG ratings can be helpful, but they only tell part of the story. It's important to question them and use them more as a starting point for developing one's own view of a company's sustainability profile.

We believe that doing this work is a major part of our value proposition as an active manager, and we deliver on this by doing intensive bottom-up analysis. This can help us potentially exploit inefficiencies that result from the biases and limitations of external ESG research.

Our active approach involves sending our analysts around the world to meet companies and talk with their stakeholders. There are small-cap companies that aren't reporting or producing sustainability reports, but are actually doing great things to create compelling investment opportunities when viewed through the lens of blended value. It can take an in-person meeting with them to learn what those initiatives are.

In addition, some enhanced techniques using big data and artificial intelligence can sort through the higher-frequency data points and help offset the fundamental limitations of traditional ESG rating systems. We see potential applications in both quantitative and fundamental research.

Integrating ESG in an authentic manner that is aligned with one's philosophy and process is difficult. It can't be achieved through a simple overlay or siloed approach.

Embedding sustainability systematically in the portfolio management process necessitates ongoing investment in the research function, including both qualitative and quantitative inputs, to help identify long-term corporate value creation potential and drive strong client outcomes.

Blake Pontius, CFAPortfolio SpecialistWilliam Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten