Historically, a combination of high yield and minimal default risk has led emerging markets debt (EMD) investors to enjoy strong returns—but the impact of COVID-19 has called into question the potential for such favorable returns in the future. Historically speaking, however, markets have overestimated the probability of default and underestimated eventual recovery rates.

Defaults Priced In

The bad news is that we believe in 2020 we will likely see more sovereign defaults than we have ever seen before in a single calendar year.

On a positive note, we believe the asset class is already priced to reflect this dynamic. Argentina, Lebanon, and Zambia (and to a lesser extent Ecuador) were all pricing in a relatively high probability of default before COVID-19 affected financial markets. Since the outbreak, Suriname, Belize, and Angola have all begun to price in a high probability of default as well.

We believe potential recovery values will be higher than the market is currently pricing.

Despite an elevated number of restructuring candidates, there are reasons to be optimistic about the potential impact on future asset-class returns. First, Suriname, Belize, and Angola collectively represent less than 1% of the total value of the J.P. Morgan Emerging Markets Bond Index Global Diversified. Second, we believe few other emerging markets will be forced into restructuring. Third, we believe potential recovery values will be higher than the market is currently pricing.

There are a few reasons for this optimism. A sovereign default with a low recovery value can adversely affect a country's ability to access international capital markets, expose the country to litigation, and impair its citizens' standard of living. Therefore, it is generally in a sovereign issuer's best interests to reach a benign settlement agreement with creditors.

Investors can also be comforted by the multilateral support a sovereign issuer is likely to receive in order to improve current and future debt sustainability.

Defaults Remain Rare, Recovery Values Understated

Sovereign defaults remain rare and recovery rates relatively high, offering EMD hard currency investors attractive return potential. The main reasons are strong interest in retaining market access and strong support from multilateral organizations.

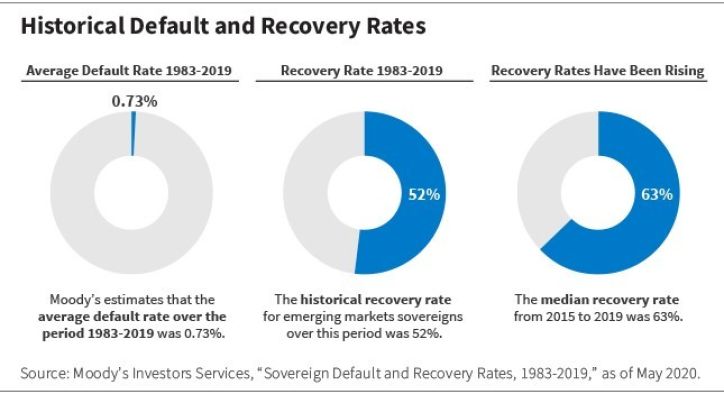

Moody's, for example, estimates that from 1983 to 2019, the sovereign default rate on bonded debt was only 0.73%. Median recovery rates have been about 52 cents on the dollar, implying that EMD sovereign credit spreads historically have offered investors a very attractive risk premium relative to historical credit losses.

Moreover, sovereigns want the ability to run fiscal deficits and need access to capital markets to fund them. They also want to act as a benchmark for companies within their borders to grow and access financing abroad. When a country is in default, these goals become problematic.

On the rare occasions that EMD issuers have felt it necessary to restructure their external debt obligations, investors have often been compensated with high recovery values, reducing their potential losses.

Our Experience With Sovereign Defaults

Restructuring can be a long process, and there are many complexities investors should assess. Below are some lessons we have learned working with sovereign defaults.

Politics and policy matter. Politicians rarely see the world in the same way technocrats do. Understanding the political and economic motivations of a particular regime regarding capital market access is critical in determining the probability of default and potential recovery values.

Willingness to pay can matter just as much as ability to pay. Venezuela continued to service its debt long after most countries would have considered reasonable because oil is essentially the only source of foreign exchange in the country, and all assets for marketing and refining Venezuela's oil are subject to attachment via judgment from a U.S. court. Similarly, Ukraine and Iraq continued to service their debt despite military and terrorist incursions causing these countries to lose control over significant parts of their territory.

African debt forgiveness is again up for discussion. A dramatic fall in growth levels across Africa, caused by COVID-19, has left many countries on the continent with unsustainable levels of debt. African countries are now engaging international financial institutions such as the IMF and World Bank as well as other multilateral and private creditors.

Legal considerations can prevent sovereigns from borrowing. Though creditors generally have weak legal recourse, creditors can prevent sovereigns from borrowing again in the international capital markets if they get a judgment.

Sovereign defaults can lead to greater risk premiums, potentially providing greater excess returns for those with the right skill sets.

Three Potential Areas of Win-Win

Through our experience working on sovereign debt restructurings over the past decade, our team has recognized the following three ideas that can help result in a win-win situation for both the investor and the sovereign.

Having a credible policy framework can lead to a reduction in borrowing costs and lower exit yields. The less frequently sovereign defaults occur and the more often market-friendly policies are enacted by emerging markets sovereigns, the lower average credit spreads will likely be for countries that wish to borrow in international markets. Sovereign defaults can lead to greater risk premiums in the asset class, potentially providing greater excess returns for those with the right skill sets.

Value recovery instruments (VRIs) can be successful in sovereign restructurings if structured well. VRIs can be a useful and fair tool to provide creditors some upside if economic conditions improve more than expected. Ultimately, they can help get deals done and reduce fixed cash payments the sovereign would otherwise need to pay as they allow creditors to recoup losses and participate in a country's success (or failure). We thus believe VRIs will be key ingredients in restructurings in both Argentina and Venezuela— eventually.

Lawyers usually benefit the most when litigation is required. Many times when a creditor is forced to exercise the rights and remedies in an indenture, both the country and the bondholder are in a difficult predicament, and legal action may be considered. However, litigation is a path that should not be considered lightly. Even while in default, interest continues to accrue at the federal judgment rate, which is usually less than the coupon rates of most emerging markets bonds. In some instances, then, it is simply better to wait than litigate.

Outlook for Sovereign Defaults in 2020

Now, let's look at the countries that are likely to restructure in the rest of 2020 and explain how we believe we are positioned to capture excess returns on behalf of our investors.

Argentina. Ultimately, Argentina would prefer to finance a deficit rather than run fiscal surpluses, but to do that it would need to regain market access—and to regain market access it needs both successful debt restructuring and policy credibility. Unsuccessful negotiations with bondholders will not achieve any of these objectives. We believe a compromise will ultimately be made, offering upside from today's prices.

Ecuador. Given the stresses from oil and COVID-19, creditors (us included) gave Ecuador the benefit of the doubt and voted to delay coupon payments until August. We believe bondholders are better off enacting a friendlier restructuring with this market-friendly administration than delaying the restructuring until the next administration. Ecuador has been one of our larger overweights in our hard currency strategy, and we still see upside from current levels, albeit limited, in our opinion.

Lebanon. Lebanon was unable to form a government for years, leading to poor policy management (particularly fiscal). Today, Lebanon is in dire shape, with debt-to-GDP ratios above 150%. This leads us to believe that recovery values in Lebanon may be lower than the median recovery value of EMD sovereigns. Having said that, we believe the market overreacted as bond prices fell precipitously, and we see value in the bonds going forward.

Zambia. Macroeconomic mismanagement has been rampant in Zambia for years. Domestic debt has been issued at particularly high rates and inflation has been soaring. Debt-to-GDP ratios have more than tripled from 2013 to approximately 90% today. And Zambia recently hired a debt restructuring advisor to begin talks. We had a favorable view of Zambian bonds, but would need to see a commitment to reforms to reduce exit yields.

A Good Opportunity

Despite economic hardship brought on by the pandemic, we believe sovereign credit offers a very attractive opportunity set with respect to risk and reward.

We will continue to engage via creditor committees and look forward to participating in a resolution that will once again seek to align investors' incentives with those of the countries and ultimately open capital markets again for these countries in the near future.

We believe that investors are being overcompensated for the risks, despite a higher-than-normal default outlook in 2020.

A more in-depth discussion is available in our white paper.

Past performance is not indicative of future returns. Investing involves risks, including the possible loss of principal. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks. These risks may be enhanced in emerging markets. Investing in the bond market is subject to certain risks including market, interest rate, issuer, credit, and inflation risk. Rising interest rates generally cause bond prices to fall. Sovereign debt securities are subject to the risk that an entity may delay or refuse to pay interest or principal on its sovereign debt because of cash flow problems, insufficient foreign reserves, or political or other considerations. High-yield, lower-rated securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Individual securities may not perform as expected or a strategy used by the Adviser may fail to produce its intended result. Diversification does not ensure against loss. Portfolio information is based on a representative portfolio and is subject to change without notice.

The J.P. Morgan Emerging Market Bond Index Global Diversified (EMBIGD) tracks the total return of U.S.-dollar-denominated debt instruments issued by sovereign and quasi-sovereign entities. (Index information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The indices are used with permission. The indices may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2020, JPMorgan Chase & Co. All rights reserved.)