As we look for compelling investment opportunities in China, it's important to pay close attention to the country's shift from an industrial economy to one that's driven by consumer spending—and analyze the trends shaping consumption among China's emerging middle class.

China is home to a dynamic and massive consumer market. Individuals are no longer saving as much as they used to, and this has driven growth in consumer spending.

It's worth noting that some investors wonder how much longer increased consumer borrowing can fuel consumption increases. But for now, the growth persists.

Much of China's consumption habits are geared toward luxury goods and travel. Not surprisingly, Chinese millennials are the driving force behind many of these spending patterns. But these trends are playing out in older generations as well.

Sizable, Well-Connected Market

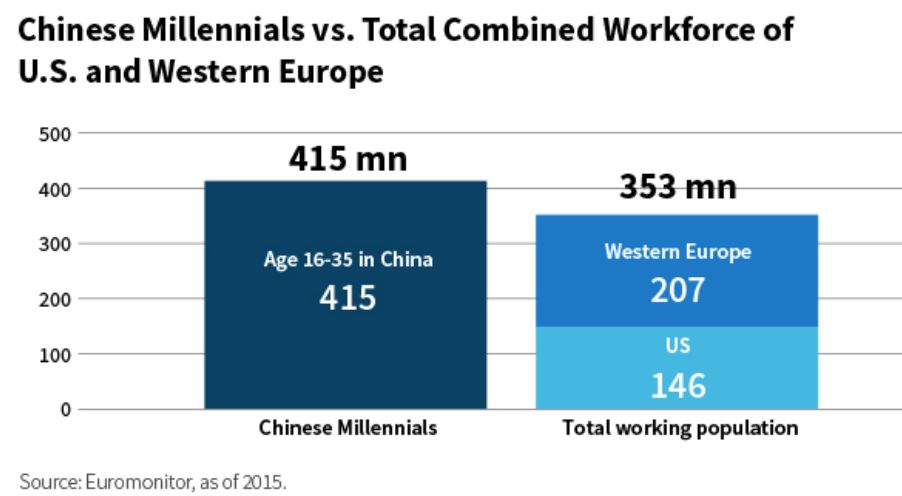

There are 415 million millennials in China. This is more than the combined workforce, of all ages, in the United States and Western Europe. Chinese millennials now make up 17.8% of their age group worldwide, behind only India, home to 454 million millennials.

Broadly speaking, China's millennials are confident, modern, and well educated. They like high-quality, beautiful items, and they don't feel guilty about owning luxurious things and enjoying life.

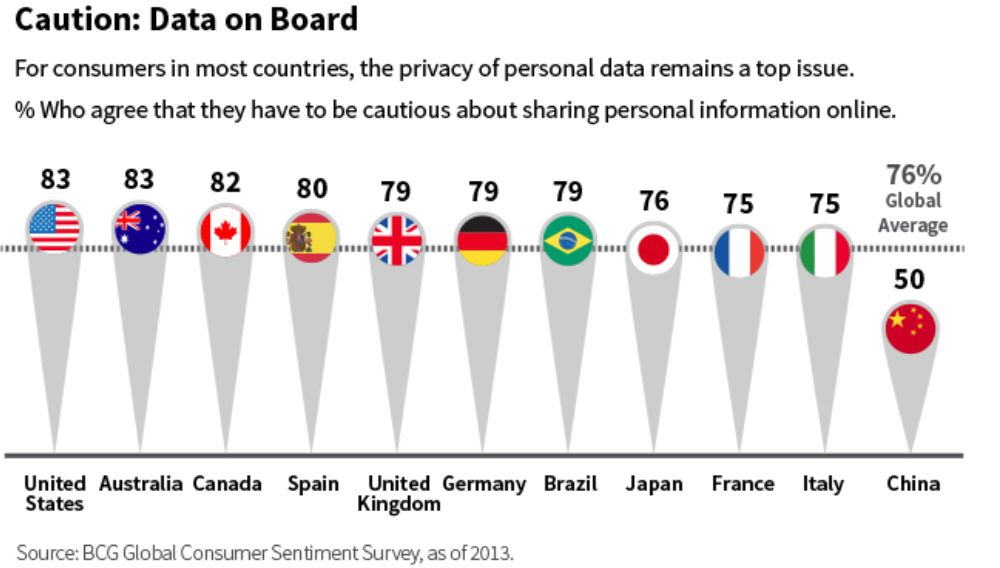

They're also connected to the world. They're enthusiastic smartphone users and comfortable with big data in ways that consumers in other countries aren't. Chinese consumers show far lower sensitivity to data privacy than those in the Western world or Japan.

Spending Across Borders and Generations

The Chinese are now the world's largest overseas tourism spenders. According to the World Tourism Organization (UNWTO), Chinese tourists spend $260 billion, more than double what Americans spend.

Luxury items are a high priority for Chinese consumers, whether traveling abroad or at home. According to McKinsey, Chinese consumers accounted for 32% of global spending on personal luxury goods in 2016, a figured that is expected to increase to 44% by 2025.

Moreover, Chinese spending on luxury goods is growing at 9% a year, three times greater than luxury spending by all other consumers globally. It's estimated that by 2025, 7.5 million wealthy Chinese households will spend about 1 trillion renminbi in luxury goods.

It's not only Chinese millennials who love to travel the world and spend. Consumption growth among older Chinese is particularly notable because it doesn't fit the typical life stage spending patterns seen in the Western world.

This is largely a result of the fact that per-capita consumption among older Chinese was very low to start with. Now that their incomes are rising, they have a lot of catching up to do from a spending perspective—even at a stage in life when consumption by Westerners typically slows. This growth from a low base is partly why we believe that this Chinese cohort has tremendous consumption power.

It's also an example of why investors need to closely analyze spending habits in China to fully understand growth opportunities related to the country's increasingly consumption-driven economy.

Vivian Lin Thurston, CFA

portfolio manager and research analyst Global Equity team

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten