The most important driver of China's transformation into a global leader has been the opening of its economy and capital markets over the last four decades. In this blogpost, I will examine how China opened in the past and how it is pursuing integration today.

Chinese Capital Goes Overseas

Over the past 40 years, much of the opening of China has centered on the country's special economic zones (SEZs). These zones generally offer businesses exemptions from tariffs, taxes, and regulations and, as such, act as gateways for foreign investment. In an earlier post, I wrote about the opportunities and pitfalls related to SEZs around the world, and in China specifically.

In China, the most famous SEZs are Shenzhen, located next to Hong Kong, and Pudong, part of Shanghai. In the span of 20 to 30 years, these cities have transformed from agricultural fields to bustling cities with populations in the millions.

While the development of SEZs has helped China gradually open its trade and capital markets to the world, the next step has been the government facilitating the flow of capital in the other direction—Chinese companies investing and setting up businesses overseas.

To this end, the Chinese government introduced a number of measures encouraging companies to invest overseas, including the “going out” policy, which was initiated in 1999. Chinese international investments grew quickly, with many Chinese companies setting up SEZs in Africa since the 2000s.

Given the success of SEZs in China, hopes were high that there would be similar results there. Though Chinese authorities originally planned for 50 or so zones in Africa, fewer than 10 have actually been developed thus far.

Overseas investment is part of a larger plan to develop more sophisticated industries at home. For Chinese companies, these overseas zones present an opportunity to use the natural resources and abundant labor in other countries. While the government helps facilitate and encourage overseas investment, it has been largely driven by Chinese companies.

Focus on Infrastructure Across “Belt and Road Initiative”

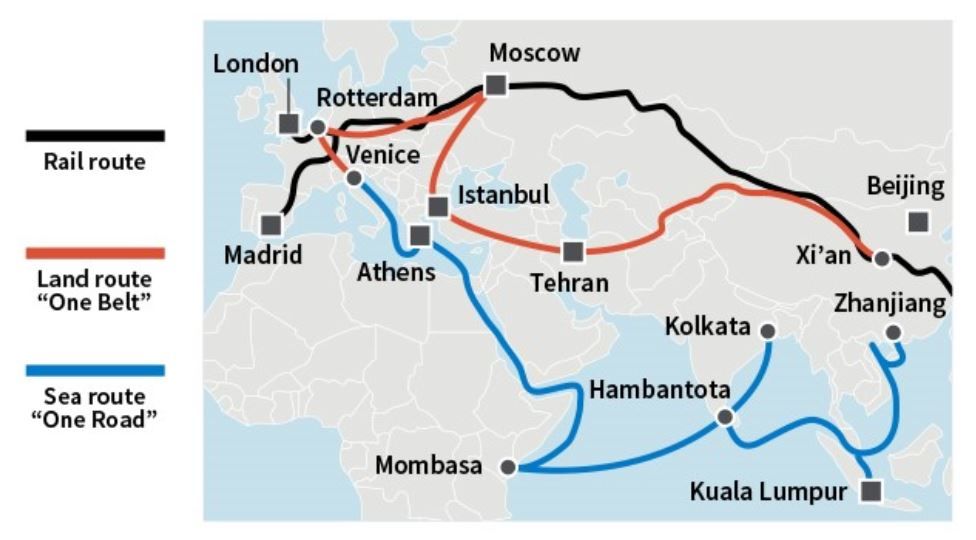

A related driver of China's foreign investments is the “Belt and Road Initiative” (BRI), where the Chinese government and Chinese companies are pairing up with foreign governments to pursue large engineering projects. The BRI spans about 60 countries along the old Silk Road bridging Europe and China.

China is setting up SEZs across this massive geographic region and has reportedly established 75 zones in 35 countries so far as part of the project.

With the BRI, China is trying to create trade links for goods as well as financial services. The initiative includes new satellite systems, underground and underwater fiber cables, and much more.

The willingness of China's government to invest in unprecedentedly large engineering projects in the BRI could support economic growth and innovation both in China and the other countries where the investments are being made.

Chinese companies and people have generally been in favor of the project. The general public initially seemed skeptical about investing capital overseas that could be directed to projects at home, but now there seems to be a general view that China as a whole will benefit from establishing itself in the world.

Investment Implications

As a team that takes a macro approach to investing, we are closely following the opening of the Chinese market. We believe that this will be as important to China's growth in the future as it was in the past.

The institutional change that occurred in China over the past 40 years has been a key component of strong economic growth, which drives earnings growth and return on investment.

Yet it is worth noting that while China has seen considerable economic growth, it also faces challenges, which I'll discuss in my next post.

Lotta Moberg, Ph.D.

Analyst, Dynamic Allocation Strategies Team

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten