When your goal is evaluating the sustainability of long-term corporate performance, it's helpful to understand where a company is in its corporate lifecycle because each stage brings different opportunities and risks.

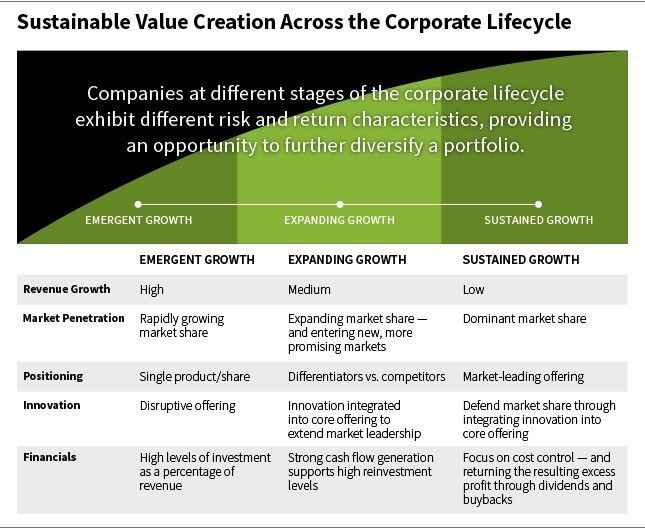

We divide corporate growth stages into three categories: emergent growth, expanding growth, and sustained growth. And knowledge of these stages affects portfolio decisions.

Emergent Growth

Emergent growth companies are early in their development, but beyond the start-up stage. They often have a single product or service that is exhibiting rapid growth, which can be disruptive to incumbent businesses.

Due to a novel or disruptive offering, an emergent growth company is capturing revenue within a rapidly growing market, or is rapidly capturing market share of a more mature but large market. In some cases it is actually creating the market itself.

The company is consistently growing revenue and adding new customers, but the focus is still on making customers aware of the competitive advantage of its offering. The runway for growth in its current product or service is long, but the long-term sustainability of the company may not yet be proven.

Emergent growth companies are top-line-driven. There is a willingness to delay profitability because maximum value is created primarily from reinvesting in the business to help grow the existing offering. Growth rates are uncertain, company-specific, and less dependent on the economic environment and secular growth drivers.

An example of an emergent growth company is a U.K.-based company that is a pioneer in the nascent but rapidly growing commercial litigation finance market. It helps businesses finance legal fees, monetize claims, and transfer risk.

It also helps law firms fund case expenses and offers risk sharing solutions. This company, though young, is a leader in a rapidly growing yet very fragmented market.

The distribution of outcomes is wide given the inherent difficulty of properly valuing the company. Due to the rapid level of growth in the emergent stage, equity infusions may be necessary to fund projects, and minimal to no excess capital is available to return to shareholders.

Expanding Growth

Expanding growth companies have successfully transitioned beyond the emergent growth category. Competition has increased, but there are clear points of differentiation in the company relative to its competitors.

The runway for growth is still long, and the company has demonstrated the sustainability of its competitive advantage, leading to increased market share.

New growth opportunities are pursued by expanding beyond the company's original product or service by innovating its core offering, introducing new products or services, establishing new distribution channels, or entering new markets and divesting older, exhausted ones.

Business risk has decreased as the company successfully fends off competition and has a proven business model.

An example of an expanding growth company is a Switzerland-based leader in the custom manufacturing of biopharmaceuticals and specialty ingredients. This company provides contract manufacturing services for pharmaceutical and biotech customers, both clinical and commercial. Its primary competitive advantage is its technical capabilities.

But it also has the proper scale, capacity, and experience to attract significant business. Profitability could increase because the company is manufacturing more products using in-house intellectual property, which adds an additional layer of revenue.

Top-line growth rates for expanding growth companies have slowed but remain elevated while margins have improved. Reinvestment remains high, but is dropping as the company matures. Growth rates become more certain, less company-specific, and more dependent on the economic environment and secular growth drivers.

The company is moving toward capital sufficiency, where cash flow meets investment needs. Additional capital infusions are more likely to take the form of lower-cost debt than higher-cost equity.

Sustained Growth

Sustained growth companies have transitioned beyond peak growth rates to reach a more mature stage of their development. They have a dominant position in the market, a strong brand image, and a sustainable competitive advantage that is difficult to dislodge.

Business risk is low due to the long history of operating performance and durability of growth versus peers.

Margins have improved to a point that the company's profitability is high and stable. The runway for growth is small, but innovation is used to defend its stable market share. The company seeks to maintain its market leadership rather than to significantly extend it.

While growth rates in the sustained stage are lower, free cash flow growth may be underestimated due to falling capital intensity from improved efficiencies, cyclical improvements in capital-intensive businesses with high operating leverage, or an underappreciated competitive advantage.

An example of sustained growth is one of China's largest companies in the spirits industry. This company has one of the strongest consumer brands in China and boasts exceptionally high profit margins as a result of its low manufacturing costs and premium prices (which it can charge because of its luxury status).

Its brand equity is derived from a difficult-to-replicate manufacturing process, quality, and safety. The process for making the liquor can be traced back 2,000 years and the brand can be traced back more than 400 years, providing a significant competitive barrier.

Cash flow typically exceeds investment needs within a sustained growth company, so excess profits can be returned to shareholders through dividends and buybacks, leading to a more stable return profile.

Investment Implications

When analyzing companies for potential inclusion in our portfolios, our analysts seek to determine whether a company's growth trajectory will stand the test of time—and at William Blair, we call this sustainable value creation.

This is central to our notion of quality. Quality companies are those that exhibit sustainable value creation, and they can be found across the corporate lifecycle—from emergent growth companies that may be disrupting an industry to sustained growth companies that dominate their markets.

Companies at different stages of the corporate lifecycle may exhibit different risk and return characteristics, so they provide diversity of growth within a portfolio, helping us pursue better client outcomes.

Watch a two-minute animated video that illustrates the benefits of diversifying across the corporate lifecycle.

Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Different investment styles may shift in and out of favor depending on market conditions. Diversification does not ensure against loss. Lifecycle stages are provided for illustrative purposes only and are not intended as investment advice or as projections of future returns. Characteristics reflect typical traits of each lifecycle, traits of companies within each lifecycle may differ. References to specific securities and their issuers are for illustrative purposes only and are not intended as recommendations to purchase or sell such securities. William Blair may or may not own any securities of the issuers referenced and, if such securities are owned, no representation is being made that such securities will continue to be held. It should not be assumed that any investment in the securities referenced was or will be profitable.

Ryan Dimas, CFA, is a portfolio specialist on William Blair's Global Equity team.

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: