To help us understand the dynamics currently driving the global energy market, we utilize Game Theory and Macro Thematic analytical frameworks. Recent developments have caused us to update our Energy/Middle East Game Theater to reflect evolving interests. Historically, this Game Theater has been focused on power dynamics in the Middle East, where the players are jockeying for longer-term influence over oil production.

Recently, however, objectives have shifted to bring all of the players—including the smaller ones—to the negotiating table. The Organization of the Petroleum Exporting Countries (OPEC) and its allies—OPEC Plus—have now become OPEC Plus Plus Plus.

Oil prices have been under pressure due to both a severe drop in demand—due to restrictions on economic activity from the coronavirus pandemic—and a supply shock. Saudi Arabia and Russia allowed a glut of oil to come to market in a market-share game that they have played time and time again.

We offer a couple of quick thoughts on the current version of this game-playing between Saudi Arabia and Russia. Russia can sustain this game longer than Saudi Arabia can because Saudi Arabia has (more) fiscal issues and a higher breakeven oil price. Vladimir Putin, ever the opportunist, took advantage of the situation by trying to capture market share and drive Saudi Arabia, to some degree, out of its markets. (Now it is clear why Russia has refused to become a part of OPEC Plus.)

Oil producers likely underestimated the effects of the demand crunch happening at the same time as their supply bids.

However, it quickly became apparent that oil producers were hurting. They likely underestimated the effects of the demand crunch happening at the same time as their supply bids.

While the demand issue was and is out of their hands, the supply is something that oil producers can control, and there was an incentive for the players to cooperate. So, on April 12, OPEC and its allies, including Russia, agreed to slash production by roughly 10 million barrels per day from May through June, and to restrain output for another 2 years.

But cutting production by 10 million barrels per day—beginning in May—is not nearly enough to counter the immediate drop in demand. Some projections require a cut of 25 million to 29 million barrels per day to do that. With such a steep drop in demand, even if the players come together (OPEC Plus Plus Plus), the price of oil still will not be significantly affected.

Our equilibrium oil-price projection is unchanged at around $51 per barrel.

That leaves our equilibrium oil-price projection unchanged at around $51 per barrel, because it is determined more by the cost of production than drops in demand like we are now seeing. That figure is supported by longer-term futures contracts on West Texas Intermediate (WTI), which are still priced around $45 to $50 a barrel.

We believe spot oil prices will gradually return to this range after we get through the concurrent supply and demand shocks we are now experiencing. We don't know exactly when it will happen, but we believe there will be upward pressure on oil prices within the next six months.

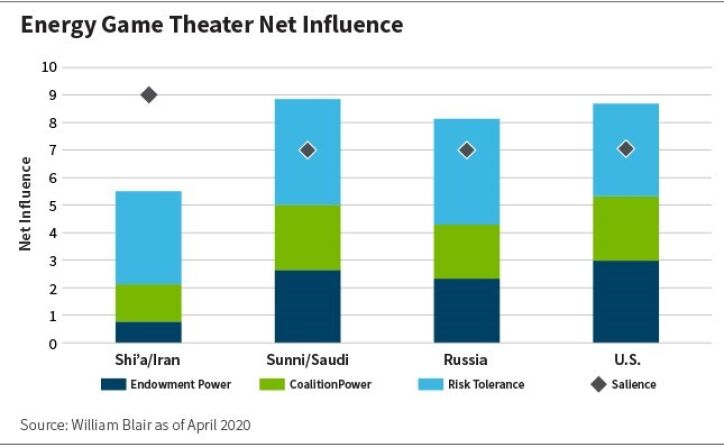

We have reflected all of this in our Game Theater, shown below.

Our Energy Game Theater Analysis

Summary: We use our Energy Game Theater to assess the impact of energy prices and trade relationships. Cooperation between Saudi Arabia, Russia, and the United States has improved temporarily in the wake of negative demand due to COVID-19. Fiscal constraints at home have pushed these players into an unprecedented agreement to cut oil production. However, these cuts are not sufficient to compensate for falling global demand.

Dynamics: U.S. President Donald Trump's withdrawal from the Iran nuclear agreement reduces Iran's endowment power but increases its risk tolerance. Risk tolerance is also high for the United States, as reflected in the killing of a top Iranian military leader, and increased U.S. engagement has proven the country's endowment power and salience. Meanwhile, Russia is taking advantage of geopolitical crises in the region to assert power.

Outlook: The global recession is pushing down the price of oil. While agreements to cut oil production may boost oil prices in the short term, these agreements are unlikely to offset the decline in demand.

Investment Implications: No player is in a position to change oil prices from an equilibrium standpoint, while the most prominent short-term impact on oil prices is stemming the fall in demand due to COVID-19. Our equilibrium oil price projection remains around $51 per barrel.

Lotta Moberg, Ph.D., CFA, is an analyst on William Blair's Dynamic Allocation Strategies team.

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten

Weitere beliebte Meldungen: