Fundamentals Under Pressure But Support Up

The fundamental landscape in emerging markets has deteriorated sharply as the global economy prepares to dive into an economic recession, and we have concerns about the ability of policymakers in EMs to both contain COVID-19 and manage its resulting socioeconomic implications.

While there are encouraging signs from a policy response perspective (fiscal and monetary, macro and micro), the magnitude of the potential impact on EM credit metrics remains an open question.

There are many structural reasons that investors may look through the current challenges.

However, we do not believe that the deterioration in measures of debt sustainability will translate into widespread EM sovereign defaults.

We anticipate strong multilateral and bilateral support. Indeed, the International Monetary Fund (IMF) and World Bank have already announced significant support programs, and we expect a strong response from the G20.

Stepping away from the present environment, there are many structural reasons that investors may look through the current challenges described above.

Growth Differentials

EM countries have matured over the past several decades. Growth has outpaced that of developed markets by an average of more than 2%, and we forecast that this gap will widen further over the next five years.

As a share of gross domestic product (GDP) using purchasing power parity (PPP) dollars, EM countries have grown from approximately 37% of total global output in 1980 to approximately 60% today.

Macro Buffers

Macro buffers have been established and improved in terms of their ability to act as shock absorbers during periods of market and economic stress.

For example, international reserve accumulation in EM countries has outpaced developed market (DM) reserve accumulation by more 50% since 1980.

In addition, EM countries are slowly becoming more resilient, not only with respect to economic shocks, but also to reversals in capital flows as domestic capital markets have deepened.

Defunct Stigmas

Lastly, EM assets have still not shaken off now-defunct historical stigmas in the minds of global investors. Major global bond indices tend to underrepresent EM fixed-income assets, and bond investors tend to be underweight the asset class despite attractive Sharpe ratios.

From a supply perspective, EMs represent 20% of global fixed income but have less than a 5% weight in widely followed fixed-income benchmarks.

While we acknowledge that there is scope for EM defaults to increase in 2020, we still believe this is an attractive entry point.

Valuations Attractive

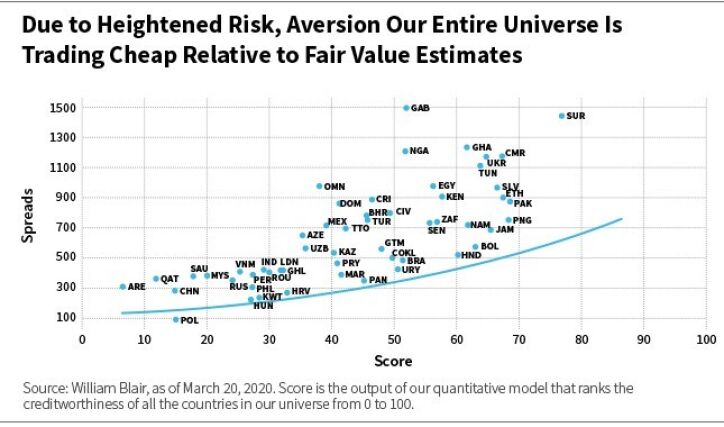

Taking the above view of the macro backdrop into account, we find valuations to be very attractive. A significant part of the investable universe is currently priced below what

we perceive to be fundamental fair value, with spreads overstating both the probability of default and loss given default relative to other fixed-income asset classes and historical levels.

While we acknowledge that there is scope for EM defaults to increase in 2020, we still believe this is an attractive entry point. Even before the current crisis and its subsequent impact on asset prices, EM hard currency debt has historically been an incredibly mispriced asset class, with expectations of losses greatly exceeding those realized ex-post.

From 1980 to 2016, Moody's estimates that the average default rate of hard currency EM sovereigns was approximately 0.78%. In addition, the median recovery rate was approximately 54 cents on the dollar. Thus, investors in EMD hard currency have historically been overcompensated for the actual risks.

We find that home-country bias and outdated memories of 1980s-style economic meltdown and contagion could be reasons that excess risk aversion is priced into EM credit markets.

EM sovereigns benefit from technical and monetary assistance from international financial institutions such as the IMF and World Bank as lenders of last resort, and this can help improve credit quality by reducing liquidity risks.

We Have Seen This Movie Several Times Before

While history does not always repeat itself, it is still helpful to look to recent experience in evaluating the current crisis. In 2008, as markets in most of the developed world were melting down, EM bond spreads blew out and correlations increased significantly.

This proved to be a huge overreaction. In truth, outside of Ecuador (which was more for political reasons), we did not see a single hard currency sovereign default as a result of the Global Financial Crisis.

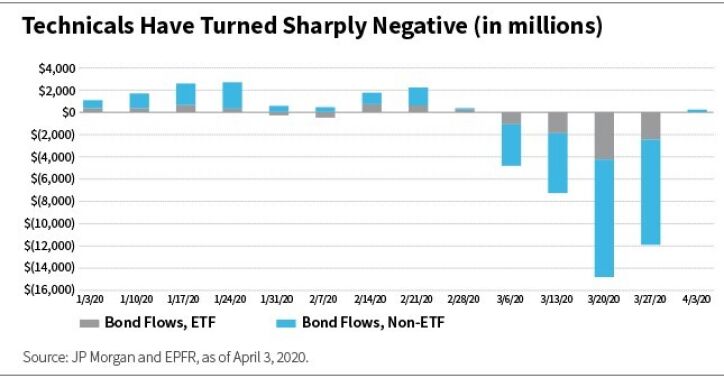

In recent weeks we have seen a rapid repricing of risky assets in a similar fashion. At one point in the past weeks, the largest EMD exchange-traded fund (ETF) experienced unprecedented outflows, which drove its share price to trade with a discount of up to 7% to its underlying assets. These outflows created massive forced selling pressures in the market, leading to significant price dislocation.

Ultimately, while we do not expect volatility in EMs to fall while other global asset volatility remains extremely high, we think that investors are being more than adequately compensated for the risks.

Improving liquidity conditions, declining outflows, and strong monetary easing globally provide reasons for optimism.

Reasons for Optimism

Significant outflows from EM funds amid very low liquidity have contributed to the major price dislocations described above, especially in the less liquid and more volatile high-yield space.

While we believe market conditions should remain choppy in the very near term, improving liquidity conditions, declining outflows, and strong monetary easing globally provide reasons for optimism.

Scheduled sovereign and corporate cash flows (coupons plus amortizations) of $60 billion in April and multilateral funding should provide additional support.

Positioning Summary

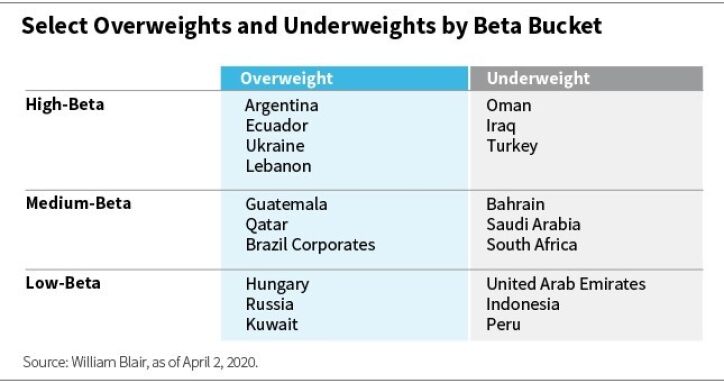

Although we are comfortable with the risk/reward profile of the asset class generally, the dramatic fall in oil prices is putting extreme pressure on oil-exporting countries where buffers are more limited and policies are less flexible.

These pressures will become critical if low prices are sustained over a longer period by successive demand (global pandemic) and then supply (inventory buildup) shocks.

Therefore, we are careful to shy away from countries where we have concerns about medium-term debt sustainability and where bond prices are not yet reflecting our full-probability

estimate of the potential for restructuring. Some of the weaker African and Gulf Cooperation Council (GCC) countries fit this description.

In contrast, we are happy to be overweight oil exporters that have sufficient resources to service debt despite current low price levels, particularly in instances where bonds are trading at levels that do not reflect this resilience. Commonwealth of Independent States (CIS) countries are well placed in this regard.

We also believe that by dividing the world into three major beta buckets (or risk categories), we can manage risk and identify opportunities more effectively while ensuring a strong risk management discipline relative to the benchmark. And there are more opportunities in selected high-beta names than in low-beta names, and as a result we are currently overweight non-investment-grade sovereigns.

A lack of liquidity and forced selling have contrived to create dislocations in markets, with bonds trading below our view of their underlying fundamental fair value. We consider Ukraine, Ghana, and Ivory Coast as examples of countries that fall into this category.

Conversely, Lebanon, Argentina, and Ecuador are all markets currently pricing at highly distressed levels. Although we do not doubt that all of these markets will ultimately restructure, we believe recovery values are very likely to be higher than where bonds are currently being marked and we see value in each.

Complementing our sovereign security selection, we include corporate issuers at attractive spreads above their sovereign benchmark using our proprietary spread-over-sovereign (SOS) model.

In this environment, we look for corporate issuers that show low liquidity concerns, are leaders in their cost structures, and have solid business profiles.

We are dipping into lower credit quality with caution given uncertainty over the length of the economic shutdown, yet we can currently incorporate quality corporate issuers at historically attractive levels.

Our SOS model has captured what we believe are opportunities across investment-grade markets, where spread levels have similarly widened in excess of our fundamental assessment. In Brazil we see more value in the corporate space; this is also the case in Peru, among other countries.

Lastly, we see an elevated opportunity to generate alpha from security selection. Forced selling and the inclusion (or not) of individual bonds in ETFs or indices are creating dislocations in pricing across an increasing number of sovereign curves.

Marcelo Assalin, CFA, is a portfolio manager on and head of William Blair's Emerging Markets Debt team.

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: