The changing nature of global economic growth requires a new look at global equity investing, away from traditional silos based on region and capitalization size.

The case for global investing has changed, and it's no longer just getting exposure to different economic outcomes that might be less correlated with each other. It's more about opening a broad opportunity set to find the best investment ideas anywhere in the world, regardless of region or country of domicile or, frankly, any constraint that a narrower mandate might have.

That approach requires active stock selection from a global set of companies, with less emphasis on their location or market cap—elements that are traditional in other growth equity strategies. Having a portfolio that can access growth irrespective of its location and constraining the manager to own only the best companies (companies that are true drivers of innovation and value creation) is the next stage in equity investing.

Historically, investing in equities outside the United States gave someone exposure to an economy that was maybe on a different cycle than the U.S. economy—a diversity of companies or regions of the world that might be moving out of sync with each other—so you got the diversification benefit. Today, that benefit has decreased because the world is more tightly integrated.

This is the result of several decades of change in the world economy that has made the world a much flatter place than it used to be. What has happened is a flattening of the global commercial market and higher correlations across different markets because they're all trading partners with each other. Consumption habits in Asia are increasingly similar to consumption habits in the United States, for example.

And we see supply chains that are global. Much has been made about the supply chain behind, say, a smartphone that might be designed in California, but the raw materials for that phone might cross borders between Asia and the United States several times before it becomes a finished product that can be shipped anywhere in the world.

Competition for companies has also intensified, and there's been a weeding out of the average and below-average companies, and weaker business models. I think the gap between winners and losers globally has been tremendous. That could be in markets, but also, importantly, it could be across markets.

The nature of innovation and disruption is changing as well. As equity growth investors, we're very attracted to companies that can innovate and change the economic landscape. And what's clear is that the nature of incumbency has changed—and there's that much more pressure from the competition than we've seen before.

A Bigger Opportunity Set

I can't emphasize enough that we're trying to isolate the world's best companies—those companies that have the best products, the best services, and the most innovation and productivity around their research and development; the companies that are coming up with solutions for tomorrow.

This is the outcome of globalization—that all parts of every economy are basically open to competition from everywhere else. Presumably one would want a bigger opportunity set to choose from, rather than a regional constraint, such as U.S.-only or developed market-only or emerging market-only.

When looking for such companies, we seek a favorable trade-off between our assessment of corporate returns, cash flow generation, and growth, and what's expected by the market.

Diversification by Development Stage

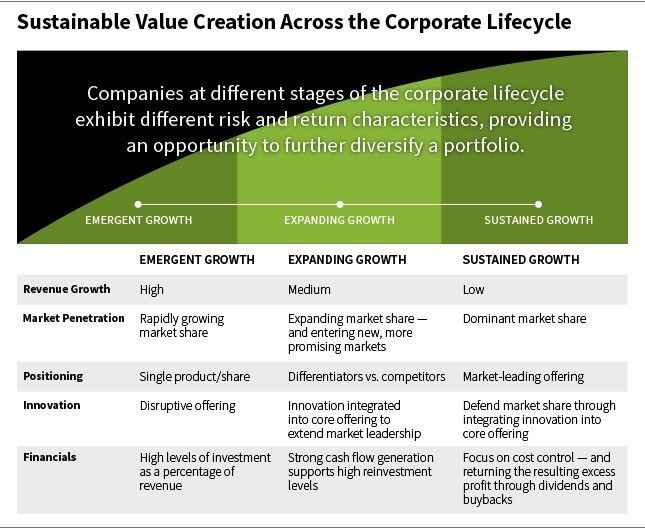

While the diversification benefit of investing outside the United States is less than it used to be, that doesn't mean diversification isn't important. Our Global Leaders Strategy looks to diversify the portfolio by stage of development: emergent growth, expanding growth, and sustained growth.

Emergent growth companies are innovative and exciting; expanding growth companies are capturing market share and extending market leadership.

But we also invest in companies that are more mature with lower growth rates for which we have a higher degree of confidence in the durability of the company's competitive advantage, and therefore, a higher degree of confidence in the longevity of that growth rate.

That differentiating strategy also applies to the need for long-term investors to diversify away from totally passive equity investing, a trend that has been growing among institutional investors since the financial crisis. That need is enhanced when dealing with growth equity, particularly on a global level, where long-term market expectations are less efficient.

The market is pretty efficient about discounting short-term growth, but inefficient in making that long-term distinction among which companies can grow more, which companies can have higher profit margins, which companies can increase their market share, which companies can generate the most cash flow. Over the long term, that's what an active investor needs to do.

And it's the long-term nature of our Global Leaders Strategy that particularly suits investors with long time horizons, such as pension plans.

Another emphasis that comes along with the search for quality growth companies is their adherence to environmental, social, and governance standards, elements that are of growing concern for institutional investors. I think there's a great deal of correlation between long-term corporate growth and long-term corporate performance, and we can be an important intermediary between asset owners and companies.

Among the growth companies primed for investment are those developing technology for global payments systems, as commerce transitions from hard cash to electronic payments; companies developing systems to process and settle those payments; and business models that are based on subscriptions rather than outright purchases, where you pay as you go rather than all at once.

Also of interest are companies that are in more “experiential” consumer products, such as health and beauty—sectors that are less likely to be negatively impacted by e-commerce.

Opportunities Abound

Regardless of sector, I'm not concerned about the amount of global investment opportunities available in the future, although I also have no illusions about how difficult long-term investing has become.

I am worried that the dynamism around corporate performance has never been higher than it is right now. And I think being in the predicting business has probably never been as challenging as it is today.

But the nature of innovation and disruption, and companies that are doing new things and creating new things, is interesting to me. That's the opportunity for what we do.

This post has been adapted from a sponsored content article published in Pensions & Investments.

Ken McAtamney

Partner & Portfolio Manager

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten