As in the prior three waves of quantitative easing, central banks' current ultra-easy monetary policies have pushed volatility levels down and asset prices up.

The age-old dictum, “Don't fight the Fed,” is even more powerful when several central banks simultaneously triple and quadruple their balance sheets.

This has discouraged fundamental-value investing and has been a good time for systematic strategies, which have seduced investors into believing that simple rules can create superior performance.

Today's rules-based strategies include purely passive (index), semi-passive (smart beta), and systematic-quantitative (factor) strategies. Of these three, purely passive strategies should have the least influence on market prices. Most are well-diversified, market-cap-weighted portfolios mirroring broad indices.

Systematic-Quantitative Strategies

The demand for systematic-quantitative—or risk-factor—strategies has surged in recent years, a growth rate that suggests marginal players are getting in on the party.

These strategies are often based on a common set of confirmed factors, such as value, momentum, quality, volatility, and yield.

“How likely is it that other funds would have the same factor exposures?” asks Andrew Lo of MIT. “If they use similar quantitative portfolio construction techniques, then more often than not, they will make the same kind of bets.” ( Khandani, Amir E., and Lo, Andrew W. “What Happened to the Quants in August 2007? Evidence from Factors and Transactions Data.” Journal of Financial Markets 14.1 (2011): 1-46)

When flows turn the other direction, the virtuous cycle that bolstered past performance rapidly becomes vicious.

Of course, not all systematic-factor strategies are structurally identical. Of primary concern are those marginal players that have unwittingly herded into similar exposures as an ultra-easy monetary-policy environment has persisted.

When flows turn the other direction, the virtuous cycle that bolstered past performance rapidly becomes vicious.

Of course, not all systematic-factor strategies are structurally identical. Of primary concern are those marginal players that have unwittingly herded into similar exposures as an ultra-easy monetary-policy environment has persisted.

Smart Beta

Smart beta exchange-traded portfolios (ETPs), while smaller in assets under management (AUM) than systematic-quantitative strategies, are the most rigid category of rules-based strategies.

While systematic-quantitative strategies constantly run their algorithms based on past data, smart beta strategies select and weight securities based on a fixed set of rules, purportedly capturing the systematic compensation of underlying risk factors to deliver better risk-adjusted returns than active portfolios. Like systematic-quant strategies, smart beta rules are predicated on previously observed “systematic” market characteristics.

Almost 64% of institutional investors use equity smart beta strategies, up threefold in only two years. ( Clearpath Analysis. “Sustainable Smart Beta Investing for Institutional Investors.” October 2017)

Risk Parity

Unlike smart beta and factor strategies that rely on factors for rebalancing, risk parity strategies instead rebalance to equilibrate risk across asset classes. They are more diversified and not as tightly rule-bound as smart beta and systematic-quantitative strategies.

The main danger of risk parity is deleveraging triggered by a simultaneous increase in asset-class volatilities and cross-asset class correlations.

With risk parity AUM estimated at about $600 billion, a deleveraging would certainly contribute to asset price declines in the midst of a correlated rules-based strategy sell-off.

Concavity and Short Volatility

Further compounding the rules-based investment approach are other investment strategies with similar volatility characteristics. Such short volatility strategies comprise almost 5% of the (circa 2017) Russell 3000 Index market cap.

Christopher Cole estimates that “as much as a $600 billion in selling pressure would emerge… if the market declined just 10% with higher vol[atility].” (Cole, Christopher R. “Volatility and the Alchemy of Risk: Reflexivity in the Shadows of Black Monday 1987.” Artemis Capital Management. October 20, 2017.)

Explicit short volatility strategies are akin to a direct selling of volatility. They must sell volatility as volatility decreases to maintain their short exposure. Lower volatility thus generates a positive feedback loop, with ever-lower volatility dulling market investors into a numb complacency to risk.

Like snow serenely building on a mountain before the avalanche, the longer volatility remains low, the higher the ultimate risk. When the bear market “avalanche” begins, the short volatility strategies' effective long market exposures increase and losses build up, forcing selling of the underlying market in order to limit losses.

These strategies are generally referred to as “concave” and amount to $1.5 trillion in AUM. They do well when volatility stays low or mean-reverts, but lose out at an accelerating rate as volatility increases or prices diverge.

Low Volatility Forebodes Correction

Prolonged periods of low volatility create market fragility and set the system up for corrections and crashes.

How? Algorithms that rely on historical volatility numbers acquire ever-larger positons to maintain exposures. Rules-based and short volatility investors have concave portfolios that migrate to higher risk levels as they attempt to maintain strategy volatilities.

When this dynamic breaks, it can do so in grandiose fashion. One group of economists looked at the connection between periods of low volatility and found a strong connection to subsequent banking crises. Low volatility turns out to be a significant predictor of banking crises.

This is yet another indication that prolonged periods of low volatility, while deceivingly attractive, are dangerous.

Early Cracks

Recently, we have seen examples of how rules-based and short volatility strategies may bear the short-term brunt of such cracks in the system.

A small Chinese yuan devaluation in August 2015 sparked fears of slowing Chinese growth, which sent markets lower. This built into a larger global sell-off, widening bid/ask spreads, and problems calculating ETP prices, and trading halts. A number of ETPs plunged in value—a manifestation of how vulnerable ETPs are in a marketplace deprived of liquidity.

Another crack appeared with short-volatility trading being forced into reverse in late January and early February 2018. The Fed vowed to raise rates. Doubts emerged about the prudence of volatility-selling strategies, and increased implied volatilities drove some short volatility ETPs to collapse.

These events exemplify how rules-based strategies are penalized when the momentum from which they benefit is disrupted and their behaviors combine to create destructive feedback loops. The next such exodus will likely follow these examples, and be both sharper and deeper than has been witnessed previously.

The Volcker Rule and circuit breakers introduced after the crashes of 2008 and 1987, respectively, will exacerbate the bear market that central banks will have already spawned. We turn to these market-changers next.

When It Stops Working

Excluding purely passive index funds, today's flavors of rules-based strategies amount to about $1.7 trillion. Systematic-quantitative and hedge-fund strategies comprise about $1.2 trillion, and smart beta strategies add about another $0.5 trillion. (Wigglesworth, Robin. “BlackRock Bets on Algorithms to Beat the Fund Managers.” Financial Times. March 20, 2018)

The transition from discretionary portfolios to semi-passive, systematic-quantitative, and even purely passive strategies involves selling losers and accumulating winners.

As long as these rules-based strategies grow, they support market momentum and price moves become detached from fundamental values.

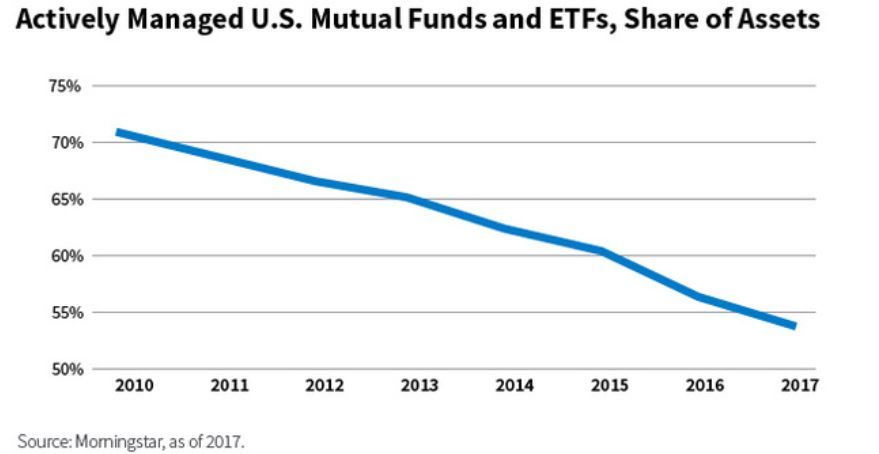

The accumulation of assets in rules-based strategies has reduced fundamental discretionary trading volumes to only about 10% of total volume. (J.P.Morgan. Other estimates place this percentage higher, up to about 20%) As the chart below shows, only 55% of mutual-fund assets are now actively managed.

The problem with this is that as more investors do the same thing, at some point their strategies simply do not work anymore.

Brian Singer, CFAPartner & Portfolio ManagerWilliam Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten