At a time when investors are concerned about equity valuations and rising correlations among asset classes, currencies' low correlation with equities may be particularly appealing. And if done correctly, separating currency and equity investment decisions can result in having your cake and eating it too.

Currency: Three Potential Benefits

The currency market is the deepest and most liquid financial market in the world; it's also perhaps the most underused and underappreciated.

As active managers of a global macro-oriented strategies, we have tremendous latitude in where, why, and how we can look for alpha and diversification—including currencies.

While currencies are overlooked by many other managers, there are three primary reasons why we believe active currency management makes sense:

- It can generate positive real returns.

- It takes advantage of macro inefficiencies.

- Currencies have low correlations with equities.

Because it checks all three of these “boxes,” active currency management is a vital part of our investment approach across all market cycles. But today, this last box is especially important, because the macro diversification benefit that currencies provide is valuable not only in reducing risk, but also in generating new return opportunities.

Lessons From the Yen and Euro

In a multi-asset portfolio, separating decisions related to equity markets and currencies can add diversification and alpha over time by allowing managers to generate returns from multiple sources in a single geographic market.

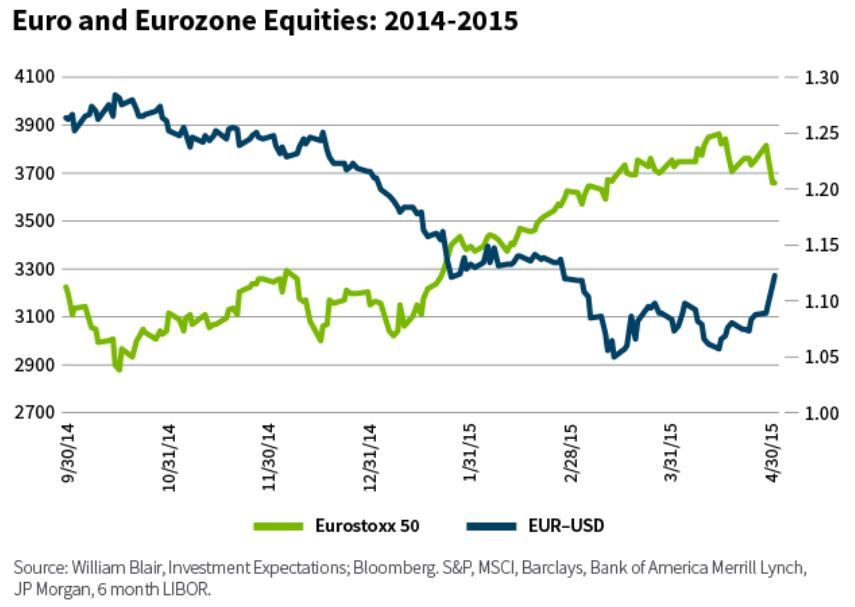

Two relatively recent examples—the yen in 2012-2013 and the euro in 2014-2015—illustrate this point starkly.

As the charts below show, both periods were characterized by deeply negative correlation between the currency and its respective local equity market.

During this time, each country's respective central bank was embarking on quantitative easing (QE) so, somewhat by design, these efforts were highly positive for the stock market but deeply negative for the yen and the euro.

Equity investors in these foreign markets on an unhedged basis during these periods were likely frustrated. Much of the gain the market provided (via equities) was watered down (via currencies).

But investors who managed their currency exposure separately from their equity exposure—going long the equity market and short the currency, in these cases—had the opportunity to generate returns from two separate sources simultaneously.

This illustrates a key benefit of currencies. What investors want can be boiled down to two things: return and diversification. Currencies, when managed actively, provide both of those things—and can do so quite well.

Today's Currency Opportunities

Where are the biggest currency opportunities today?

On the long side, the Turkish lira continues to be among the most fundamentally attractive currencies, even after recovering a portion of its value since its significant August 2018 downturn.

Another currency that is undervalued but still has good fundamentals is the Philippine peso. It has been weakening dramatically since 2013, but it's been happening relatively slowly so it's been out of the spotlight for the most part.

On the short side, we don't like the Thai baht, which we believe is expensive, and the Swiss franc, which, while less expensive than it used to be, has not returned to fair value quite yet.

We also are happy to be short the New Zealand dollar. While it is fundamentally expensive, it has the added benefit of being correlated with risky assets, so shorting it provides a hedge to our broader portfolio's systematic market exposures.

Key to successful positioning in these or any currencies is, as noted, the separation of the investment decision between currency and equity strategy.

Tom Clarke

Portfolio Manager

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten